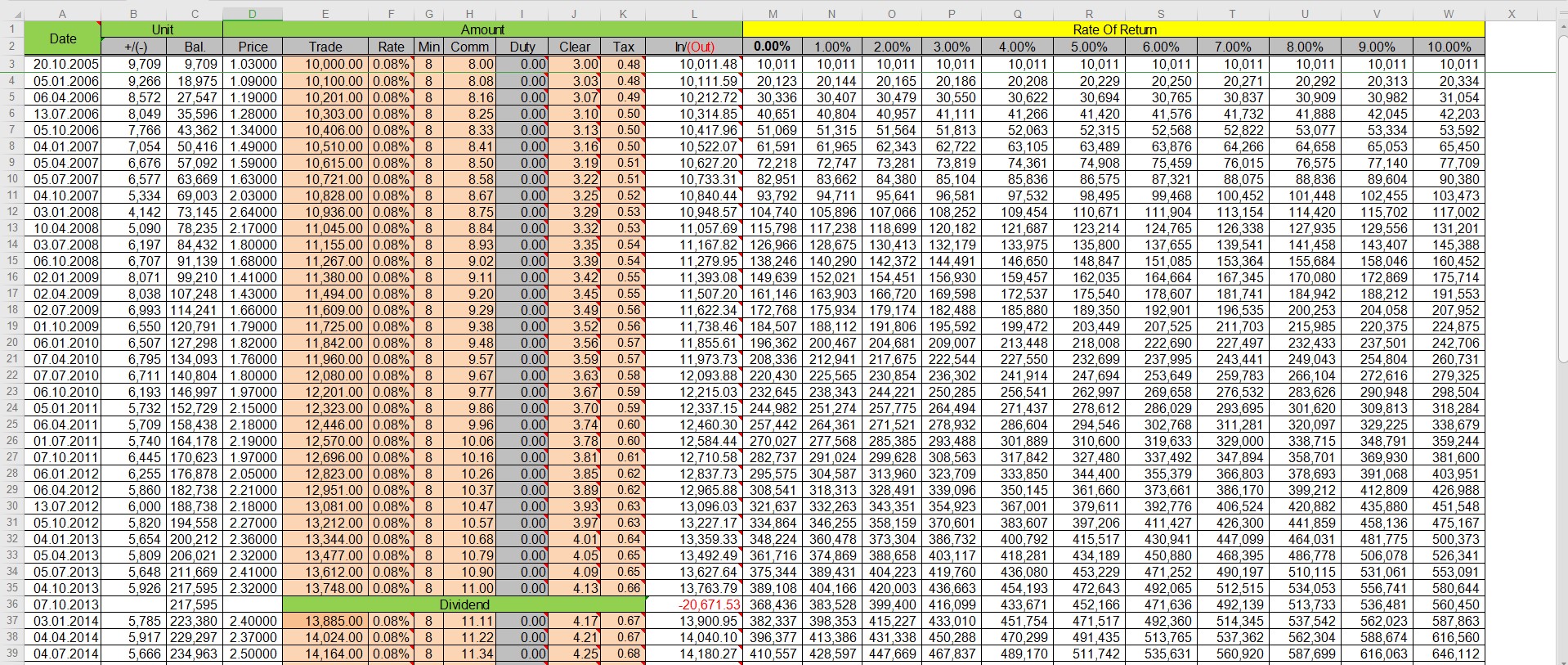

Assumption:

1) Start to invest RM10,000 into this stock in October 2005.

2) Then for every subsequent quarter, in Jan, Apr, Jul, Oct, until today,

3) Invest RM10,100, RM10,201, RM10,303, RM10,406, i.e. increase 1% from quarter to quarter,

4) Try to buy at the earliest date of the month, but some time no data available, have to assume buying in the second or third week.

5) The 1% increment per quarter or about 4% per year is reasonable, as to invest the same amount through out the 15 years is not making sense at all.

6) We get more units when the price is low, and get less units when the price is high, that is the purpose of Dollar-Cost Averaging.

Now, fast forward to today.

1) We would have 395,669 units of this stock now.

