For a copy with better formatting, go here, its alot easier on the eyes.

(CHOIVO CAPITAL) Airasia Group Berhad (5099) – The RM6 Billion Baggage Fee

========================================================================

Airasia Group Berhad used to be an on/off investment for me that I sold just before the MCO happened, and the rest of the world went into lock-down.

I had wanted to write an article on my research into the company since

as early as March 2020. However, the process of completing my research

and compiling my old notes took more time than expected (it just kept

expanding and taking detours), as well as other priorities.

If i have to be honest, i guess the main reason for the delay is

because I don’t consider it a good investment based on my criteria’s,

and that the only reason I’m really writing this is because I promised

someone I would, subsequently announced it the my friends, and

afterwards, i just felt like i had to finish it, and do a good job at

it.

I don’t think I did that good a job (mainly because i don’t plan to

invest in it, but it still reached 10,000 words lol). However, I think I

managed to illustrate the gist of the company and all the pertinent

issues surrounding it currently, and how it would affect the valuation.

I hope it provides some value to some of the Airasia investors here,

who i’m sure have a lot of questions regarding the company today.

Background Grandmother Story

To be honest, the experience of researching and writing this article

has been a little bit of a roller coaster ride intellectually and

emotionally for me.

Airasia is one of those companies that I have some deep emotional ties with.

I remember that as a kid growing up, i had constantly read and actively

observed the meteoric rise of Airasia and could not help but be in awe

of the company and the man that was Tony Fernandes.

I still vividly remember the day when his autobiography came out.

I did not have much money and was therefore not able to buy it.

However, I remember sitting in the bookstore for 3 hours and finishing

it in one go.

I also remember in 2008, just before the 2008 World Cup, when I was a salesman for OSIM at Subang Parade.

A friend had told me he was at the Heng Seng (I think) store nearby.

I quickly ran over, introduced myself, shake his hand, and “helped” my

friend sell him a huge RM50k LED TV System to watch the World Cup on

(TV’s used to be much more expensive then).

When I first started reading up about Warren Buffett and value

investing, one of the first company I thought about with Airasia and

Tony Fernandes.

Despite not knowing anything about the numbers and the company, beyond

what i’ve read in his autobiography, and my observations, i always

encouraged my parents to invest in his company’s and IPO’s, which

included AAX and TUNEPRO.

If not for their own risk controls in terms of portfolio sizing, that would have been a much more painful experience.

It was also one of the first companies that i had “Sailang”-ed in early 2016.

This was after the short report by GMT Research. At that time, i was

very certain, that at minimum, Airasia was not faking the numbers. It

may be messy and imperfect in terms corporate governance, but it was not

malicious or fraudulent.

I bought a large position (whatever money I had) at RM0.9-RM1.2, doing

very little research (it was peak period in audit and I had no time) and

sold it off at RM2-RM3 and above.

Having said that, with the experience that inevitably comes with time

(though slower than I would like), my perspective on Airasia is no

longer as positive.

Overview

For many businesses, its often not that difficult to have an outlook on their futures with a high confidence level.

Companies like BORNOIL are likely to be underperforming and destroying capital for next 10 years.

Reasonably good companies like LIIHEN and PETCHEM are likely to

continue chugging along with good profits helped by favorable

industry/business dynamics. While wonderful companies like TIMECOM etc.

can be expected to increase revenue and profits like clockwork for the

next 5-10 years. The real question is mainly on the price.

(I can sense Phillip about to disagree with me right about here haha.

I’ll extend an olive brand say concede that QL is a wonderful business,

the price is just a little too rich for me given other opportunities.)

For companies like BORNOIL, it’s just so obvious. Incompetent

management coupled with a horrible industry is unlikely to do well.

And for business like LIIHEN, PETCHEM or TIMECOM. Their futures are to

an extent quite predictable to due to their business models being proven

with reasonable/wide moats around it.

Revenue and earnings of these companies are also stable as they know

very clearly how to continue being quite profitable, and where to invest

this profits in order to obtain above average returns.

As the saying by Warren Buffet goes,

“You don’t need to know the age of a man to know if he’s old, or the weight of a woman to know if she is fat”

Wonderful investments often look obvious.

This is not the case for Airasia, even before the COVID 19 epidemic. A TIMECOM this is not.

Its Low Cost Carrier (“LCC”) business appears to be proven and is

growing rapidly, but its economic dynamics are different in each of its

airlines in different countries (an airline business in Malaysia faces

very different economic and political problems in Indonesia or India).

Coupled with very strong competitors in certain regions, who are often

deep pocketed, and more than willing to burn money and cut corners in

order to obtain more market share. This has resulted in their

profitability (along with the industries) being sporadic. Spectacular at

times, middling to reasonable in most, and atrocious in others.

And to top it off, unlike businesses like HARTALEGA or TIMECOM, who

define their circle of competence very clearly, and drive hard at these

circles while waiting for fat pitches, Airasia seems to take on Venture

Capital like characteristics, where they take stabs and gambles at other

vertical or horizontal industries.

Instead of focusing on their core Malaysian LLC business, the company often has new ventures popping up continuously.

And again, some did spectacularly.

Airasia Thai, AAE Travel Pte Ltd Joint Venture with Traveloka, Asian Aviation Centre of Excellence, Tune Insurance etc.

While the others seem more than capable of crippling the company in the long run.

Airasia Japan, Airasia Indonesia, Airasia India, Airasia Phillipines, Big Pay, AAX

And now, we have the COVID-19 epidemic, which have placed both Airasia

and the entire airline industry in deep and unknown waters with their

survivability in doubt.

Given the above, I genuinely doubt that it’s even possible to identify

the fair value of this company within a range of 30% or so, and create a

5 year discounted cash-flow that will have less than 50% variance to

actual outcome.

In more ways than one, investing in Airasia feels very similar to

venture capitalism where one is investing in a relatively hazy and

opaque future.

And like most startups/venture capital type companies, Airasia is not a

wonderful business that even an idiot can run (PCHEM is one, but they

do have middling management, the best management that money can buy in

terms of GLC’s, but that is a really low bar).

It has so many self-inflicted complexities, that in order to survive,

much less thrive, this company needs extremely competent management,

especially during times like this.

Given all these factors, when analyzing this company, i decided to

double and triple down on the qualitative aspects, and when looking at

their history, to see if the management’s decisions / thought process

made sense at that point in time, and how each decision was executed.

And from there, get an idea of how Airasia will handle the current

crisis at hand, and its long term plans.

And so, we need to take a walk in this business through the shoes of Tony Fernandes and Kamarudin Meranun.

Walking in Tony’s And Kamaruddin’s Shoes

It was a sunny morning in 1983, when Tony woke up in his Epsom College

dormitory bed, hungover, and with a strange woman in his arms who

appeared to have been a British Airlines air stewardess…

Just kidding.

We all know the story of Airasia in its early days.

On 8 September 2001, Airasia was purchased by Tony Fernandes and Kamarudin Meranun’s company Tune Air.

When they took over the company from DRB Hicom, it had negative equity

of more than RM100 million. They injected about RM110 million worth of

capital and expanded the company.

For the next 10 years, their rise will be meteoric.

They had correctly identified the huge latent demand when it comes to

air travel in South East Asia (I still remember the days when, as a kid,

i just can’t help but feel a certain sense of awe whenever I meet

someone who had traveled overseas by airplanes before, due to how rare

it is as a result of the high costs) from referencing what Virgin,

Ryanair and Jetstar did for the western world.

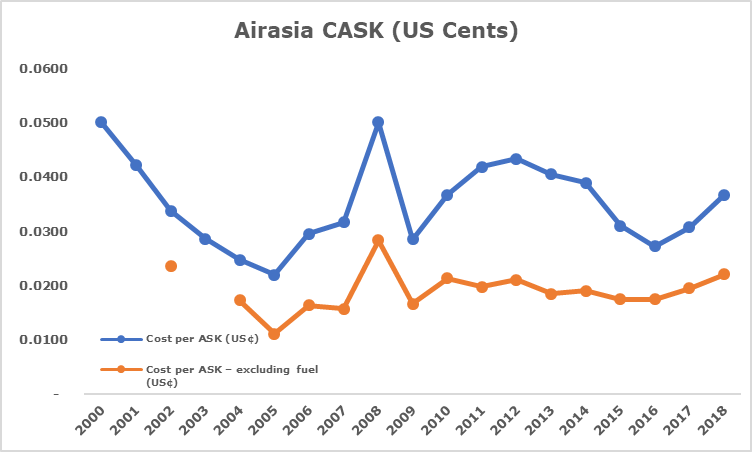

The business model they decided on is to have the lowest “Cost Per

Available Seat Km” (CASK) in the region (and the world) and thus charge

the Lowest Fares and rip market share from Malaysia Airlines (and every

other airline in Asia in the next few years).

For the first 5 years, as they scaled up, there was quite frankly zero competition in South East Asia.

And by 2005, they had the lowest cost base in the world. Compared to

its competition like MAS, its cost was at one point 70% lower.

By the sixth year of operation Airasia overtook MAS.

So how did they do it?

During the first 10 years of its birth, Airasia pioneered (or took the

initial ideas of Ryanair etc to the extreme) some innovative methods to

lower costs, such as.

-

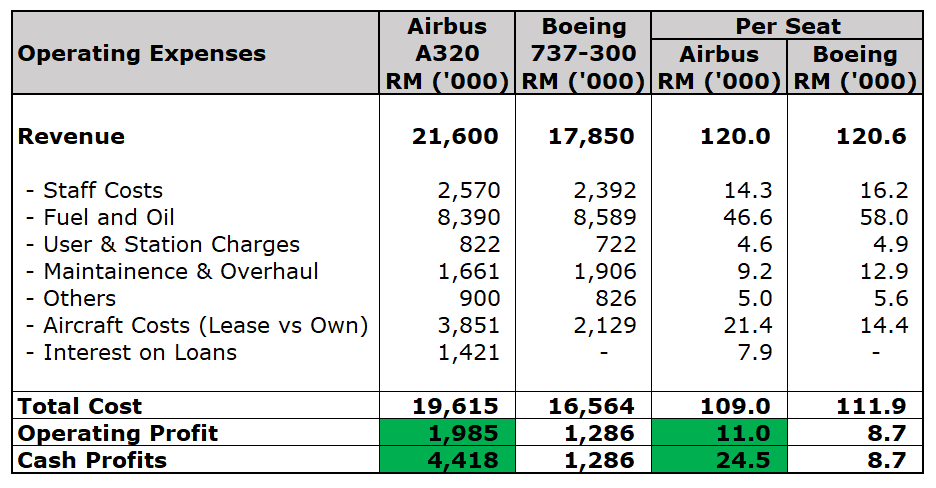

Changing from Leasing Planes to Buying Planes, and to do so in Bulk

When they first took over the company, Airasia’s planes consist of leased Boeing 737’s. They had lower capacity (148 seats versus 180 seats) compared to the Airbus A320’s that they had planned to replace it with.

When looking at it in terms of KL – Kuching, the cost comparisons were as followed.

Assumptions:

Fuel Cost: $75 per Barrel

USD:MYR: 3.65

Fare: RM150

Load Factor: 80%

Airbus A320 Seats: 180

Boeing 737 Seats: 148

This was the first step.

Given their early success, and seeing the huge vacuum in the market,

Airasia then decided that the right step was make their company the LCC

leader in ASEAN in order to have economy of scale and enable them to

drive costs even lower, and the solution was to go all in at creating

associates and joint ventures in South East Asia.

This enabled their second step, which was to buy their planes in bulk.

Airasia was one of the first (and to do it to such extremes) to make

gigantic plane orders that stretched more than 10 years in advance.

In 2007, they secured an order of 130 Airbus A320’s for delivery up to

2012, planes worth easily 10-20 times the value of the company then.

They then increased this amount to 200 Airbus A320’s by 2008.

In 2011, they ordered another 200 of them, and from this order, becomes Airbus’s single largest customer.

In 2012, they placed orders for another 100 of them, and in 2016, they did it again by ordering another 100.

By placing such huge orders, they were also able to obtain discounts of

30% or more off the list price, and get the planes customized to suit

their needs exactly.

In addition, as their initial orders were made just after the financial

crisis, and before the boom in low cost airlines (A trend that was

sparked by Airasia) in Asia, they were able to buy large amount of

planes at a discount from the already low prices that were at the low

end of the cycle.

This allowed Airasia Group to charge its Joint Ventures and Associates

leasing fees for using their planes (The company AAC was created in 2013

to manage this) and it also enabled them to be in a business to of

selling planes and slots to airplane leasing companies when the airline

boom started.

In just a few years, this would go from a cost cutting measure, to a

highly profitable venture and one of the key reason for Airasia’s

profitability.

-

Extremely Good and Cost-Efficient Marketing

Before Airasia came onto the scene, I think very few people would have heard of ads that say things like,

“20,000,000 Free Seats”

These were some of the really innovative ads that had a clear call to action/purchase. And to this day, Airasia’s ads and graphics is still top tier.

It also spawned a business model where customers started to be conditioned into making holiday plans and air ticket purchases months in advance.

This enabled Airasia to now fill up planes long in advance, and then use hedging to lock in fuel prices etc (this is not necessarily a good thing, as hedging is essentially insurance, and therefore there is a net cost element to it), and thus lock in the profits.

They were also the first to identify the fact that referees have some of the most television time in the English Premier League, but had zero advertising on their clothes, and thus obtained an extremely cheap price for the first few years of that sponsorship.

