Join Us for Stock Market Insights, Study Notes and Information:

LCTITAN

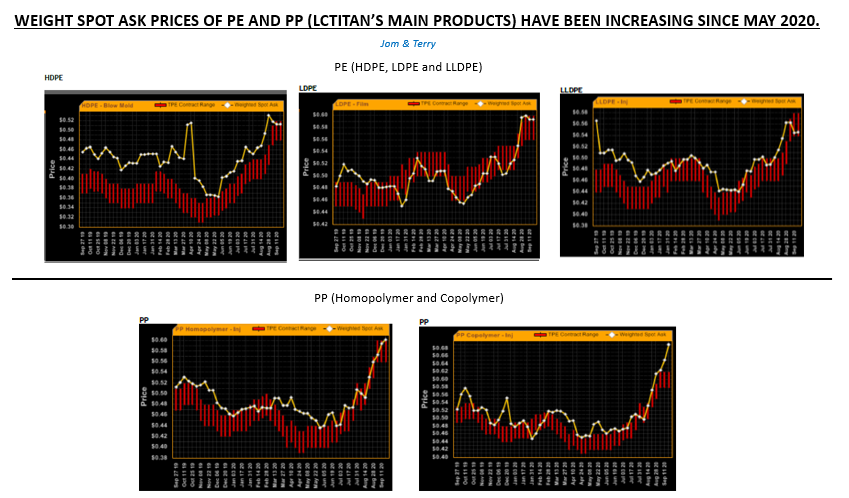

ALL TIME HIGH SALES VOLUME AT ELEVATED ASPs?

HOW LONG CAN THIS LAST?

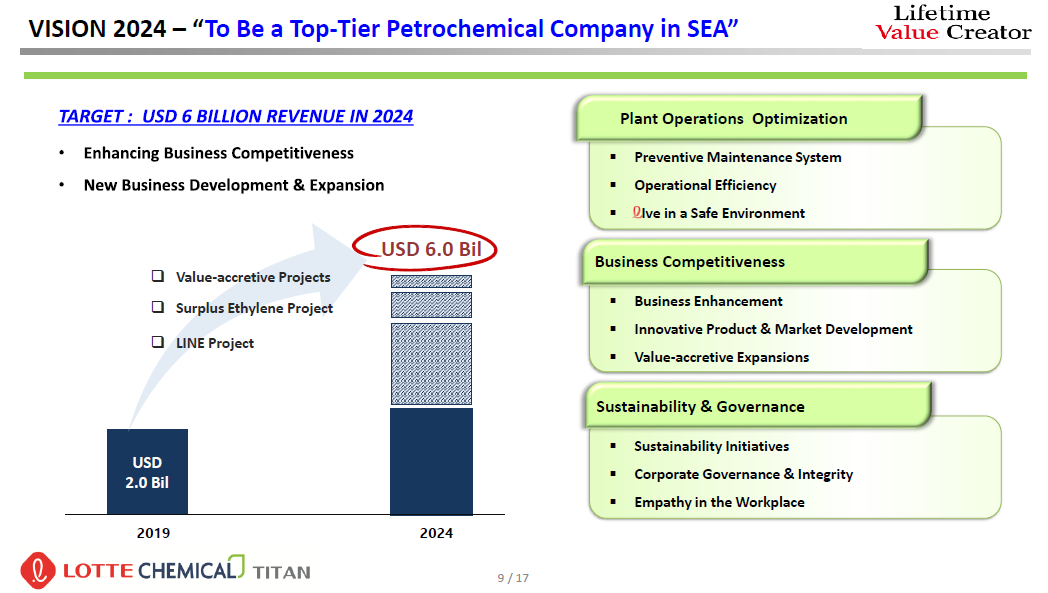

AND, AIMING TO TRIPLE REVENUE IN 5 YEARS.

MACRO VIEW: GLOBAL POLYOLEFIN MARKET GROWS IN TANDEM WITH POPULATION GROWTH

Source: Mordor Intelligence

The Polyolefin market is segmented by 4 material types: Polyethylene (PE), Polypropylene (PP), Polyolefin Elastomer, and Ethylene Vinyl Acetate.

- Polyethylene (PE) is the most widely used plastic in the world, being made into products ranging from clear food wrap and shopping bags to detergent bottles and automobile fuel tanks.

