Date : 21th MAY 2020

THE BIG-4 GLOVES - YOU WONT GET CHEAP ONCE YOU LETS IT GO NOW!

(SUPERMX - TOP GLOVE - HARTA - KOSSAN)

On 29th April - I had called and posted the article regarding this sector.

- Gloves Cant Get Cheap - read here

Started from that, all the big-4

prices keep rising and soaring non-stop and have a few correction stage

with minimal retracement.

KIM'S LATEST TARGET BIG-4

Date : 22/5/2020

1. SUPERMX - TP1 : 8.30

2. TOP GLOVE - TP1 : 13.30

3. HARTA- TP1 : 12.30

4. KOSSAN - TP1 : 10.30

WHAT KIM SAID ABOUT KOSSAN TOMORROW?

After I had read their report today. I stick and agreed my target for tomorrow as follow :-

1. "TOMORROW FLY TO RECORD A NEW HIGH AGAIN TO HIT RM9.50"

2. "GRAB THIS OPPORTUNITY. DONT SELL IT YET"

3. "ADD MORE IF HOLD, BUYBACK IF SOLD"

"The best and most safer business are Gloves & Healthcare 2020"- Kim

FYI, Local rubber glove makers are

estimated to chart strong improvement in their financial performance for

FY19 and FY20, underpinned by higher demand for rubber products and

resolved labour issues.

The coronavirus

outbreak started in China has increased the demand for rubber gloves on

the back of increased awareness across the region to prevent

cross-contamination between virus carriers and caregivers. Now this

Coronavirus confirmed as pandemic by World Health Organization.

The coronavirus sweeping across the world is a pandemic, the World Health Organization declared on 11th March 20. That time over 118,000 cases of COVID-19, the disease caused by the virus, in 114 countries around the world.This is the first pandemic since H1N1.

Currently, this

Covid-19 pandemic, which has killed more than 331,191 people, will

result in higher demand for rubber gloves as the healthcare sector

contends with the rising number of infected individuals. Total Global

cases now stood at 5.1 millions.

However,

we had seen some news regarding Covid-19 vaccines ready/success.

Unfortuantely all kinds of news not accurate and failure. Mostly, what I

had see, there is some agenda to stable the market and trying to reduce

the panic among peoples also to protect some of business.

By the way, we will see

most rubber glove stocks as defensive stocks now since their share

prices have retraced quite significantly from their highs towards the

end of the H1N1 pandemic in the first half of 2010.

Istill and had sticked on my note that most of rubber glove stocks as defensive stocks now. Since their share prices have retraced quite significantly from their highs towards the end of the H1N1 pandemic in the first half of 2010.

I also listing my top pick is Supermax Corporation Bhd remained its top sector pick because its earnings are more sustainable as the firm derives secondary income from its distribution business.

As we know, we expect

the world’s demand for natural and synthetic rubber medical gloves to be

about 345 billion pieces this year while it was only 298 billion in

2019. Malaysia is looking to export about 65% or about 225 billion

pieces or more depending on the spread and duration of Covid-19.

We believe Malaysian

glove producers have been the global preferred suppliers because they

have the capacity to meet the increased supply-demand. So, going

forward, they should be able to perform better. The local glove

producers could see improved margins early this year, driven by

increased production.

So I think they could

sustain the margin, in fact, they might see an expansion going forward.

When they ramp up their utilisation rate and capacity, technically the

cost will be lowered. We would think it is possible to expand margin.

From the beginning, the prices of all Big-4 as follows and non-stop with big retracement.