In addition, by having all the Joint Venture / Associate airlines under a single brand, they are now able to spread marketing costs widely, and thus obtain marketing costs per km that was close to 80% less than the competition, while advertising more widely.

And to top it off, during the 2007-2008 financial crisis, when advertising spending was at an all-time low, they went big into marketing the business, and during this period, with the help of cost cutting everywhere around the world, they helped permanently changed consumer and business habits to be accepting of low-cost flights.

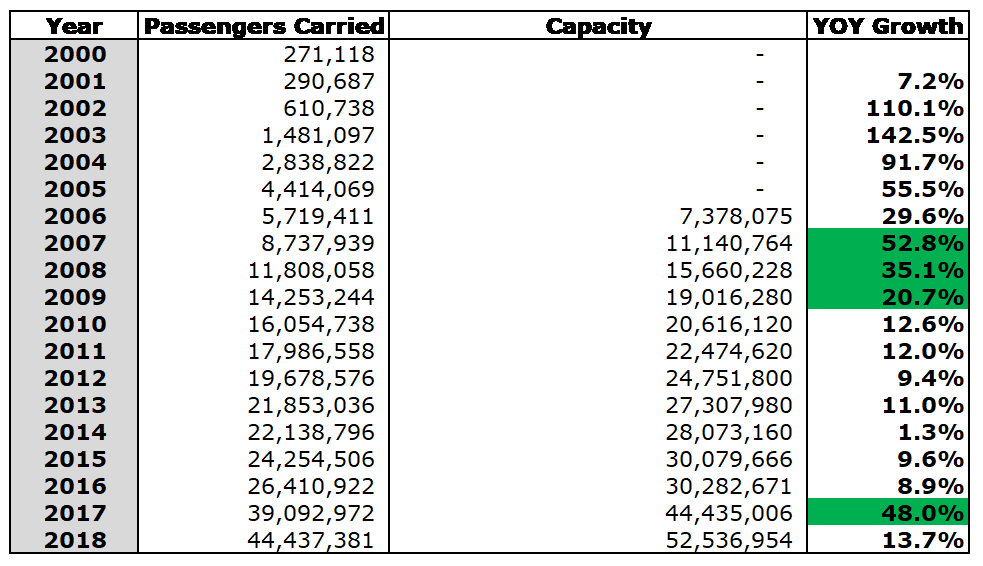

By the end of 2009, they have almost tripled the number of passengers

carried at 14.3 million, from 5.7 million at the end of 2006.

The same can be said for capacity which increased from 7.4 million at the end of 2006 to 19.0 million.

This level of growth rate will not be seen or matched until 2007, when

Airasia Indonesia and Airasia Philippines turned from associates of the

company, to subsidiaries under the group and had their traffic combined.

-

Income Tax Allowance (extra 60% on top the 100%, can brought forward indefinitely)

Airasia also negotiated with the government to provide them with an additional 60% Capital Allowance on purchase of airplanes, which can be set off against a maximum of 70% of Statutory Income.

They first obtained it in 1 July 2004 – 30 June 2009, this was then extended another five years from 1 July 2009 – 30 June 2014.

Subsequently, in view of the higher profits and less support required, it was lowered to 50% to 50% 1 July 2014 – 30 June 2019.

This enabled Airasia to have a better cost structure.

This was originally supposed to apply for planes in Malaysia only, however, it also applied when the plane is purchased by the Malaysian company, to be leased out to the associates.

-

Low maintenance and staff cost.

“Cost are like fingernails; they need to be trimmed constantly”

In addition to having an incredible focus on cost-cutting, Airasia also happen to be located in a low-cost region, when the industry is used to paying USD rates for airline staff.

In their earlier days, they also managed to lock in long term maintenance contracts at low prices.

If you were to read the annual reports, the sheer drive they have to lower costs and be more fuel efficient is incredible.

Unfortunately, i can’t seem remember much beyond sharklets, and computer testing of routes etc, and i don’t think there is too much value in me giving it to you in detail as they are know to have the lowest cost per km in the world.

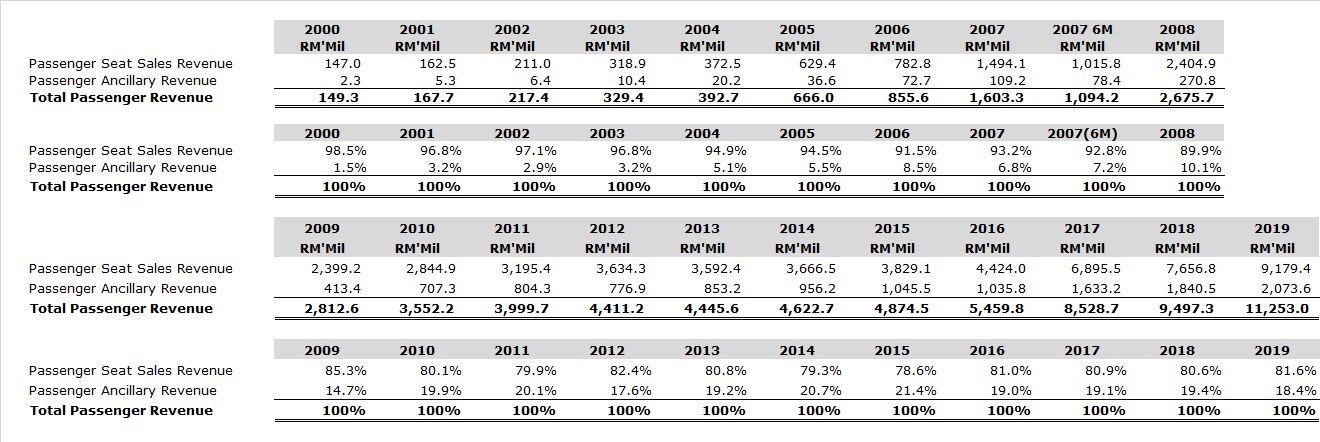

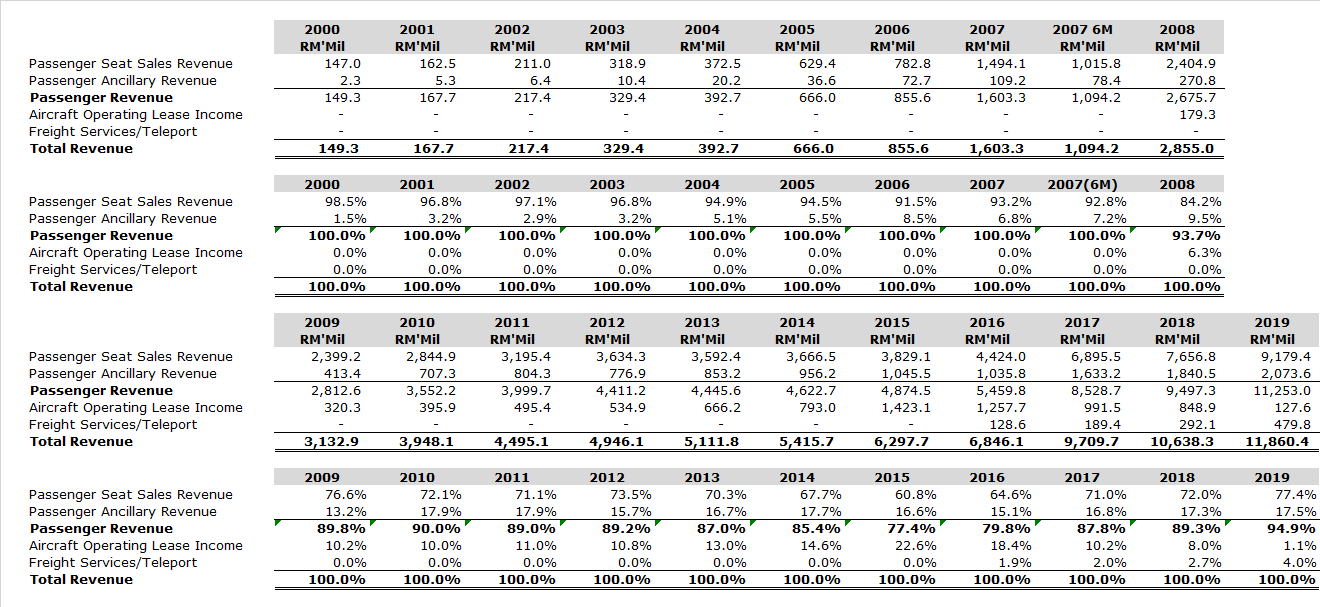

However, Airasia did not just focus on the costs, starting from 2005 onwards, they started really driving ancillary income.

The gains in ancillary income is two pronged, the first is the

passenger related ancillary income, the second, is the income from the

new horizontal or vertical businesses, as well as optimizing the usage

of planes (Teleport etc).

In terms of Passenger Related Ancillary income, after they started

driving it in 2005, it only took them about 5 years to hit the maximum

in terms of proportion of passenger related revenue.

By 2010, it was 20% of passenger revenue and has maintained around that region since.

The rest of the gains came from non-passenger related revenue such as

the Aircraft Operating Lease Income (which we will go into later) as

well as Freight Services/Teleport.

At its peak in 2015, these ancillary revenues hit 22.6% of revenue, all of it coming from Aircraft Operating Lease Income.

Currently, Ancillary Income in Airasia can be basically split into 3 types.

Passenger Ancillary Revenues

-

Live Dynamic Pricing

This was introduced in 2015, which basically means that the price of the airfare charged depends on the supply and demand at that point in time. Its not considered ancillary revenue but I wanted to somewhere to disclose it.

-

Express Boarding

Self explanatory. Pay to board early.

-

Seat Selection

Self explanatory. Pay to choose your seat.

-

Luggage/Baggage Fees

This one was quite interesting. Over the first few years, you can see the company start optimizing this by increasing the minimum size and spend. Correctly predicting that there is a certain pricing in-elasticity for people who need to bring a luggage bag and what is the perfect amount to get the maximum revenue.

And in 2017, they took it to the next level by introducing Live Dynamic Pricing depending on the supply and demand at that point in time.

-

Food

Started out standard, now they are opening the restaurant, will explain further below when discussing Santan.

-

Insurance

Travel insurance is one of the most profitable kind of insurance you can do. Combined Ratios for Travel Insurance at times can be as low as 60%. For more information on combined ratios refer here.

Aircraft Operating Lease Income

With the purchase of these huge purchase planes to fund their regional

ambitions, as stated previously, Airasia, the Group Company now had a

new income stream that would grow far more profitable than expected.

It would not be unreasonable to say that by 2016, this has grown to be

their second largest revenue and largest profit contributor.

Without it, the Airasia Group would be lossmaking.

Externally, this also caused huge headaches with accusations by GMT

Research that Airasia was only profitable due to the leasing of these

planes resulting in profit transfers from unprofitable regional Joint

Ventures, to the group holding.

Internally, i’m sure the other joint venture or associate partners did

not feel comfortable about this as well, as it could be seen as Airasia

Berhad milking the associates for all its worth.

This culminated in the sale of the planes and the leasing business

- 28 Feb 2018 (Completed 31 Dec 2018) – BBAM Limited Partnership / FLY RM 9,775.6 million and RM 262.3 million (82 Aircraft and 14 Engines)

- 24 Aug 2018 (Completed 8 August 2019) – Castlelake L.P. USD 739.5 million (RM 3,559.5 million) (25 Aircraft)

- 25 July 2019 (Completed 31 December 2019) – Castlelake L.P. (RM 1,240 million) (14 Airbus A320-200)

Resulting in net gains of RM 298.8 million and RM 101.54 million, but a

net loss in profit of around RM 643 million p.a until the new planes

come in.

For the more cynical and realistic individuals, the real reason for the

sale would be to settle Tony Fernandes’s and Kamarudin’s RM 1 billion

margin loan that taken to inject into the company back in 2016 when

prices of the shares were so low.

COVID19 non-withstanding, i do consider this a bit of a mistake.

With hindsight, it looked like a good decision due to COVID 19

happening, but I think fundamentally, it was an erroneous decision, made

mainly for the reason of paying out enough dividends for Tony and

Kamaruddin to pay back the margin loan, as the income lost is really too

significant and the gains too little.

Freight Services / Teleport

Previously, each Joint Venture and Associate was responsible for filling up the belly space of their own planes.

Starting from 2016/2017, the responsibility of filling up the belly

space of all the planes in the Group was allocated to HQ, and in 2018

Teleport was founded to finalize this and provide end to end shipping

for customers.

The Overseas Airline Ventures

Earlier in the article, we wrote about how Airasia correct identified

the gap in affordable air travel in South East Asia and after pioneering

it in Malaysia, decided to do the same in other ASEAN countries.

They started this as early as 2004, just 3 years after taking over from

DRB-Hicom, taking an extremely aggressive line in terms of business

expansion.

To a large extent, to really drive down cost and drive up ancillary income, these ASEAN related airline ventures were needed.

So how did they do?

Well, even before COVID 19 happened, its record was spotty at best.

Now, do note the numbers i’ll be showing here do not include the loans

and advances made by Airasia to these Associates and Joint Ventures.

They are very significant and will be included afterwards.