- Polypropylene (PP) is a rigid and crystalline thermoplastic used widely in everyday objects like packaging trays, household products, battery cases, medical devices (gloves, masks, syringes), etc.

As PE and PP are used almost throughout the entire plastic fabrication industry, the demands of PE and PP are expected to grow in tandem with global population growth.

North America has the largest polyolefin market.

Asia Pacific has the fastest-growing polyolefin market.

CYCLICAL PETROCHEMICAL INDUSTRY

The petrochemical industry has been cyclical. It is characterised by periods of tight supply, leading to high utilisation rates and margins, followed by periods of oversupply primarily resulting from significant capacity expansions, leading to reduced utilisation rates and margins.

The demand and supply may favour one position or the other for an extended period of time and may not rebalance quickly. Due to various factors such as market conditions, natural disasters and geopolitical dynamics, it is not possible to predict the supply and demand balances accurately.

Recently, due to a natural disaster, PE & PP in the US and US export markets are now undersupply. This phenomenon may benefit LCTITAN.

DUE TO NATURAL DISASTER, PP & PE IN THE US ARE NOW UNDER-SUPPLIED

1 September 2020

(Source: Plastic Today,https://www.plasticstoday.com/resin-pricing/weekly-resin-report-hurricane-caused-disruption-further-tightens-pp-pe-supplies)

- Hurricane Laura in the US hit Lake Charles and LA. An estimated 14 PE reactors with daily capacity of 30 million pounds, and 5 PP reactors with daily capacity of 20 million pounds were shut down.

- This further tightens the already-scarce PE and PP supplies.

-

Buyers were aggressive with orders:

- Some sought urgent shipments before Houston warehouses closed, while others secured additional material to provide a buffer against potential supply disruptions and rising prices.

- Spot PP trading was very active, demand was strong, and many buyers chased limited resin availability.

- Price increases for both PE and PP were implemented in August.

- There is increasing likelihood that additional hikes will be secured for PE and PP contracts.

9 September 2020

(Source: Plastic Today, https://www.plasticstoday.com/resin-pricing/weekly-resin-report-spot-resin-prices-soar-trading-sets-hectic-pace)

- Although there was limited damage to Texas and Louisiana petrochemical complexes, the area’s electrical grid suffered, causing widespread power outages and delayed restarts PE and PP plants

- The disruption could go on for many more weeks, and will further restrict resin availability in an already tightly supplied market.

- Even with the higher prices attached, resin could still be difficult to source.

- The spot PP market saw fewer deals completed than prior weeks, but it was because of a lack of supply, not demand.

- Domestic PP supplies should remain incredibly tight and spot prices will likely rise further.

- Export offers are starting to develop from other international regions hoping to score sales into the US market.

11 September 2020

(Source: ICIS, https://www.icis.com/explore/resources/news/2020/09/11/10551826/insight-prolonged-us-chemical-plant-shutdowns-squeeze-tight-markets)

- Power outages caused by Hurricane Laura could delay start-ups at chemical plants until the end of September, long enough to squeeze several markets that are already tight.

- PE was already in high demand because of the coronavirus.

- Supplies of PE and PP were tight even before Hurricane Laura.

- Even when power is restored, workers returning to the plants could find more extensive damage, which could keep plants down for even longer.

- US producers and traders are discussing September spot export business at sharply higher prices.

LCTITAN MANUFACTURES PE & PP, RAW MATERIALS FOR THE PLASTIC FABRICATION INDUSTRY

LCTITAN’s main products are PE and PP. They make up more than 80% of LCTITAN’s revenue.

LCTITAN’s PE products include HDPE, LDPE & LLDPE. They are the most commonly used forms of polyethylene. LCTITAN’s PP products include PP homopolymer, random copolymer and impact copolymer.

LCTITAN’s products, PE, PP, olefin, and derivate products are raw materials for the plastic fabrication of multiple industries, including healthcare (gloves, masks, syringes, hazard bins), yarn & fibre, buildings and construction, industrial, automotive, household products, consumer packaging (food packaging, bottles and containers) and electrical appliances.

Amidst the COVID-19 pandemic, the demand of healthcare products, including gloves, masks, syringes and hazard bins increased. The demand of consumer packaging, including food packaging, bottles and containers also increased due to practices of food takeaways and social distancing.