MAC/APRIL 2020

|

TOPGLOV HARTA KOSSAN SUPERMX |

RM 6.05 – 6.10 RM 6.38 – 6.40 RM 5.05 – 5.10 RM 1.50 – 1.60 |

MAY/JUNE 2020

|

TOPGLOV HARTA KOSSAN SUPERMX |

RM 11.66 RM 10.00 RM 8.63 RM 5.40 |

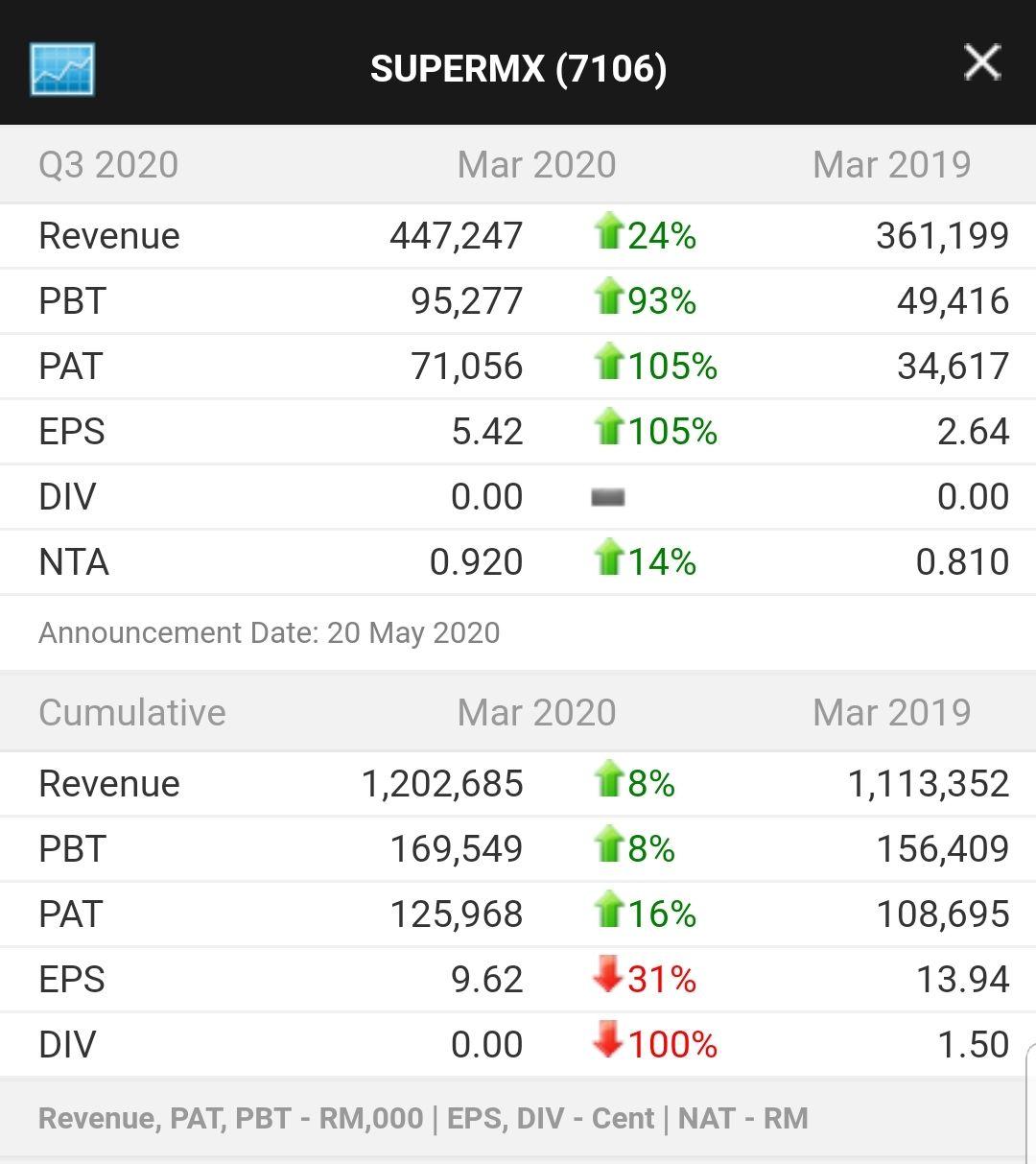

SUPERMAX RESULT

- Net Profit

more than doubled to RM71.06 million in the third quarter (Q3) ended

March 31, 2020 from RM34.96 million a year ago.