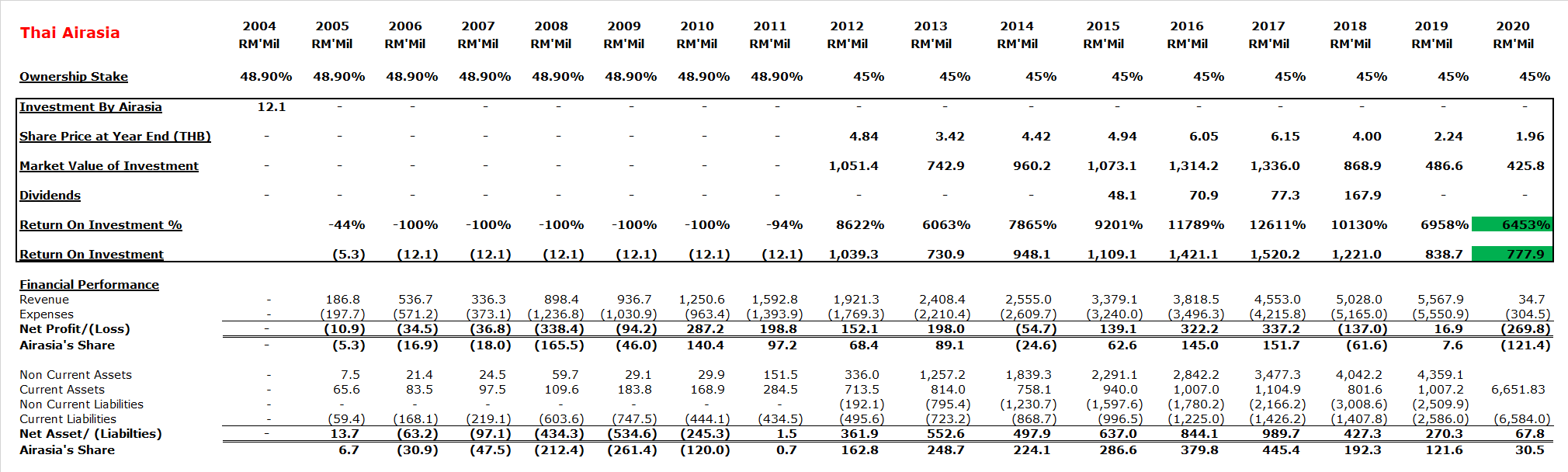

Airasia Thailand

Airasia Thailand was started in 2004 as a Joint Venture with Shin

Corporation, and recorded increasing losses for the first 4 years as

they expanded rapidly.

Like the Malaysian Portion, it was during the 2007-2008 financial

crisis, when Airasia took advantage of the low advertising by other

companies, and went on a marketing blitz, making low cost flights the

choice for companies cutting costs then, that things turned around for

them.

Losses instantly narrowed from RM 338.4 million in 2008 to RM 94.2

million in 2009, and by 2010, the company had recorded its maiden profit

of RM 287.2 million and also repaid all loans owing to the group

company.

In 2011, they showed profits of about RM 152.1 million, showing a

certain ability to maintain profitability, and so Airasia instantly

started the IPO process, and managed to raise money at roughly 10X

earnings.

This meant their stake is now worth roughly RM 1,051.4 million, a

roughly 8,622% return on investment of RM 12.1 million. (Airasia owned

the Thai Airasia Stake, which is then owned by the publicly listed

holding company. However, as the main business of the public listed arm

is in owning the Thai Airasia Stake, we can easily do some extrapolation

on the value assigned by the market to this stake)

Again, this is just on the investment in shares and not all the

advances and loans made to the company over the years which have been

repaid.

Over the years, Airasia Thailand have generally maintained its

profitability, and is the only one of the joint ventures to ever pay

dividends back to the Airasia Berhad and in a relatively consistent

manner.

It was the crown jewel of the overseas ventures.

Things started to turn sour starting 2018 and 2019 due to losses, and

in 2020 equity has fallen from a high of RM 989.7 million in 2017, to

RM67.8 million. A sum that a mere one more quarter of loss will turn

negative giving significant bankruptcy risks.

At today’s share price, the stake in Airasia Thailand is estimated to

be around RM777.9 million, but, as stated earlier, this is based of the

value of the holding company which owns the 55% stake in Airasia

Thailand, and so that company has its own assets and may not be liable

for the losses of the subsidiary in which Airasia owns its stake.

Therefore, by using the share price, I am probably overestimating the

value of Airasia Thailand. A more accurate price would probably be the

book value of just RM67.8m, the same valuation currently given to

Airasia Berhad.

Or, if one is a touch more morbid, as Raymond Yap from CIMB famously put for AAX, Target Price RM0.

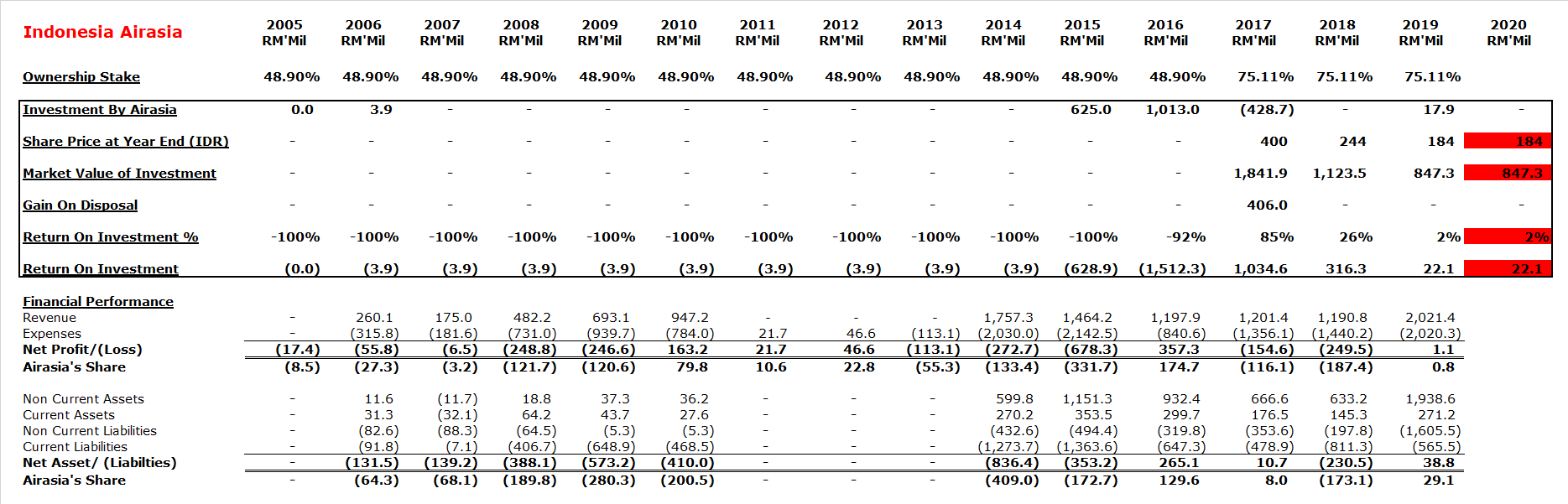

Airasia Indonesia

Airasia Thailand is where the sweet dreams end and the nightmare begin.

If Airasia Thailand was the crown jewel.

Airasia Indonesia might as well be a chronic slipped disk injury, that

threatens to turn you into a quadriplegic at any point in time.

The company was started just one year after Airasia Thailand in 2005

with PT Fersindo Nusaperkasa. And like Malaysia and Thailand, it grew

quickly, making increasing losses, and turned around during the 2008

financial crisis.

However, that was where their paths start to differ.

They were unable to maintain profitability as giants like Garuda

Indonesia and Lion Air decided to enter this space and basically fight

Airasia Indonesia to the death.

This was unlike Thailand, where the National Carriers like Bangkok

Airways decided to stick with full service instead of going into the LCC

model, giving Airasia Thailand full reign of the LCC market with the

competitors being either too small, or Thailand not being their major

markets.

As for Malaysia, it did so well because the only competitor was MAS and

they are a GLC without a monopoly who never had serious competition

before. Its like taken candy from a baby/

By 2015, the company was so illiquid that any advances and loans to

them needed to be capitalized, and RM 625 million was converted to

shares. In 2017, they had to inject a further RM 1,013 million.

In 2017, the company somehow managed to make a profit, and Airasia

decided to IPO the company in record speed by doing a reverse

acquisition. This valued their effectively 75.11% stake at RM1,841.9

million, and a gain on investment of 85%.

Miracles do not happen twice in a row and they were hit by massive

losses again in 2018. The bleeding did not end and by 2019, the shares

were suspended.

It is currently negative equity, with the amount not disclosed in the

annual reports. And it has not published its quarterly reports since the

end of 2019.

To say its currently worth zero would be understating it.

Chances are Airasia have advanced significant amounts to the company, which will probably need to be impaired.

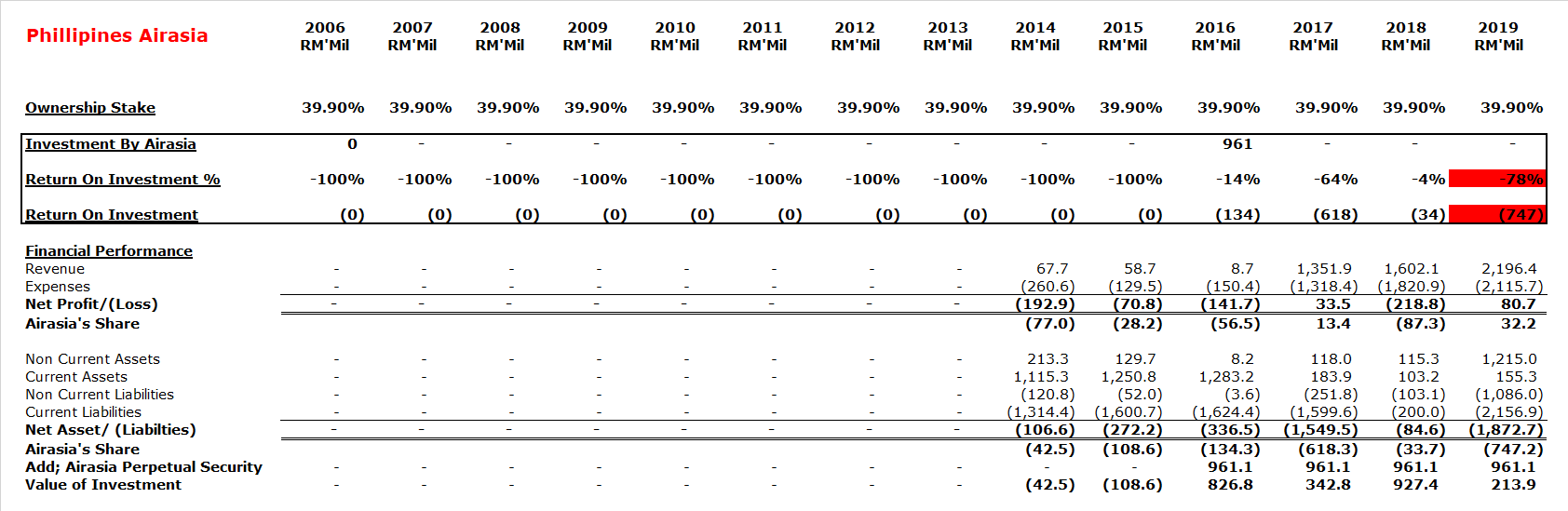

Airasia Phillipines

Airasia Phillipines was basically started in 2006, but never really got

off the group till 2013 with the acquisition of 85% Zests Airways.

And surprise surprise, a deluge of losses followed.

By this time, there are many low cost carries in south east asia, and I

don’t think Airasia still has the edge outside of Malaysia and

Thailand.

Just 3 years after taking over Zest Airways, the company became

illiquid and needed Airasia to convert RM 961.1 million advances into

perpetual securities.

As of 2019, accounting for the perpetual securities, the value of Airasia’s investment is now only RM 213.9 million.

I would imagine that 2020, would knock that amount down to negative when results come out.

And like Airasia Indonesia, the amount advanced / loaned to them is likely lost.

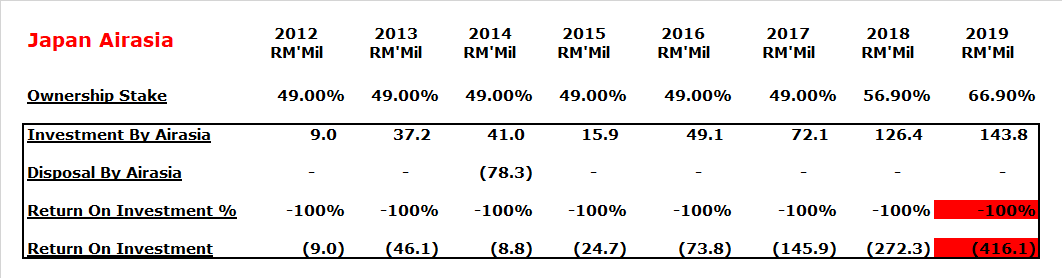

Airasia Japan

Ever the glutton for punishment (The real mark of ambition and an

entrepreneurial spirit) , Airasia also started a Joint Venture with All

Nippon Airways (“ANA”) in 2012 for a low cost carrier in Japan.

As usual, losses for the first few years and thus requiring constant

capital injection. However, in 2014, in a stroke of good fortune, ANA

decided to buyout Airasia and recompense them in full.

True to the Airasia Spirit, Airasia instantly found another partner in

the four musketeers of Octave, Rakuten, Noevir and Alpen to restart the

venture that same year.

