It is results season where companies are reporting their quarterly results and >90% of these companies are reporting bad results due to COVID-19.

But there are a few companies reporting very strong results and there are also companies who are big beneficiaries of the COVID-19 crisis as they manufacture goods that are needed during this crisis.

A very cheap ACE Market company caught my eye as they satisfied both of the above (reported very strong results and is a big beneficiary of the COVID-19 crisis) but has obviously not been discovered!

The stock name is DPI Holdings Berhad. Currently trading at 11x PE with more than 100% earnings growth in last 2 quarters!

What does DPI do?

DPI is one of the largest spray paint manufacturers in Malaysia. If anyone has purchased a bottle of spray paint in their lives, you most probably purchased DPI's ANCHOR brand. DPI has 25% market share in Malaysia. Besides spray paint, DPI also produces various chemicals. Here is a description of what DPI does and also some of the chemicals they produce:

So how does DPI benefit from COVID-19?

Not 1 or 2 but 3 WAYS!

1. Production of key hand sanitiser ingredient, isopropyl alcohol.

Below is a typical hand sanitiser and its ingredients:

2. Spray paint for motorcycles

With COVID-19, food delivery has been booming and you can easily see the number of food delivery motorcycles multiplying like mad on the streets. I have a motorcycle myself and unlike cars, if you own a motorcycle, it is highly likely that you have a bottle of spray paint to cover the scratches every now and then. Saves money instead of going to the workshop to do it.

With the large increase in number of motorcycles on the road, it is highly likely that demand for spray paint will increase.

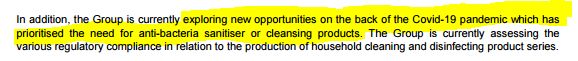

3. Looking to produce disinfectant sprays

With expertise in the spray paint business, DPI is now looking to produce disinfectant sprays. Below is what the company said in their quarterly results which was released last Friday:

Company Earnings

Not only will DPI be a big beneficiary of COVID-19, their earnings in the past few quarters have been incredibly strong!

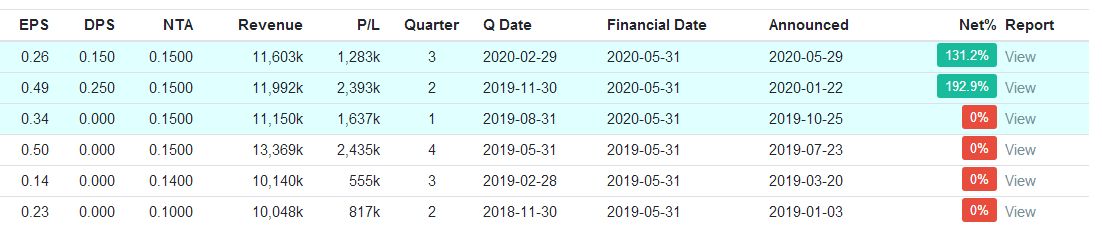

Here are the results from KLSE Screener which shows year-on-year growth for the last 2 quarters:

Earnings growth of >100% in the last 2 quarters!

Assuming DPI has zero growth in the next quarter and earns RM2.4million profit (4Q19's profit), DPI's profit for the whole year will be close to RM8million. If DPI maintains this RM8million profit in the next financial year, they will qualify for Main Board transfer! And this assumption of zero growth is crazy when they have been showing >100% growth in the last 2 quarters and DPI will also be benefiting from COVID-19!

Another surprising thing is that this 17.5sen stock actually pays dividend! Up to the 3rd quarter, DPI has already declared 0.4sen dividend. It is so rare to find 10-20sen stocks that pays dividends.

Valuation

How to value DPI?

The closest comparable to DPI is Hexza Corporation Berhad, a manufacturer of industrial chemicals. Recently, a research report by CIMB highlighted one of the chemicals produced by Hexza, ethyl alcohol which is another key ingredient in hand sanitisers. Hexza is trading at a PE multiple of 30x !! Using 30x PE and assuming FY20 profit of RM8million, DPI should be valued at RM0.49.

DPI is now only trading at RM0.175 at 11x PE! It is obviously undiscovered but I do notice that trading volumes have picked up in the last 2 weeks or so.

If we were to look at other companies that is producing or has ventured into COVID-19 related products such as Luxchem, CCM, SCGM and the pharmaceutical and glove companies, you will find that their PE multiples have increased so significantly. Companies like CCM are trading at >20x PE even though their past few quarters earnings and even the most recent earnings are horrible while other companies like SCGM are trading at PE multiples of >100x !

Many companies that produce or will produce COVID-19 related products have not been able to show improving earnings but their share price has been rallying and this is dangerous for investors when earnings do not support the high share prices. However, DPI is able to show incredibly strong earnings!

The share price of DPI is actually still trading below its IPO price of RM0.25! It is a matter of time before the share price of DPI catches up with its peers and re-rates significantly.

https://klse.i3investor.com/blogs/shareseatreasure/2020-05-31-story-h1507926014-Undiscovered_COVID_19_Hidden_Gem_Extremely_Undervalued.jsp