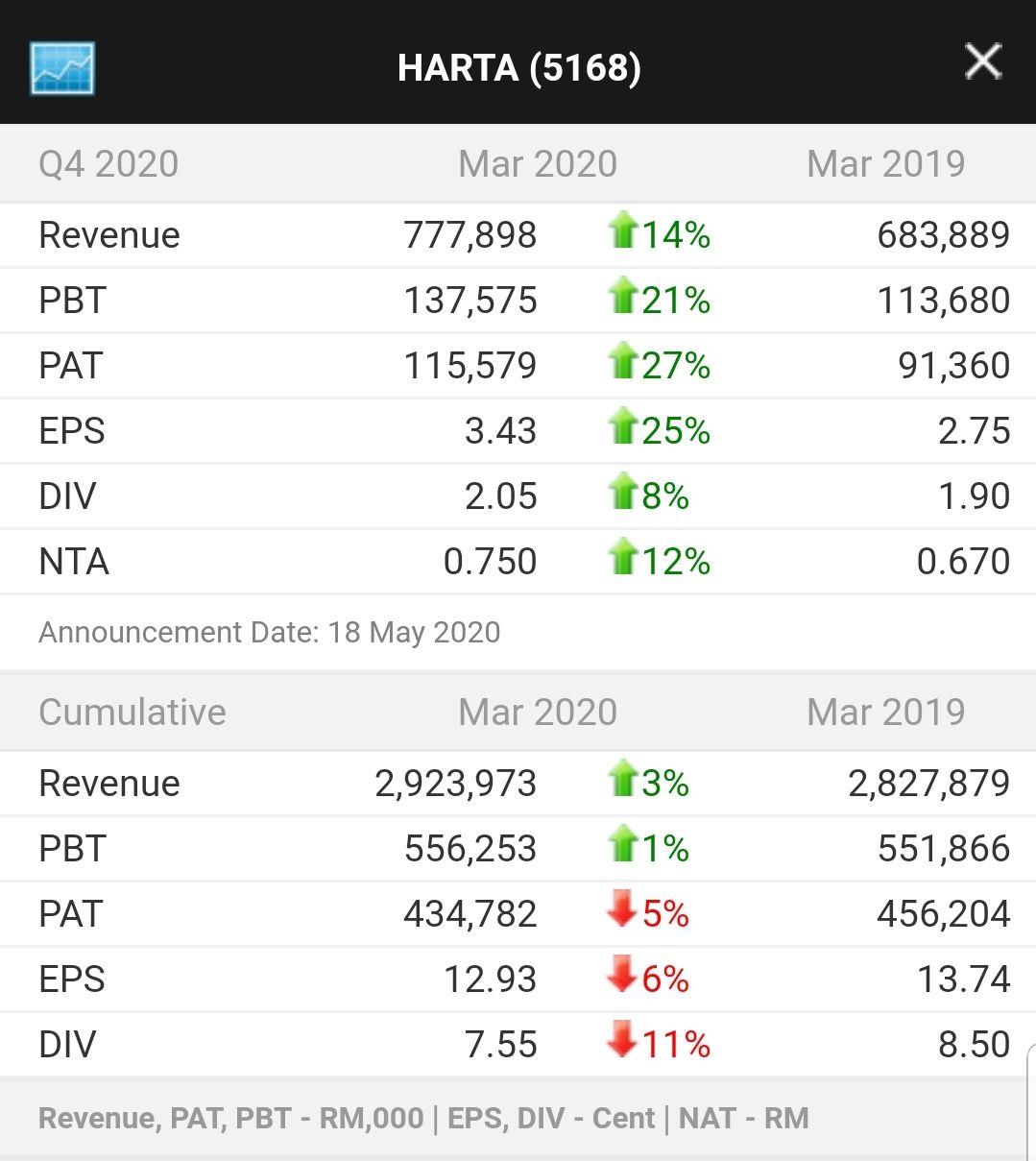

HARTALEGA RESULT

- Lower annual net profit of RM434.78 million for the financial year ended March 31 2020 (FY20), versus RM455.18 million the year before.