To date they have invested RM416.1 million (not counting advances) and

is likely in negative equity (or it wont need so much constant

injections), and I imagine 2020 will not be a good time for them.

For the sake of Airasia Berhad shareholders, i hope a miracle happens

again, and the four musketeers buys out Airasia this time as well, and

recompense them in full.

I’m personally not betting on it though.

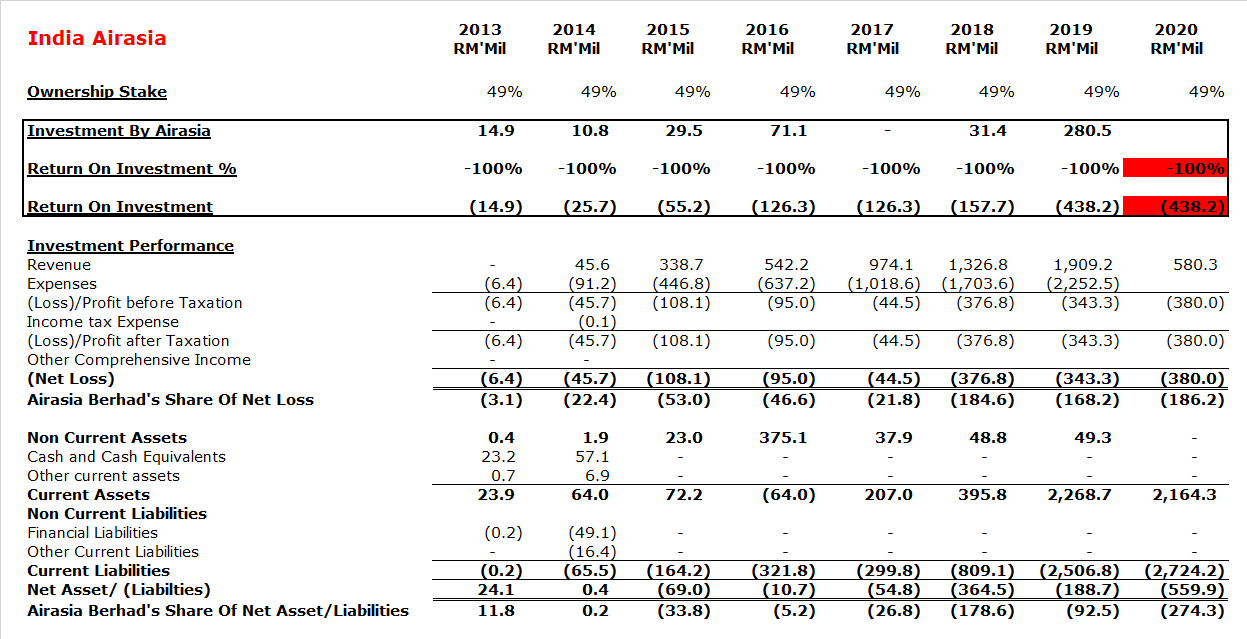

Airasia India

And if you thought Airasia India was bad, well you have not met Airasia

India, which I think should darken the skies of any Airasia investor.

This joint venture was done in together with Tata Sons Limited and Telestra Tradeplace Private Limited.

If there is one thing that public listed companies in Malaysia have

learnt, it is to never do any business in India unless absolutely

necessary.

Mudajaya can show the scars for it, and even till today, they have not fully healed.

The reason for this is due to the absolute sheer idiocy of the Indian

Government and Indian Bureaucracy. The fact that someone as insane as

Modi can be considered a good choice shows you just how bad the rest of

it is.

The bureaucracy of that place is so retarded, that in order to buy a

phone simcard in india, you actually need government approval.

You actually have to fill in a 6 page form in quadruplicate with 4

passport photos to buy a simcard. And it takes 3 days minimum for the

approval to come through.

Good lord.

Imagine having to do business in a place like this, and an incredibly hard one like airlines to top it off.

And by the way, airlines also do particularly badly in India (read Kingfisher Airlines).

This is due the government forcing airlines to fly uneconomically

viable route, with no compensation, as well as other retarded rules on

international travel (remember, just for simcards you need to fill in a

six page form in quadruplicate).

And with the partner being TaTa Sons Limited, where the sons are, to

put it mildly, not known for their business acumen, does not bode well.

If this was Reliance (Mukesh, not Anil), I would be more optimistic.

So far, RM438.2 million have been invested, not including advances and loans.

Here’s to hoping this is entire amount that Airasia India will cost the company

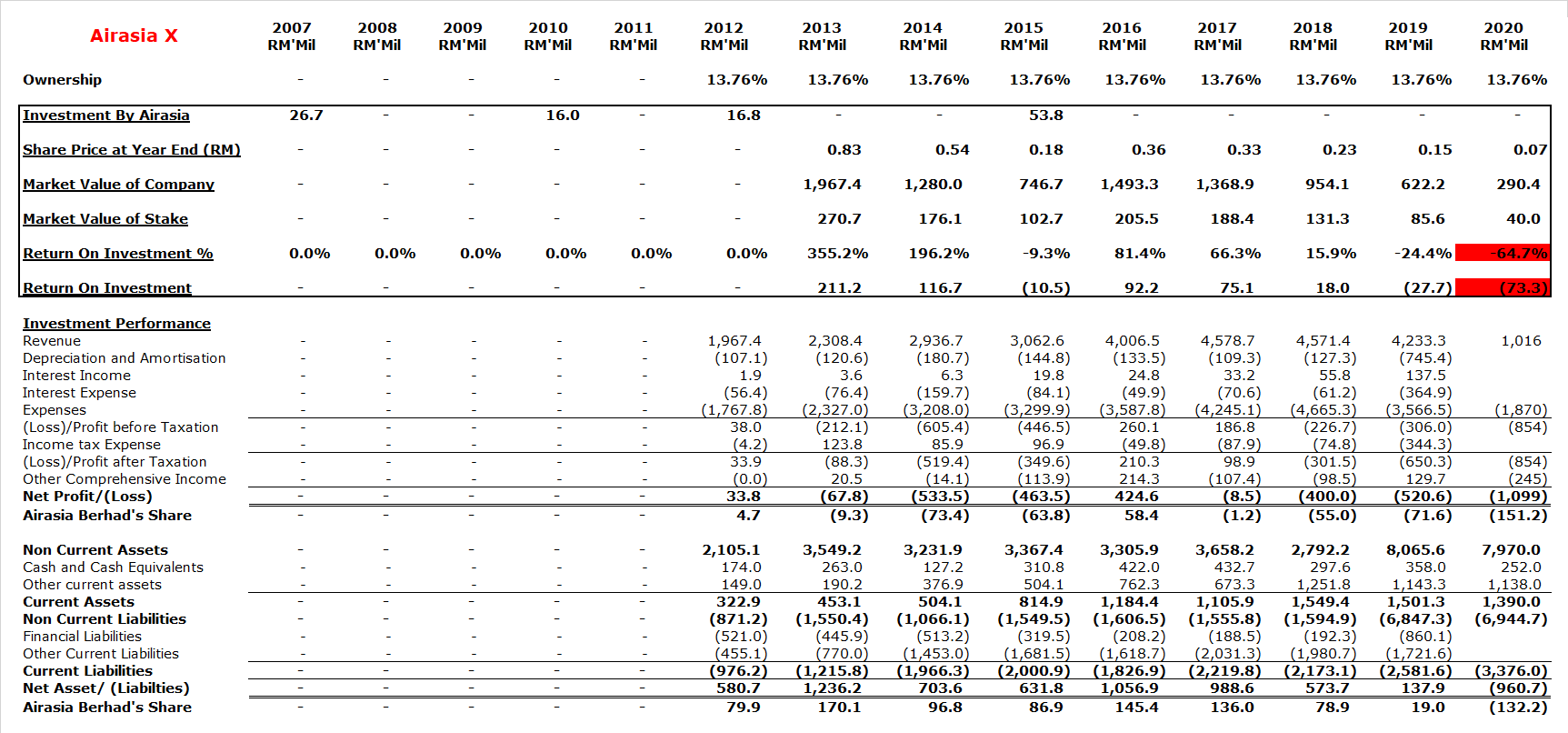

Airasia X

This one does not really count as an overseas venture, but its convenient to elaborate on it here.

It started with a subscription of RM 26.7 million in preferred shares

in 2007. The company was owned by Tune Air then. (Why does it need to be

owned by Tune Air while being funded by Airasia? Corporate Governance

is another theme we will touch on later.)

Another RM 16 million was injected in 2010, and in 2012, the company

bought RM 16.8 million of ordinary shares and converted the rest

resulting in a 13.76% stake.

During the IPO in 2013, Airasia was on a high related to its strong

earnings since 2009 and optimism towards the company was at an all-time

high.

Post listing, the market value of the stake held by Airasia was worth about RM270.7m.

Unfortunately, massive losses again followed. And by 2015, it require a rights issues and capital injection to be kept afloat.

Airasia had to inject and additional RM 53.8 million. As at today, AAX

is negative equity, and it would not be a stretch to say the RM0 target

price given by CIMB is accurate.

The reasons for AAX losses, are probably two pronged.

One, the long distance LCC business has not be proven.

Long distance flights are usually more expensive, due to the distance,

and the increased weight of the planes due to the longer distance

requiring more fuel and the type of planes and engines used is also

different.

This meant higher base costs. Now Airasia runs a no frills airline, where if you want the

“Frills” , you need to pay for it.

“Frills” , you need to pay for it.

For shorter distance flights, the business models work, because “Frills” are a larger percentage of the costs.

But for long distance flights, the frills are now a much lower

percentage of the costs, and for customers, if you’re going to be stuck

in a plane for 15 hours, you would probably pay up for some comfort.

A 45 minute flight to Singapore?

Well, Airasia can stuff me into the luggage space for all i care, as

long as it’s the cheapest option. A 15 hour flight is a different story.

The second prong is probably an incompetent CEO. When you need to give

out free flights during your AGM, you know you screwed up.

Unless i’m mistaken, Benyamin Ismail the CEO was also the person who suggested the Malaysia to Hawaii Route.

How on earth is one supposed to make money on a RM2,000 two way flight

to Hawaii is beyond me. And when it comes to flight slots, when you get

it, you’ve got to run it, regardless of whether or not it makes money.

The unsuitable business model is probably not helped by having a CEO who appears less than competent.

Other Non Airline Ventures.

Unlike Airasia’s airline related ventures overseas, its non-airline

related ventures did much better. And we will start with the one that

did best.

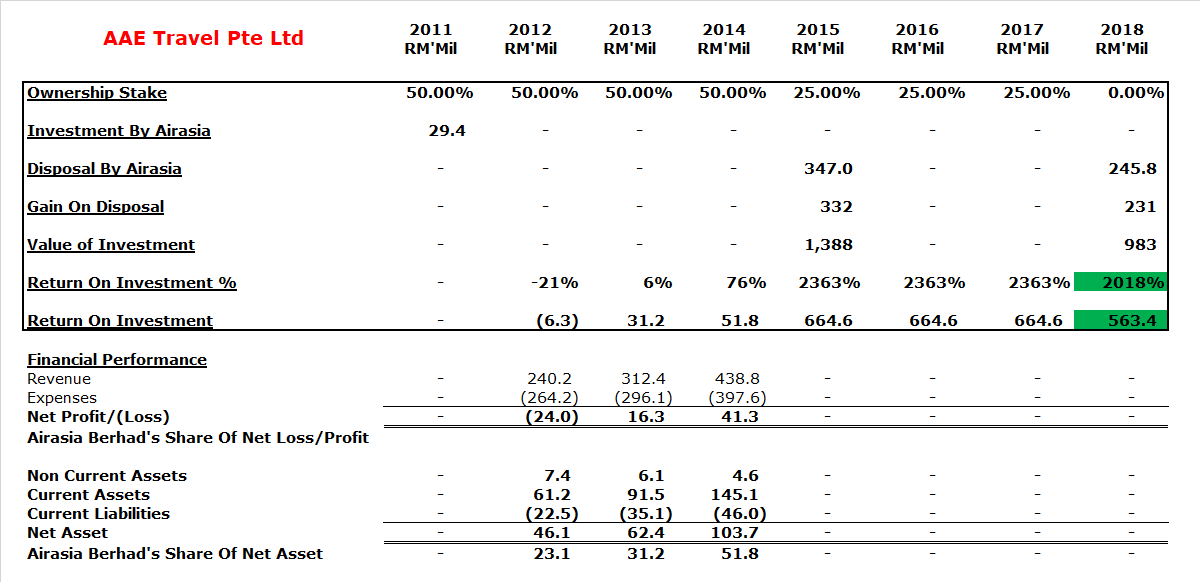

AAE Venture Pte Ltd

AAE Travel Pte Ltd was an online travel agency joint venture with

Expedia. Airasia invested approximately RM 29.4 million in 2011 for a

50% stake.

The company took off the ground quickly. By the second year, it was high profitable, and by the third it had tripled earnings.

Expedia probably realized their error of doing the joint venture with

Airasia (as most of the work was done by Expedia), and wanted to buy

back the shares.

Airasia sold half of it back for RM 347 million, with the company

valued at RM 1,388 million (or about 34 times earnings), giving them a

2,363% return on investment.

Personally, I think they could have probably gotten more for it at that point in time given the sentiment and the growth then.

However, as I don’t have the accounts or did a deep dive into the situation then, I can’t comment too much.