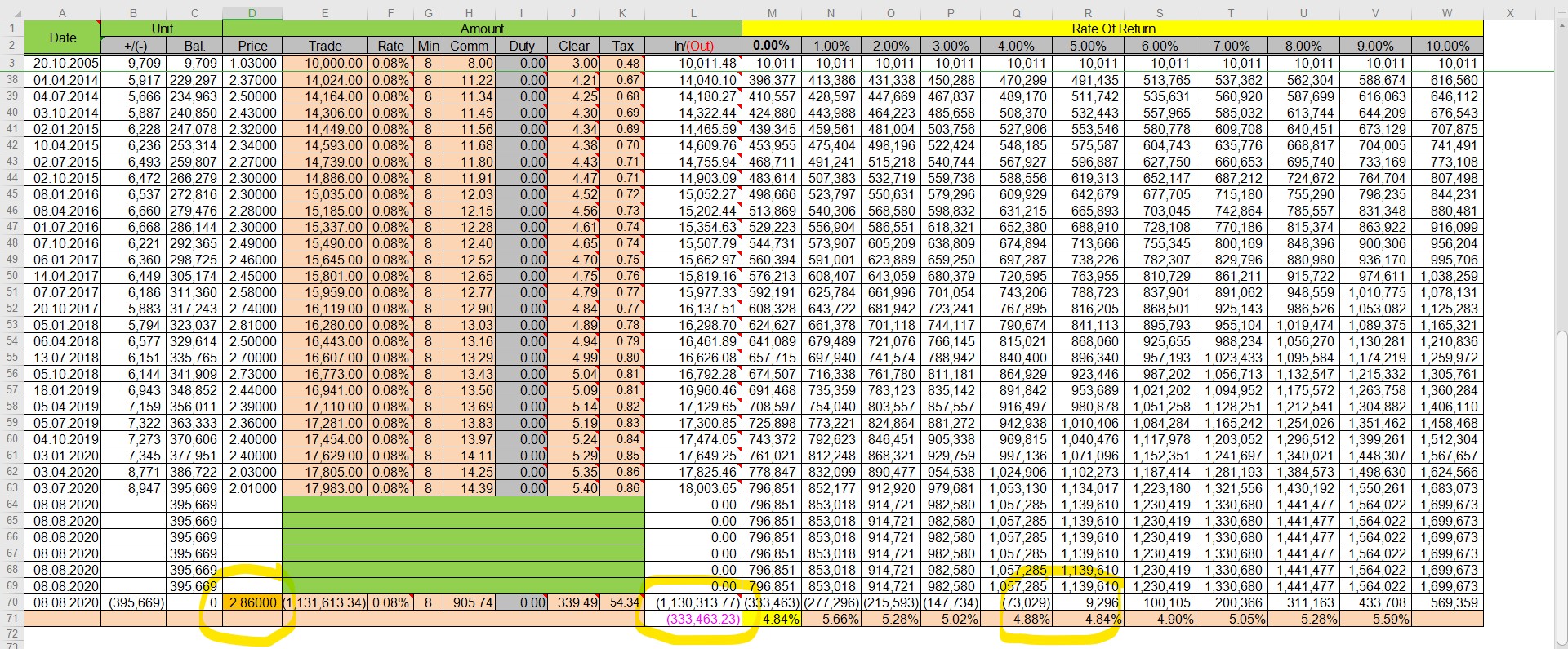

2) Suppose we can sell all today at RM2.86, we would get back RM1.130 million, a net profit of RM330 thousand. The compounding rate is 4.84%. (Refer 2nd screen shot).

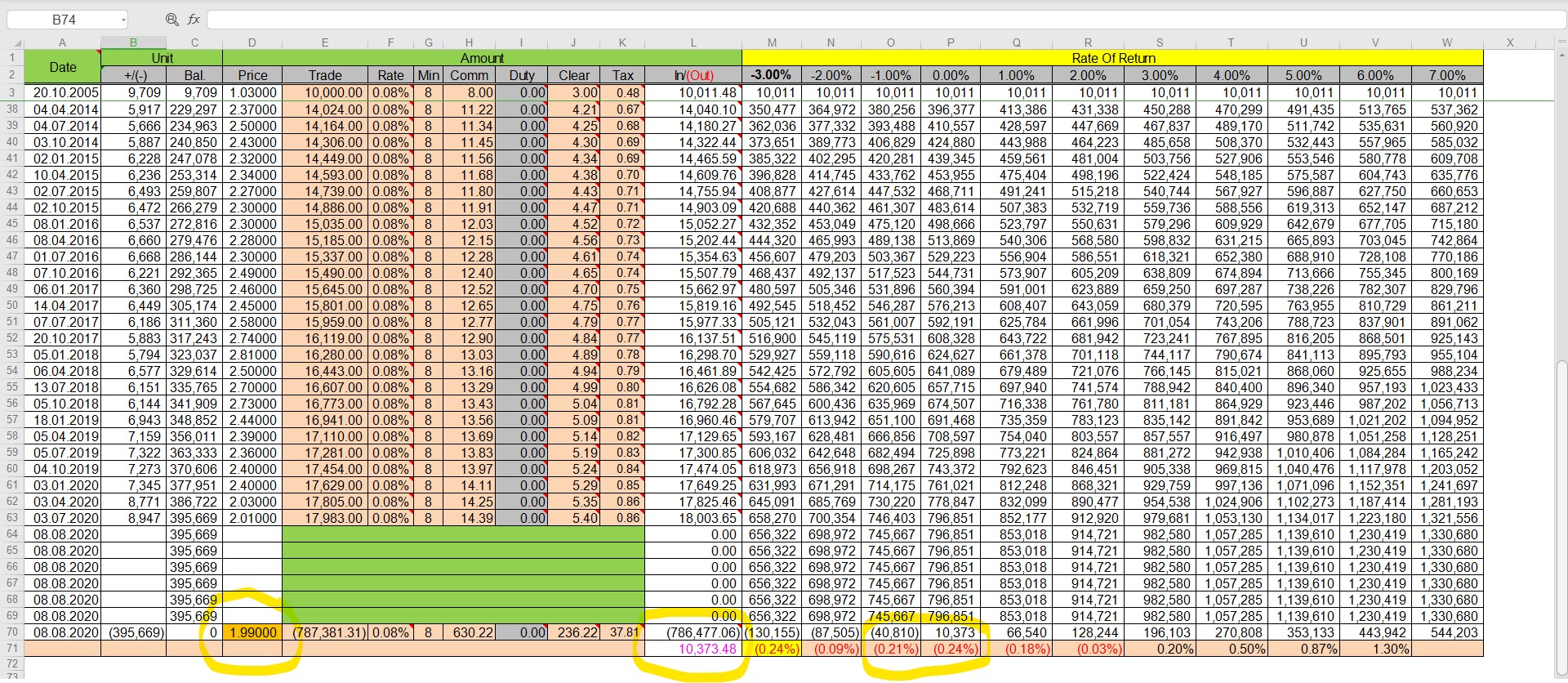

3) What if we could only sell at RM1.99? We would get back RM786 thousand only, a net loss of RM10 thousand. The compounding rate is -0.24%.(Refer 3rd screen shot).

Discussion:

1) Dollar-Cost Averaging does not necessarily good for all cases.

https://klse.i3investor.com/blogs/gambler/2020-08-08-story-h1511592350-Dollar_Cost_Averaging_DCA_Case_Study.jsp