Join our Telegram channel for stock and market insights:

JOHOTIN

UNDERVALUED & GROWING

- ESTABLISHED COMPANY WITH PROVEN TRACK RECORD

- DEFENSIVE PRODUCTS, MANAGEMENT EXCELLENCE AND EFFECTIVE EXPANSION LEAD TO GROWING EARNINGS

- TEMPORARY MCO LOCKDOWN OFFERS INVESTMENT OPPORTUNITY - EXPANDING CONDENSED MILK FACILITIES, UPCOMING CONTRIBUTION FROM MEXICO

- AGGRESSIVE SHARE BUYBACK BY SUBSTANTIAL SHAREHOLDERS

-

NET CASH POSITION OF RM14.6 MILLION ENABLES EXPANSION USING INTERNAL FUNDS

- HIGH DIVIDEND YIELD OF 4.3%

-

AT A CONSERVATIVE, BELOW-AVERAGE PER OF 15.0X, JOHOTIN’S SHARE IS WORTH RM2.04. THIS REPRESENTS A 38% UPSIDE BASED ON A SHARE PRICE OF RM1.48

-

AT AN AVERAGE PEER PER OF 22.5X, JOHOTIN’S SHARE PRICE IS WORTH RM3.11. THIS REPRESENTS A 110% UPSIDE BASED ON A SIMILAR SHARE PRICE OF RM1.48

-

AFTER ENDING ITS 2-MONTH DOWNTREND AND 2-WEEK CONSOLIDATION BETWEEN RM1.30 AND RM1.35, JOHOTIN'S SHARE PRICE HAS JUST STARTED TO TURN UPTREND AGAIN

-

BASED ON CURRENT MARKET SITUATION, VALUATION AND UPTREND SHARE PRICE MOVEMENT, JOHOTIN SEEMS TO BE AN ENTICING BUY FOR BOTH INVESTORS AND TRADERS

JOHOTIN, AN ESTABLISHED COMPANY WITH PROVEN TRACK RECORD

Johotin manufactures tins, cans and containers to F&B and chemical customers in Malaysia and Singapore. Johotin also provides tinplating printing services to customers across South East Asia. Johotin also manufactures and sells dairy products including milk, condensed milk, evaporated milk and milk powder packed in bulk and consumer packs.

DEFENSIVE PRODUCTS, MANAGEMENT EXCELLENCE AND EFFECTIVE EXPANSION LEAD TO GROWING EARNINGS

Johotin’s products are defensive. Dairy products and other F&B products (and hence their tins, cans and containers) are demanded by the market all the time. This makes Johotin a resilient company across all economic situations. Combined with management excellence and effective ongoing expansion, Johotin has achieved increasing revenues and earnings since 2013.

TEMPORARY LOCKDOWN OFFERS INVESTMENT OPPORTUNITY - EXPANDING CONDENSED MILK FACILITIES, UPCOMING CONTRIBUTION FROM MEXICO

In the last quarter, Johotin reports lower earnings due to MCO lockdown, where their workforce is limited to 50%. Nonetheless, this offers an opportunity for investors as value emerges on Johotin’s share price. Johotin continues to expand its condensed milk facilities. There is also upcoming contribution from its new plant in Mexico. PublicInvest Research expects Johotin to achieve annual net profits of more than RM50 million in 2021 and 2022 respectively.

Source: Sinchew, 10 August 2020

NET CASH POSITION OF RM14.6 MILLION ENABLES EXPANSION USING INTERNAL FUNDS

Johotin has a total short term loan of RM33 million and a total long term loan of RM2.2 million. At the same time, it has a total cash of RM49.8 million. This means that deducting both short and long term loans, Johotin still has a net cash of RM14.6 million. This net cash position enables Johotin to fund its own expansion without incurring additional borrowings that impact their bottom lines.

AGGRESSIVE SHARE BUYBACK BY SUBSTANTIAL SHAREHOLDERS AND JOHOTIN ITSELF

Johotin’s directors have been buying their own shares in March 2020 at prices between RM1.00 and RM1.10. On 10 August 2020, Johotin bought back 80,000 units its own shares at prices between RM1.28 and RM1.29.

BUSINESS RISKS

Johotin’s business is subject to lower consumer demands and foreign exchanges.

HIGH DIVIDEND YIELD OF 4.4%

At a share price of around RM1.48, Johotin offers a high dividend yield of 4.3%.

38% - 110 % UPSIDE BASED ON INDUSTRY PER RATIO BENCHMARKING

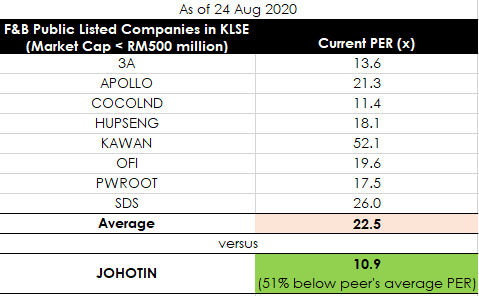

Share prices of many F&B players have broken new highs and have an average PER of 23x. On the other hand, Johotin’s share price is far below its previous high and is traded at a PER of only 10.9x.

At a conservative, below-average PER of 15.0x, Johotin’s share is worth RM2.04. This represents a 38% upside based on a share price of RM1.48. At an average peer PER of 22.5x, Johotin’s share price is worth RM3.11. This represents a 110% upside based on a similar share price of RM1.48.

After ending its 2-month downtrend and 2-week consolidation between RM1.30 and RM1.35, Johotin's share price has just started to turn uptrend again. Based on current market situation, valuation and uptrend share price movement, Johotin seems to be an enticing buy for both investors and traders.

DISCLAIMER

The article is for sharing purpose only. There is no buy/sell recommendation.

Join our Telegram channel for stock and market insights:

https://t.me/jomnterry

https://t.me/jomnterry

https://t.me/jomnterry

https://klse.i3investor.com/blogs/jomnterry/2020-08-24-story-h1512508001-JOHOTIN_UNDERVALUED_GROWING_UPTREND_MARKET_IS_STARTING_TO_RECOGNIZE_IT.jsp