They sold the rest of it in 2018 for RM231 million. Valuation has

fallen during the sale of the these remaining shares, as i imagine

earnings of the company would have fallen due to Google eating the lunch

of Online Travel Agencies with the Google Hotels module.

As a whole, Airasia gained RM563.4 million or a 2018% (not sure if this was intended!) return on investment.

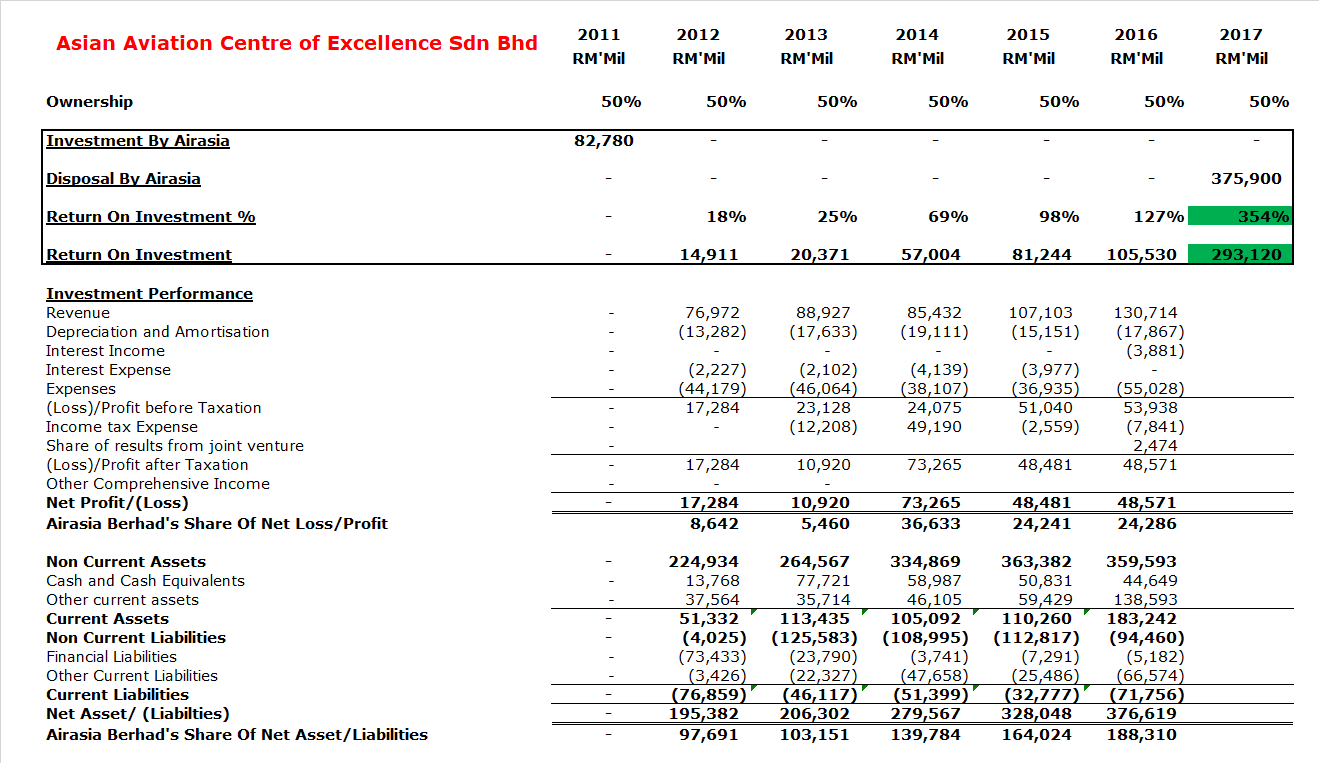

Asian Aviation Centre of Excellence Sdn Bhd

Asian Aviation Centre of Excellence Sdn Bhd was a joint venture with

CAE International Holding Ltd to provide academy for aviation staff.

At this point Airasia was growing so large, that they needed their own training academy.

Airasia invested RM 82.8 million for a 50% stake of the joint venture and it was profitable from day 1.

CAE International Holdings bought out the stake in 2017 for RM 375.9

million resulting in a net gain of RM 293.1 million or return on

investment of 354%.

At about 16 times earnings, i think that Airasia probably sold it for a

little too cheap, especially with it growing so quickly. However, as

they also got a long term fixed rate on the training out of the deal, it

was mostly still quite reasonable.

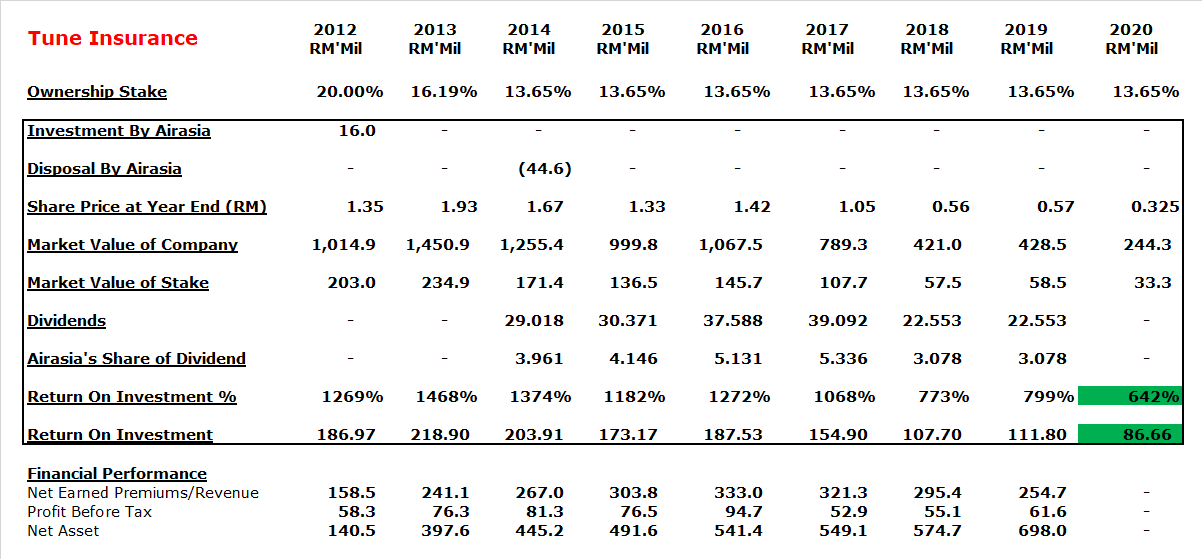

Tune Insurance

Tune Insurance was a company being run by Tune Money, a company outside the Airasia Group owned by Tony and Kamarudin.

Before the company was listed, Airasia had a call option on the company for 20% of the shares.

Airasia exercised it for a 20% stake in 2012.

It was listed in 2012, giving the company an instant net gain of RM 187 million or 1,269% return on investment.

For me, the real question here is this?

For a company’s, whose primary business at that point consisted of

selling insurance to Airasia’s passengers, why was it done from

Tunelife, the holding company of Airasia owned by both founders instead

of Airasia itself?

Now this is not illegal and may not even be considered unethical.

However, serious (in my opinion) conflict of interest like these happen

a lot in Airasia’s corporate history, mainly because Tony and Kamarudin

both do Airasia related business via Tunelive outside of the Group.

I think this one is still relatively benign, but in our next example, the conflict of interest will be more egregious.

In any event, back to the business, so how is it?

As an insurance company it

is decent, due to the incredible combined ratio when it comes to the

travel insurance sold to the customers of Airasia and other airlines.

However, this incredible business is also coupled with some really major flaws.

For one, as a digital insurance company, it has completely dropped the ball on online insurance offerings.

It was one of the first to do online insurance for cars and vehicles,

but other banks and insurance companies were very quick to do it as

well.

The key products for insurance which need to be done online, due to

high agent fees, are life insurance, health insurance and savings plans

etc, which are unfortunately not offered by TUNEPRO.

Unlike other insurance companies who cannot do this due to the baggage

they have in terms of agent networks etc (try doing it and all your

agents will boycott you), TUNEPRO did not have this problem.

And now companies like AIA allows you to basically sign up for all your

insurance needs online. And we also have fintech companies like

Covertouch and Sureplify etc doing the same thing.

To an extent, I think Tony and Kamarudin knows this as well, which is why they changed 3 CEO’s in 2 years plus.

And as an insurance company, one of their biggest failures for me, is the lack of a good investment team within Tunepro.

Currently, significant portions of the funds is managed by malaysian

unit trust companies, which comes along with its own obscene malaysian

boleh level of fees.

If it were at least placed into Exchange Traded Funds it would not be as bad.

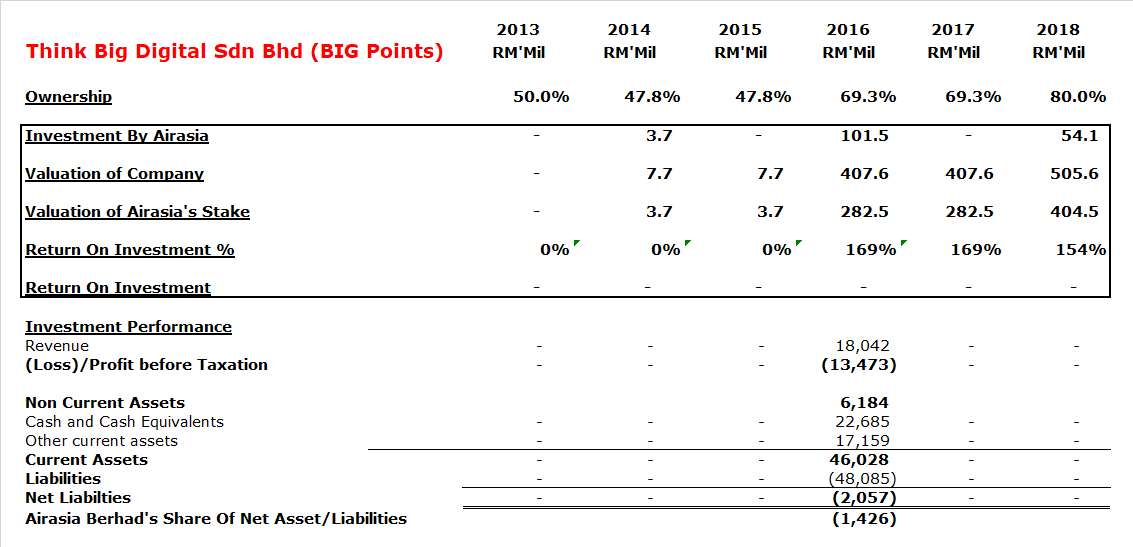

Think Big Digital Sdn Bhd (BIG Points)

In terms of failures in corporate governance

(Do note just because a company have imperfect corporate governance and

contains large conflicts of interest, it is still possible to have

everything be above board and be perfectly legal, as in this case).

this one takes the cake for me.

In 2013, Airasia Berhad, along with Tune Money Sdn Bhd (owned by Tony

and Kamaruddin) opened a RM 2 company for a Joint Venture to do BIG

POINTS, Airasia’s version of Bonus Link Points.

In 2014, this company was now magically worth RM 7.7 million, and

Airasia invested an additional RM 3.7 milion and now included Almia

Holdings UK II Limited (no idea who) as a shareholder. Its stake now

falls to 47.8%.

Just two years later, the company is now magically worth 54 times more

at RM 407.6 million. And Airasia Berhad now purchases a 24.9% from Tune

Money International Sdn Bhd (the company owned by Tony and Kamaruddin)

for RM 101.5 million.

And what did the company have to show for it that year?

Losses of RM 13.5 million and negative equity of RM 2 million.

Come 2018, the company is now worth “only” 25% more, and Airasia bought

a further RM54.1 million stake from Yickal Holdings Limited (no idea

who, probably a partner, a venture fund in the company, or some related

company).

Now, in the best case scenario, Airasia somehow bought this company at a

castle in the sky, loss making tech companies level of valuation, and

that both the management of Airasia (Tony and Kamaruddin and Board of

Directors) as well as Tune Money (Tony and Kamaruddin) considered this a

fair price.

Non withstanding the fact that Tony and Kamaruddin only own 32% of

Airasia Berhad and 100% (Probably? The number is probably close or much

higher than 32%) of Tune Money.

Or….. Well, I don’t want to speculate.

But I doubt a “Points” provider business is worth this much.

And here’s the thing, even if the intent was, to put it nicely,

non-extra virgin olive oil, all of this is completely above board.

As all you need is, board approval from a board whose directors were

effectively elected by the majority shareholders of Airasia.

And these directors also basically own either zero or very little shares.

I mean, other than one person, Dato’ Mohamed Khadar bin Merican, the

number of shares owned by the other members do not even amount to one

year’s worth of directors fees.

To be fair, I think Dato’ Abdel Aziz may own some shares in Tune Live

(The main shareholder of Airasia owned by Tony and Kamaruddin) by virtue

of being a founding member.

Then again, this is a flaw within every single public listed company globally, except for Berkshire Hathaway and maybe CACC, so you can’t fault them too much for it.

To be fair, Tony seems very earnest in pushing for Big Points, and

Airasia is doing a lot of stuff with Big Points, but I seriously doubt

it is worth that much, and the serious conflict of interest issues

happening is not helping.

Of course, one potential explanation is that Tune Money did this

together with some venture capitalist who went crazy with the valuation,

and if everyone already paid so much, you can’t exactly do a

down-round, and so Airasia needed to bite the bullet.