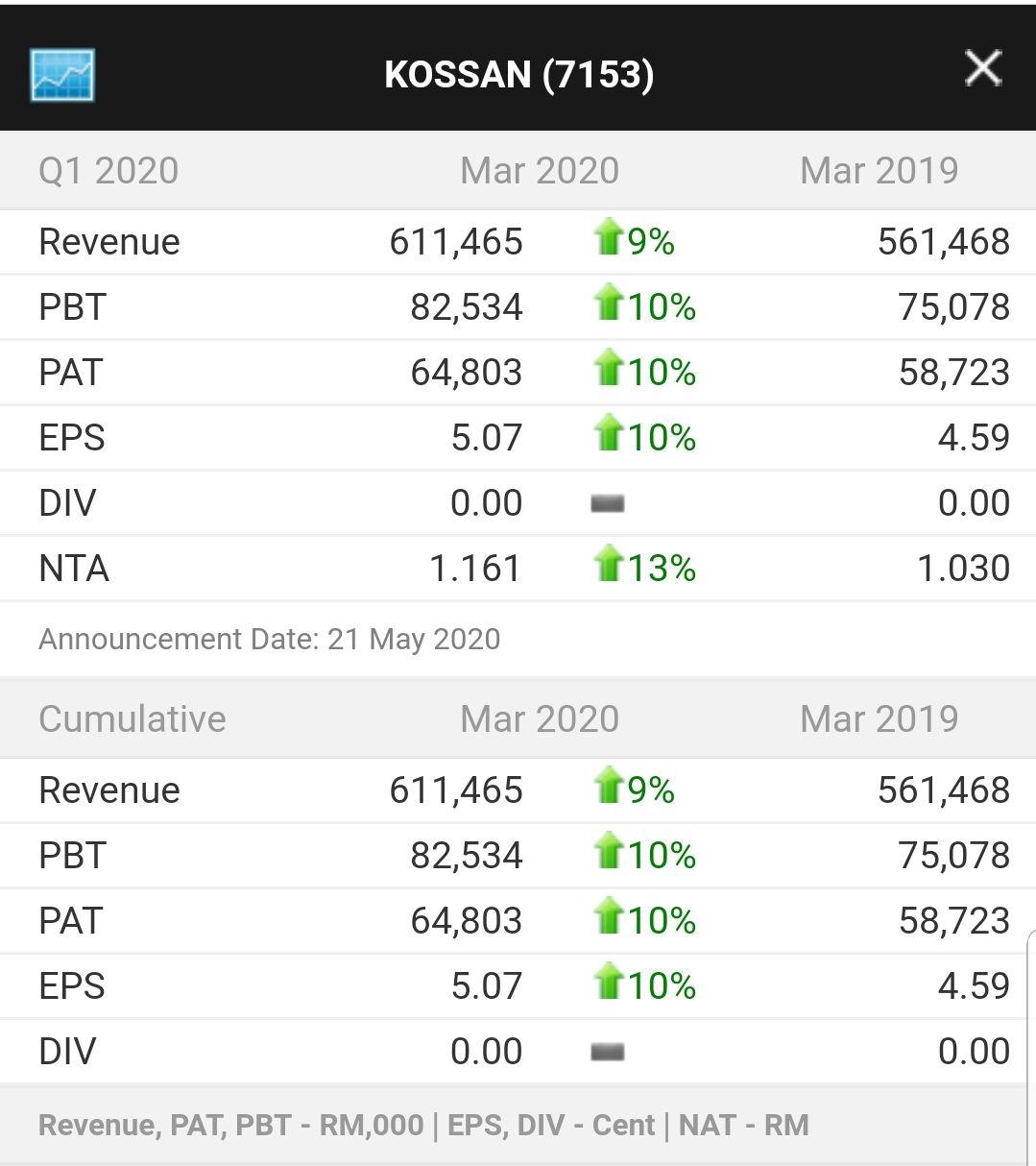

KOSSAN RESULT

-

Net Profit rise 10.35% to a record high of RM64.8 million from RM58.72

million last year, on greater rubber glove sales. Quarterly revenue also

reached a new high of RM611.47 million, from RM561.47 million last

year.

TOPGLOV RESULT

- Expected on June.

THE CONCLUSION

- I had maintained the bullish on Gloves till end-of Y20. After looking and reading all

their report card this Quater. There is nothing wrong bad results. Plus you should keep

invest and wait till next coming quater.

- Next quater all I forsees is good & superb results. So stay tuned, you wont regret to follow Kim's Stockwatch!

WHY GLOVES SECTOR IS THE BEST?

1. Global demand - Rubber gloves sector to see upsides from surging world demand.

- We maintained overweight on the

rubber gloves sector with expectations of surging demand from the US due

to the trade-war effect. Since Sept 1, a 15% tariff has been imposed on

Chinese-made medical and vinyl gloves, which should increase their

pricing versus local rubber gloves.

- We also expects the positive impact to be felt from the final quarter of the year as US gloves demand switches to local glove players, where the US accounts for 28% to 55% of glove players' group sales.

2. Glove Shortage - From oversupply to shortage due to pandemic and MCO

- We also expects the positive impact to be felt from the final quarter of the year as US gloves demand switches to local glove players, where the US accounts for 28% to 55% of glove players' group sales.

2. Glove Shortage - From oversupply to shortage due to pandemic and MCO

- It was only last year when there were

repeated concerns of an oversupply in the rubber glove industry that

hogged the headlines. But the situation has completely changed today in

just a span of just a few months into the year 2020 with talk of an

oversupply in the rubber glove industry being firmly a thing of the

past.

- The Covid-19 outbreak which is now

categorised as a global pandemic has upended everything and there are

now concerns of undersupply in the rubber glove industry at this very

crucial time.

3. Exchange Rate USD/MYR For Export. ( Ringgit Loser)

- Export-based companies: Glove makers

such as Top Glove Corp Bhd and Supermax Corp Bhd - who rake in US

dollar-denominated revenues, will likely see an erosion in margins this

year due to the stronger ringgit, unless they can pass on the additional

costs to consumers.

4. Low Crude Oil Prices

- Rubber glove shares wil rise when oil

prices fall actually. Rubber glove also on attention while oil prices

crashing. Rubber will get cheaper to make as the price of crude oil

drops. Production costs will be low.

5. No vaccine for COVID-19 yet.

- According to WHO. Vaccine for new coronavirus 'COVID-19' could be ready in 18

months. The first vaccine targeting China’s coronavirus could be available in 18

months, so we have to do everything today using available weapons. Told by WHO.

WHICH GLOVE COMPANY IS THE BEST TO INVEST?

- We are participated only the Big-4 Gloves Company, which is :

1. SUPERMX

2. TOP GLOVE

3. HARTA

4. KOSSAN

Good luck and stay tuned! -

Only the rubber sectors will have a big jump and bright prospect for now!

- Article wrote by Kim

-= Kim's Group =-

https://klse.i3investor.com/blogs/spartan/2020-05-22-story-h1507777899-THE_BIG_4_GLOVES_YOU_WONT_GET_CHEAP_ONCE_YOU_LETS_IT_GO_NOW.jsp