Other than in 2018, Airasia does not disclose the results of BIG Points

and I’m not interested in spending the money to buy these reports. And

so, ill end this one here.

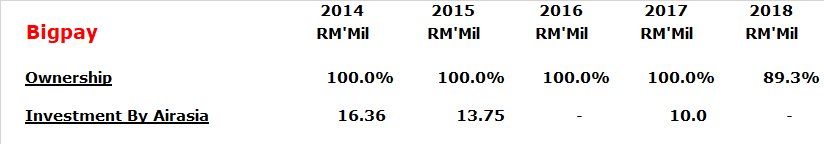

Big Pay

In 2014, 100% of Big Pay was purchased from Tune Money for RM10 mil

(cue corporate governance spiel), and there is subsequent fund

injections.

In 2018, Tony Fernandes said this company will be worth more than airasia.

Well, it may very well happen, but I just don’t see it

Well, it may very well happen, but I just don’t see it

(It may IPO to massive numbers like AAX, TUNEPRO and Airasia Indonesia, but I doubt the long term economics is that good)

the way its going.

In 2020, BigPay now has more than 1 million debit card holders.

Except, I’m certain they are still losing money.

Now, one can think of this as building the base for a very profitable

business in the future. Rome is not built in a day after all, but I

don’t think this is the case.

The main reason people use BigPay Cards (I have one) or basically most

e-wallets etc out there, is because my credit cards give me good

cashback when I deposit money into Big Pay.

That’s it.

Their remittance business looks ok, but the cost structure and method

of transfer is very different from Instarem or Transferwise who use the Islamic “Hawala” system.

I’m personally not psyched on this.

Also in 2018, 11.3% stake was given to the founders Christopher Paul Davidson and Navin Rajagopalan.

As i understand from talking to Airasia staff, one of the things that

Airasia and Tony likes to do, is that when someone has an idea that Tony

likes, and the guys seems capable of carrying it out, Tony will usually

open a company and ask that person to run it, and potentially give a

stake somewhere down the line.

So, this may probably the above scenario.

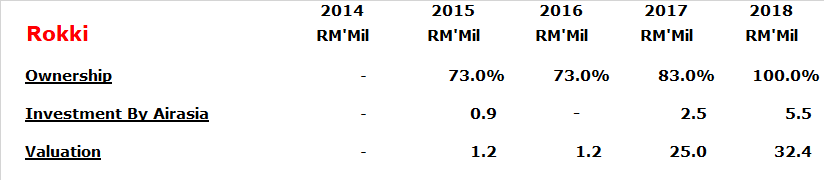

Rokki

In 2015, Airasia acquired a 73% stake Rokki (not from a related party this time, or at least its not obvious) for RM 876k.

It was a company that aims to provide in plane wifi service. It also

had negative equity and on the verge of bankruptcy. The founder

continued to work in the company.

In 2017, they purchased another 10% for RM 2.5 million.

Somehow in two years, this previously almost bankrupt company became worth an additional 21 times more.

And in 2018, the remaining 17% stake was purchased for RM5.5 mil, and the company has somehow grown in value by 25%.

It’s still loss making.

To be fair, this could just be a way to pay the previous owner for his

performance in the company, but I honestly don’t know how he or the

company is worth anywhere near that amount.

Do you know how much is the owner of MFCB Berhad, the owner of the Don

Sahong Hydroelectric Plant, whose contract took blood and sweat to get

and build and will now contribute RM 240 million to RM 400 million a

year in profit.

RM500k.

For some reason, this guy is worth about 8 times more. Maybe Tony’s heart got too soft.

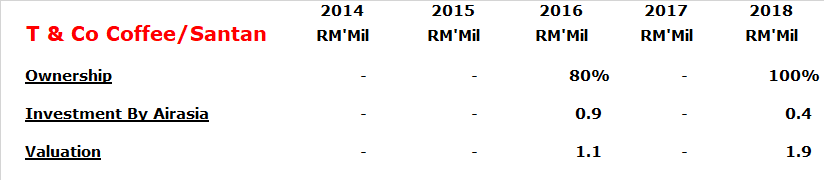

T & Co Coffee / Santan

In 2016, Airasia paid RM 914k for and 80% stake in T&Co with, the remaining 20% stake purchased for RM 380k.

From there, they have used this as a launch pad to create Santan.

This is a business I actually quite like and I think there is a strong possibility of success if they can solve a few items.

The idea for Santan is this.

Airasia has central kitchens in all around Asia. Instead of just

supplying food to the planes, why not supply it for a franchise (or own

some of the restaurants) all around asia as well, as the food in Airasia

is fairly decent.

The plan is for the food to be pre-cooked and pre-packed before sending

to the franchisee every other day. So, all the franchisee needs to do

is heat up the food. This really saves a lot of the costs and

complexity.

It used to be “Now everybody can fly.”, well its now “Now anybody can open Santan franchise.”

In addition, Santan also has a website where people can order food

online to be delivered, and so far, as I understand, about 40% of a

shop’s revenue come from online.

Looking at the food packages, its RM12.90 for the Nasi Lemak and Juice

(the juice tasted quite nice and the packaging looks great). I would

prefer if the price is more like RM10.90, but they can probably set the

right price themselves.

My only qualm is this, the food is not at the level where I would actively seek them out.

The sambal in the nasi lemak is ok, so is the chicken, but the rice is actually quite bad and sticking together like a pulut.

However, as I understand, Tony and his team (I think the CEO of Santan

is called Catherine? Very young and hands on) will be aiming to improve

it, so we’ll see.

The franchise fees is also around RM65k, which sounds mostly reasonable?

As I understand, Airasia also opened a chicken farm called OurFarm in

Vietnam (or Cambodia?) due to the inability of chicken producers to meet

their demand (This does not make sense to me but ill take it at face

value for now).

Chicken farms are generally very difficult businesses, but if its

Vietnam (or Cambodia?) where income and consumption of meat is going to

boom, it should do OK I guess?

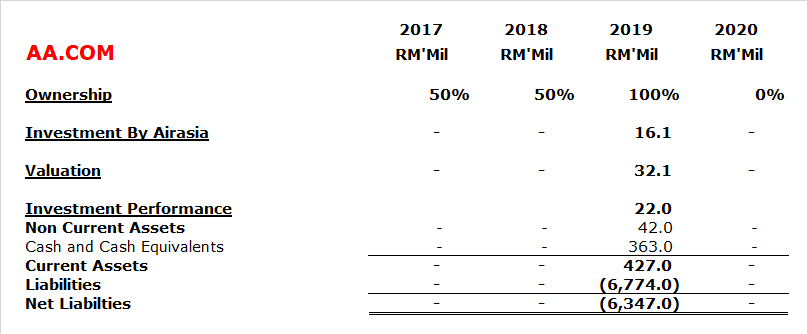

AA.COM

AA.com is one of those companies that just popped up in 2017 with no explanations for one reason or another.

However, in 2019, they paid RM3.5m for the remaining 50% stake from

Netrove Ventures Corporation & Aaron Sama, and further invested

another RM12.6m

As I understand, they are trying to make this site into an Airbnb type

business, and to an extent, it makes sense due to the sheer amount of

traffic Airasia gets.

My only question is, why does Airasia need to pay to buy a company

which is borderline bankrupt with a website, instead of making it on

their own?

Maybe its just a matter of speeding things up? No idea.

The business have reasonable probabilities for success, but i won’t bank too much on it.

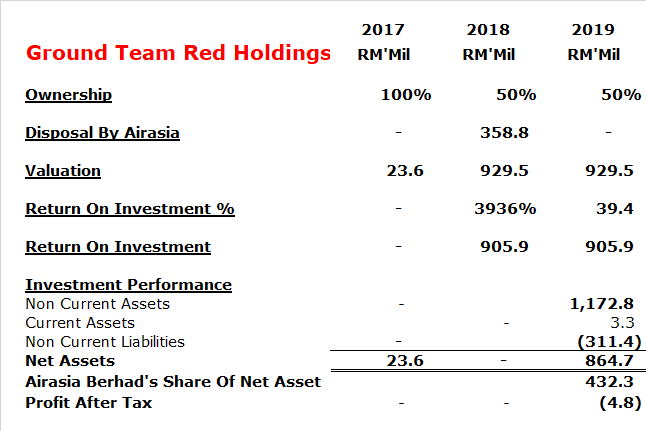

Ground Team Red Holdings

This was one deal, i found really confusing in a good way.

I have no idea how earth Tony pitched this ground management business to SATS in Singapore.

But somehow, SATS were willing to pay about 40 TIMES NET ASSET and

80% of SATS Ground Services Singapore for a 50% stake in Ground Team Red

Holding.

Its so insane, that i do not think too much valuations like this in

the very bubbly tech venture capital exists, unless it was paid by Son

Masayoshi

Wow. Just wow.

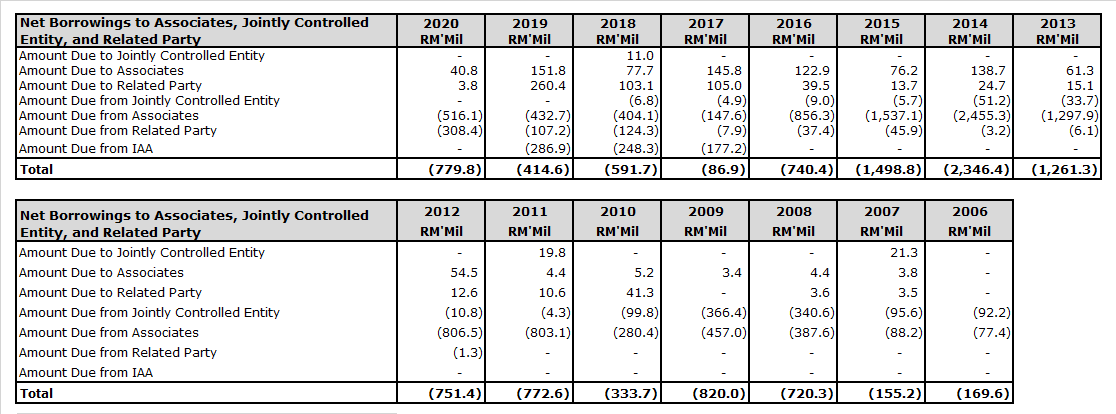

The Amounts owed by Associates, Jointly Controlled Entity and Related Parties.

And here I’ve included a summary of the net amounts owned to by the

various Associates, Jointly Controlled Entity and Related Parties.

The amounts from 2014 to 2017 fell mainly due to the amounts owing

by Airasia Phillipines and Indonesia being converted to Preference

Shares and Ordinary Shares due to liquidity problems in those companies.

With COVID 19 (or even if COVID 19 didn’t happen) I expect for this to continue.

One thing to note is that Airasia Phillipines and Airasia Indonesia

are considered subsidiaries since 2017, this is due to control being

held by Airasia Berhad instead of the other parties.

This means the amounts owing by those companies are not in the list

above, I expect them to constitute the largest amount, potentially

larger than the entire amount above combined.

The Covid 19 and Malaysia Airlines Factor

With COVID 19 happening, airlines around the world have gone into a tailspin.

As for Airasia, they are slightly luckier due to the company having

disposed of all the planes before this, and so unlike other airlines,

they have very little loan covenants etc.

What this means it that there is little chance of everything being

due at once and sending you right to the bankruptcy court when you break

the covenants. Instead, you get a little leeway as only a certain

amount is due each month, come rain or highwater.

Now, some people would argue that amount due to aircraft leasing companies is more flexible than banks.

I don’t really think this is the case, as aircraft companies like

AERCAP would take your plane away within a week from any airport in the

world and redeploy it somewhere else if you don’t pay up.

Now obviously they will not do this now as there is nowhere else to redeploy the planes.

In addition, the terms are such that, like banks, the only thing

that can stop them from chasing the money from you is bankruptcy, if you

are not bankrupt, they will chase you down.

However, like banks, if you owe them so much money that their own

lives are at risk if you default, and you are worth more to them alive

than dead, they will likely be willing to be flexible.

For investors in Airasia, there is really 2 major items related to

COVID 19 and MAS that needs to be answered before a right price can be

put on Airasia.

The Bailing Out Of Airasia

As of today, I would challenge anyone to find me a better airlines’s

balance sheet than Airasia’s, other than the recently bailed out SIA.

I would think it would be a real struggle, and this is mainly due to

the disposal of the planes 2 years ago. Today most airlines in the

world (especially South East Asia) is up to their gills in planes they

own, that are not flying, whose value will fall every day, while the

loans outstanding stay the same.

While Airasia is in an interesting position, where they can

potentially negotiate on the lease rates of these aircraft, whose values

have fallen and are in large supply.

When they get out of this, given the large amount of additional

aircraft’s that these aircraft lessors will have, it is not unthinkable

for them to get a discount on the current rates, and be able to lease a

large amount of new aircraft’s at a much lower rate, enabling them to

make super-normal profits for the first 1-2 years and get a nice

head-start.

In addition, Airasia as a business in Malaysia, is good enough, that

if the Malaysian Government does not bail it out, someone else will via

capital injection.

So, what are the differences between the two?

Government Bailout

Some here may remember, that just one or two months before MCO, when

the government was discussing handling the MAS problem, one of the lead

runners for the deal was Airasia.

The plan was for Khazanah to pay Airasia around RM12 billion to take MAS out of their hands.

The RM12 bil paid is for the cost of canceling plane orders, do

layoffs, cancel rubbish contracts, buy new planes to replace the

Boeing’s that is to be disposed etc etc

And then COVID19 struck.

Now, there is nothing that Khazanah would like to do more than get

MAS out of their hands. And, if the government ever gives any soft loans

to Airasia, they will want to somehow tie MAS into the deal.

Except the terms at this point in time is unlikely to be as pretty as before, since Airasia really needs a soft loan now.

From Airasia’s perspective, they may want to consider playing chicken with the government a little bit

Why?

This is one of the few times where the government actually have a good reason and excuse to let MAS die.

They can always say that due to how horrible everything is, they

need to prioritize on who to save, and they just don’t have the capacity

to save MAS.

And so, it may make sense for Airasia to wait for the government to

come to this conclusion, before they push hard for the soft loan.

Either way, whether MAS dies or is combined with a Airasia, an

Airasia without MAS to compete with in Malaysia will enter a new age of

super-normal profit in Malaysia and Singapore, and good luck to whoever

who wants to compete the LCC line with them.

The only question is how and when it happens.

If Airasia is forced to capitulate and take MAS in on onerous terms,

with much larger than expected dilution (Khazanah will want some

shares), the future super-normal profit may not be enough to make it

into a good investment.

Just ask CITIBANK or AIG shareholders who were diluted 99% due to

both companies being close to bankruptcy then. Until today, the share

prices have not even reach 10% of the pre 2008 crisis highs.

And lastly, even if the government gives a soft-loan in addition to the purchase of shares, it is not so simple either.

Is this softloan only to save Airasia Malaysia?

Or the Philippines, Indonesia, Thailand, India and Japan arms as

well? Is it even politically tenable for the Government of Malaysia to

be seen as bailing out other countries economy and jobs at a time like

this?

Other than Thailand (and its just a very very small possibility),

there is no way on earth the governments of those countries will want to

bail out the foreign owned airline in their country, and Airasia is

just too small in those countries to talk any kind of terms.

For example, in Indonesia, why not just bail out Garuda and Lionair,

and have them buy over the carcass of Airasia Indonesia?

Private Bailout

The more likely option in my opinion, would be a bailout by private hands. Tony once raised SK Corp as an option.

Having said that, that was 2 months ago, and the amount is too small.

Realistically, with Airasia making the decision to save their

associates and subsidiaries, looking at the Q2 2020 report where they

transferred RM 724.3 million out to them, I think Airasia would need a

minimum of RM 3 billion.

Thailand will lose at least RM500mil this year.

Indonesia will probably lose at least RM600mil.

Phillipines probably RM300mil.

Japan I would estimate about RM200mil.

India at least RM600mil.

And Airasia X, if they somehow want to save it, will need at least RM800mil.

And I think this is the minimum, if they are willing to let a few of

them die they may need less. So, the question now is this?

Who can and will buy the stake?

For me, I think there is only really one company in any position to do this now.

Singapore Airlines.

After the gigantic bailout for them from the Singaporean government

for them to the tune of SGD 19 billion or RM58.3 billion, and with

Airasia only selling for RM 2.2 billion on the public markets now.

Buying the entire company would only cost them less than 5% of the bailout money.

In addition, the Singapore government have explicitly given SIA the

authority to use this money to not just survive, but to thrive and to

take advantage of this crisis to come out stronger.

If I were a betting man, I think Airasia would probably need to

issue at least around RM 2 billion in share via private placement at a

premium to SIA, while SIA will extend a further RM 1 billion or so in

loans to the company as well.

After that (or concurrently), Tony can just sit tight and wait for

the Malaysian Government to capitulate and give them a nice deal for MAS

and buy some Airasia shares.

The reason being that the Government of Malaysia (“GOM”) simply

cannot let SIA (which is basically owned by the Singapore government

now) be a majority shareholder in Airasia, as it would be too big of a

slap in the face.

At minimum, Tony & Kamarudins and GOM’s stake together needs to be larger than SIA’s.

With MAS, AIRASIA and SIA now combined, there will be no one who can compete with them in Singapore and Malaysia.

However, all this is just speculation and its just too hard to know

what’s the right price for the business until a solution to the above

problems is known.

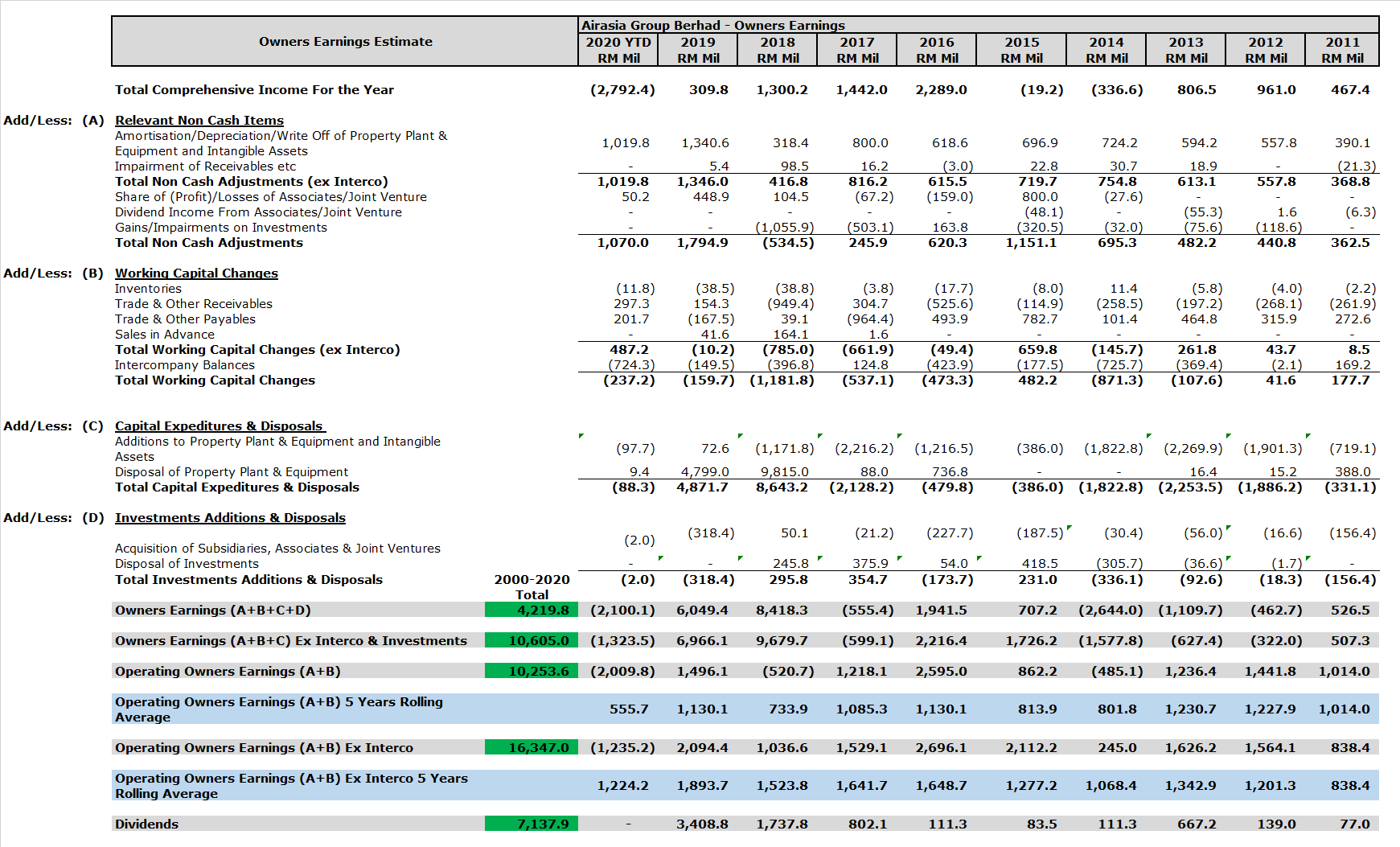

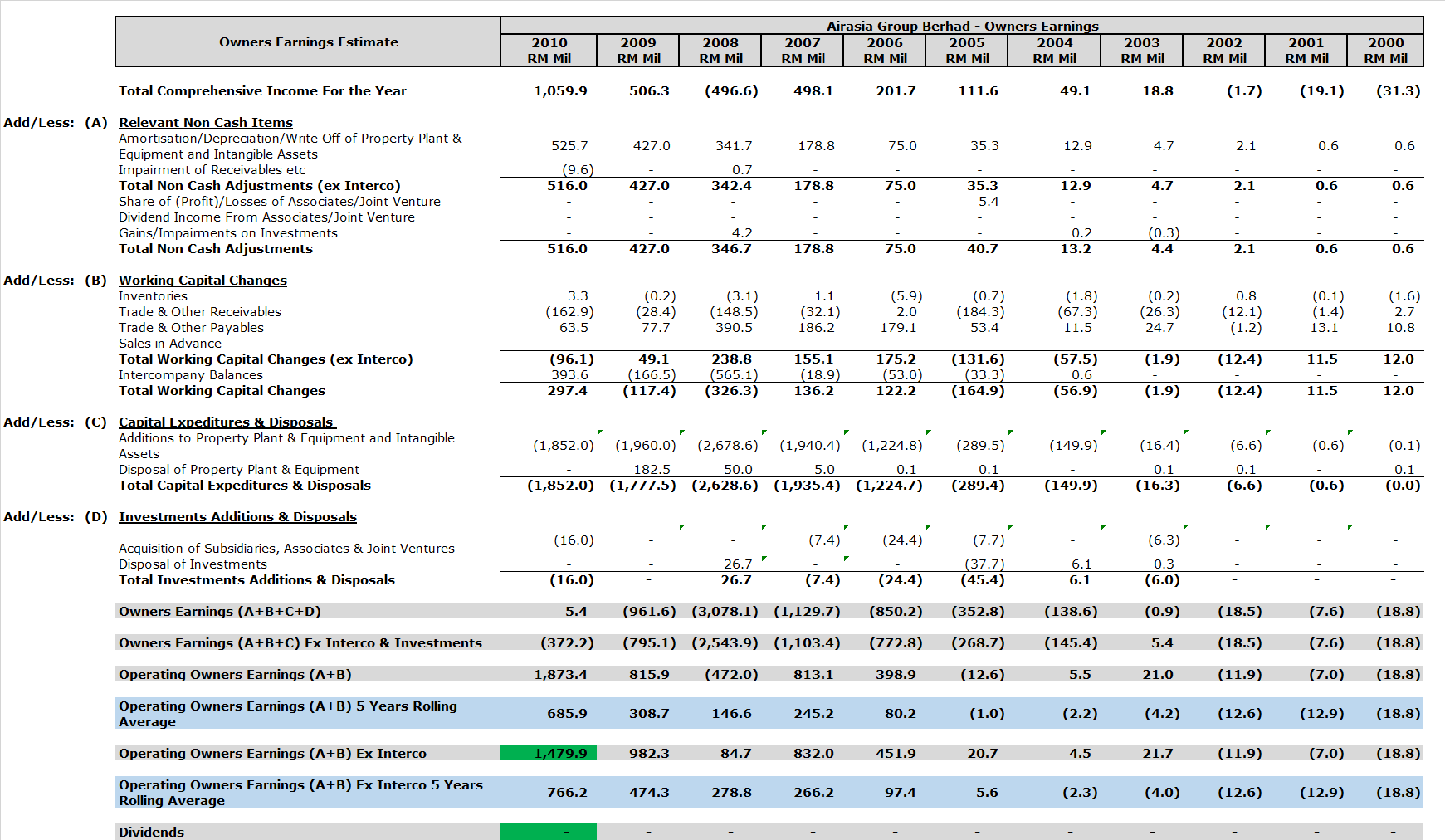

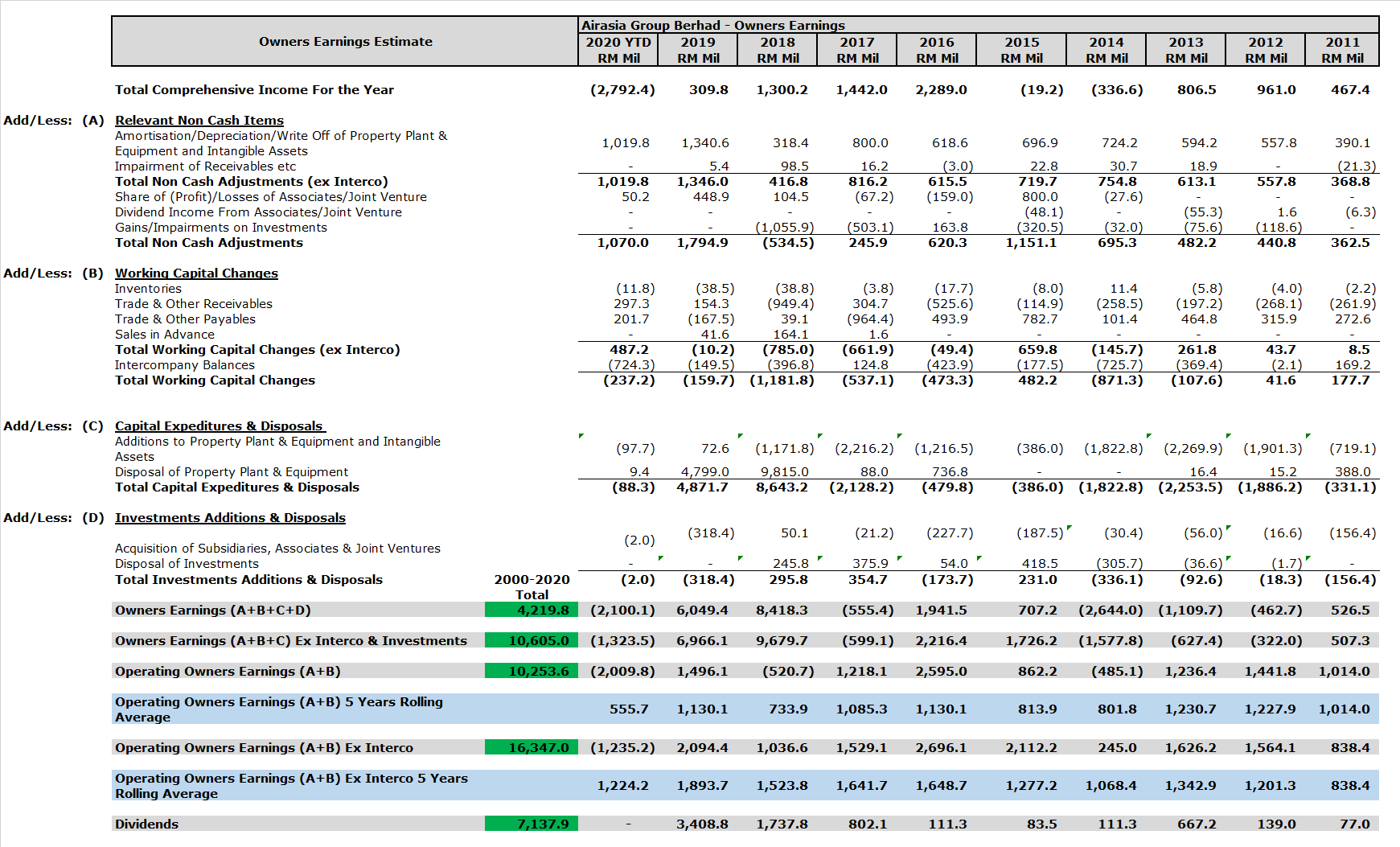

Airasia’s Historical Numbers

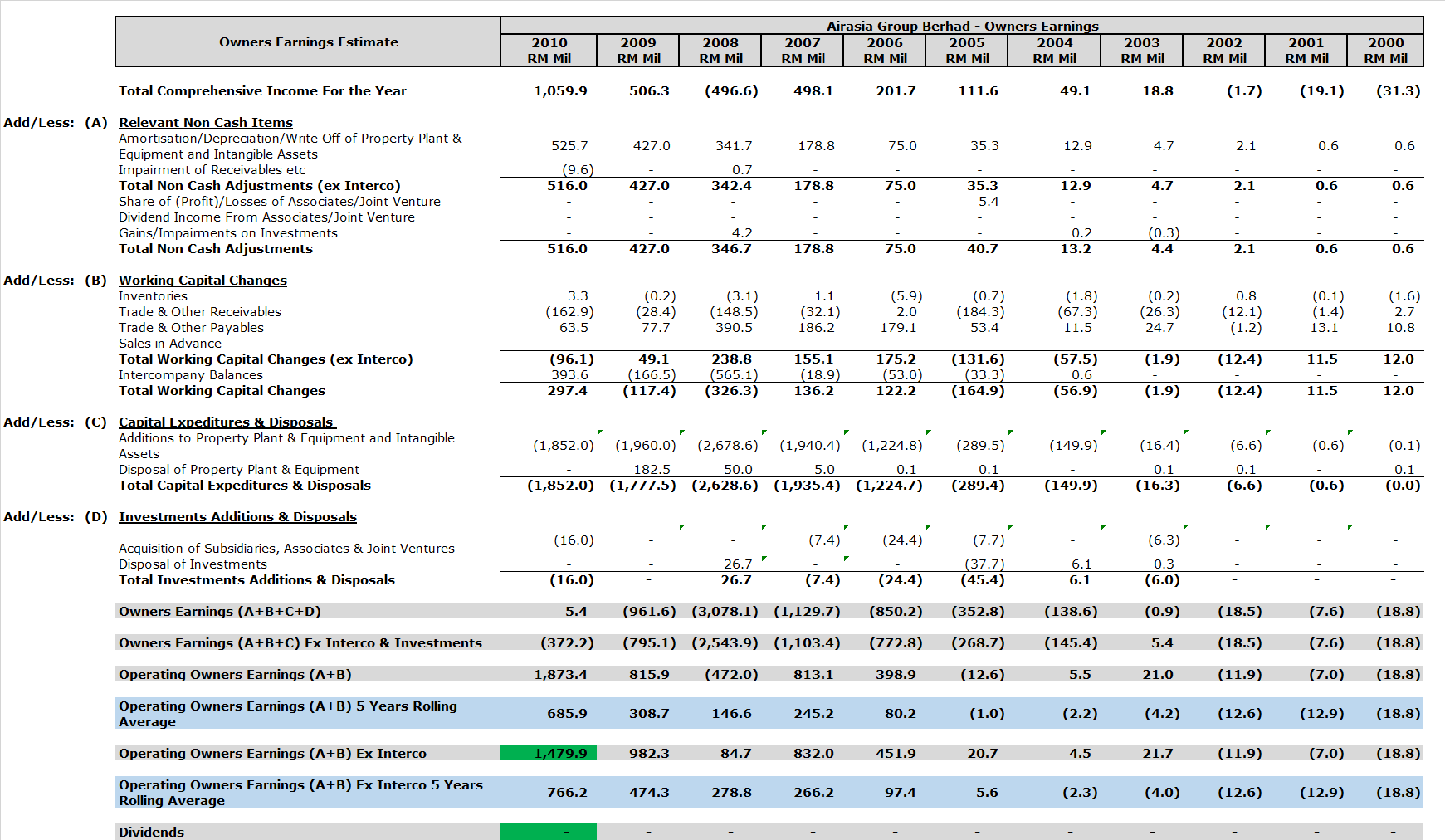

Now, let’s talk about the historical numbers of Airasia. One of the

things I decided to do, is to do an owner’s earnings analysis of

Airasia.

In my piece above, I wrote about the blackhole of losses faced by

Airasia from their overseas ventures. And so the question I asked myself

is this.

“What if Airasia decided to focus

on the short-haul Malaysia market, the market where competition is

non-existent, did zero airline joint ventures, and even forgoes all of

the very profitable non airline joint ventures?

Ie, What if Airasia just stuck to their core competence and edge.”

Ie, What if Airasia just stuck to their core competence and edge.”

Now, a few things to note, my “Owners Earnings” is not the kind typically defined at Investopedia.

This is because I wanted to know some additional information.

I created 4 different types of owners earnings

-

Owners Earnings (A+B+C+D)

This is relatively standard owners’ earnings, except I used comprehensive income instead of profit after tax. The reason being I consider “Other Comprehensive Income/Losses” just as relevant as profit or loss. As I did this analysis for a 20 year period ,the fluctuation balances itself out.

I did not deduct certain non cash items like forex gains/loss, derivative gain/loss, as these items are very real costs, and if taken over a long period of time, is very relevant. And since these amounts are under / overprovided and adjusted each year, it evens out.

Investment related Gains / Losses are deducted out, as I wanted to see the real operating numbers, and as these differences are recognized in the “Investments Additions and Disposals”. Very simply put, if you invest money into a company and made losses, upon disposal, the amount you get back will be less. Showing a net negative.

However, as most companies invest more than they dispose, this one will always show a negative, which is why I also created an “Operating Owners Earnings” to show a normalized number that excludes any Capex and Investment.

If the companies acquisitions and expansion is accretive financially, it should show an increase over time.

And lastly, for this category, I did not deduct share of associates/joint venture profits or dividends from associates and joint ventures, as i consider them just as valuable or damaging to the company as if it was cash, and it also nets off against the “Investment in Associate / Joint Ventures” in the balance sheet which is paid with cash.

To put it simply, i think about Investments in Joint Ventures and Associates the same way I think about Property Plant and Equipment acquisitions.

-

Owners Earnings (A+B+C) (Excluding Interco and Investments)

This one basically answers our question,

“What if Airasia decided to focus on the short-haul Malaysia market, the market where competition is non-existent, did zero airline joint ventures, and even forgoes all of the very profitable non airline joint ventures?”

in terms of how the Owners Earnings would look like.

In this case, i removed the share of associates / joint venture profits (losses) or dividends from associates and joint ventures, as well as the working capital changes related to inter-companies.

In addition, the “Investment Additions & Disposals” is also not added, basically resulting in a good estimate of how the numbers would look like if Airasia Berhad focused on Malaysia only.

-

Operating Owners Earnings (A+B)

Basically Owners Earnings (A+B+C+D), excluding C and D.

-

Operating Owners Earnings (A+B) (Excluding Interco and Investments)

Basically Operating Owners Earnings (A+B), excluding C and D.

And so, what do we see?

- Owners Earnings (A+B+C): RM4.22 billion

- Owners Earnings (A+B+C) (Excluding Interco and Investments): RM10.60 billion

- Operating Owners Earnings (A+B): RM10.3 billion

- Operating Owners Earnings (A+B) (Excluding Interco and Investments): RM16.3 billion

In essence, Airasia’s dalliance with items outside of their core

competence where they have an edge cost them about RM5.6 billion to RM6

billion. And this is excess baggage they are going to have trouble

getting rid off.

Ie, the RM 6 billion baggage fee. Jeng Jeng Jeng. Lol.

In addition if you were to look at the “ 5 year Rolling Average

Operating Owners Earnings”, when related party working capital

requirements are included, you would be hard pressed to find any upward

trends from 2011 onward. If there was any, it is very slight.

Remove the intercompany working capital requirements, and it shows a truly beautiful upward trend.

Its Malaysian arm is truly a wonder, that is somehow managed to subsidizing all these blackhole overseas investments.

In addition, if you ask me, i think companies like Santan, Rokki,

Asian Aviation Centre of Excellence, Tune Insurance (Travel Arm),

Leasing Arm and Teleport, are items that are firmly within Airasia’s

circle of competence, as they touch their own core business very

directly.

In more ways than one, its not so much a new venture, but maximizing

income from their core assets, and reducing costs of the core

operations.

Having said that, while writing this article, i was thinking if

there is a better way to go about the overseas joint venture for quite a

long time.

The reason being, if I was in Tony’s and Kamarudin’s shoes in back

in 2004 and 2005, I think I would have thought that doing the overseas

ventures was a good idea and have done the same.

The one business model that I think makes sense in this scenario, is

the one used by Hilton Hotel in managing their hotels globally.

Hilton hotels do not actually own the hotels, they only provide the

HQ services and core competence to manage these hotels, any profits and

losses belong to the joint ventures.

I think a modified version of this model could work.

One where the other party comes out with the capital, and Airasia

provides the management to run it, and lease them planes at a cheaper

rate due to the low price they got for the planes (enabling them to

still buy planes in bulk).

If it is profitable, Airasia would get 50% of the profits calculated on a high water mark basis.

If it made losses, in terms of the cost of managing it, Airasia

would bear all of it (HQ cost, HQ staff cost, Upper management cost in

JV). While, the airplane lease fee is maintained, as a discount is

already given, limiting their loss since airplane lease fee is often num

1 or 2 in costs.

Conclusion

Having said so much, I am reminded of a poem by Theodore Roosevelt.

“It is not the critic who counts;

not the man who points out how the strong man stumbles, or where the

doer of deeds could have done them better. The credit belongs to the man

who is actually in the arena, whose face is marred by dust and sweat

and blood; who strives valiantly; who errs, who comes short again and

again, because there is no effort without error and shortcoming; but who

does actually strive to do the deeds; who knows great enthusiasms, the

great devotions; who spends himself in a worthy cause; who at the best

knows in the end the triumph of high achievement, and who at the worst,

if he fails, at least fails while daring greatly, so that his place

shall never be with those cold and timid souls who neither know victory

nor defeat.”

At the end of the day, I am a person with the benefit of hindsight,

who have never started a business, much less impacted lives in South

East Asia the way Tony Fernandes & Kamarudin Meranun had.

Because of them, the low cost carrier model was ignited sooner, and now almost everybody in South East Asia can fly.

Quite frankly, as i was writing this. i wondered if I even have the

right to criticize Tony Fernandes & Kamarudin Meranun in the

management of Airasia.

The only relevant comment I can make is on the Corporate Governance.

If I am being very honest, I don’t think Tony Fernandes & Kamarudin Meranun is actively trying to screw over Airasia.

Instead, I’m sure that they keep a certain account of things in

their head, where, if Airasia got an extremely good deal from their

private businesses in one way, they will take some of it back via

another deal.

However, I do feel the ledgers are a touch more towards their private businesses.

Having said that, many of these decisions may be a little

unconscious, but affected by the knowledge that they know deep in the

recesses of their minds, that they own 32% of Airasia, and a lot more of

the other.

And with this I end this piece. I hope you find it useful.

As always, if you feel i’m wrong, or missed out on anything, please let me know.

Disclaimers: Refer here.====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

Website: www.choivocapital.com

Email: choivocapital@gmail.com

https://klse.i3investor.com/blogs/PilosopoCapital/2020-08-30-story-h1512605220-_CHOIVO_CAPITAL_Airasia_Group_Berhad_5099_The_RM6_Billion_Baggage_Fee.jsp