NEAR ALL-TIME LOW RAW MATERIAL COST, ALL-TIME HIGH SALES VOLUME, POTENTIALLY ALL-TIME HIGH ASPS, ALL-TIME HIGH EARNINGS SEEMS POSSIBLE

LCTITAN generates earnings from the margin spread between polymers ASP and naphtha (raw material). Naphtha price is near all-time low. At the same time, ASP of PP and PE are expected to increase sharply in September due to the undersupply situation.

According to LCTITAN, highest sales volume recorded in the month of May of June, since its inception 29 years ago. Well, sales volume could go even high in August and September due to potential orders from the USA, at higher ASPs.

With near all-time low raw material cost, all-time high sales volume with potentially all-time high ASPs, all-time high earnings for Q3 seems possible. However, it is hard to determine exactly how long this situation will last.

LCTITAN’S PAST 3-YEAR EARNINGS BATTERED BY OVERSUPPLY

In the past 3 years, US polymer suppliers diverted cheaper products to Southeast Asia to avoid China’s tariff hike. There was also additional supply from China. This led to oversupply issues that eroded LCTITANS’s margins and earnings. In the same period, LCTITAN’s share price has dropped from RM6 to RM1.84 per share.

GROWING EXISTING MARKET, COULD BENEFIT FROM THE LARGEST POLYOLEFIN MARKET

Having existing customers from Malaysia, Indonesia, China, Hong Kong, Southeast Asia, Northeast Asia (also Indian Sub-Continent and others), LCTITAN is exposed to Asia Pacific, the fastest-growing polyolefin market. Due to recent supply and demand disrupts in the USA, LCTITAN may also benefit from America that includes North America. North America has the largest polyolefin market.

AIMING TO TRIPLE REVENUE IN 5 YEARS

LCTITAN envisions to be a top-tier petrochemical company in SEA and aims to achieve USD6.0 billion (RM24 billion) revenue in 2024, a 3x jump from USD2.0 billion (RM8 billion) revenue in 2019.

DECENT FINANCIALS

LCTITAN is net-cash. It has a healthy current ratio of 7.4x and zero gearing. LCTITAN has a cash balance of RM3.9 billion and a market cap of RM4.2 billion. Investors are only paying a ‘nett RM0.3 billion’ to ‘acquire a RM4.2 billion LCTITAN’. LCTITAN has an NTA of RM5.34. At a share price of RM1.84, the market is valuing LCTITAN at only 34% of its NTA – despite potentially all-time high earnings for its Q3.

RISKS

LCTITAN is positioned in the cyclical petrochemical industry. The oversupply situation has suddenly become an undersupply situation due to unforeseen natural disaster. If the issue of undersupply softens sooner than expected, LCTITAN's PE & PE's selling volume ASPs may normalise sooner than expected, too. On the other hand, the cost of raw material price, naphtha, may increase.

CONCLUSION

-

Global polyolefin market grows in tandem with population growth.

-

The petrochemical industry is cyclical. Due to natural disaster, PP and PE in the US are now under-supplied.

-

LCTITAN manufactures PE and PP. It

is exposed to Asia Pacific, the fastest-growing polyolefin market. It

may also benefit from America that includes North America, the largest

polyolefin market.

-

Near all-time low raw material

cost, all-time high sales volume, potentially all-time high ASP may

lead to all-time high earnings in Q3. However, it is hard to determine

accuralely how long this situation will last.

-

Business

risks of LCTITAN: If the issue of undersupply softens sooner than

expected, LCTITAN's PE & PE's selling volume ASPs may normalise

sooner than expected, too. The cost of raw material price, naphtha, may

increase.

-

LCTITAN

has a cash balance of RM3.9 billion and a market cap of RM4.2 billion.

Investors are only paying a ‘nett RM0.3 billion’ to ‘acquire a RM4.2

billion LCTITAN’.

- Despite potential all-time high earnings, net cash, zero gearing, healthy current ratio of 7.4x and strong cash balance of RM4.2 billion, at a share price of RM1.84, the market is valuing LCTITAN at only 34% of its NTA.

https://klse.i3investor.com/blogs/jomnterry/2020-09-25-story-h1513550839-LCTITAN_ALL_TIME_HIGH_SALES_VOLUME_AT_ELEVATED_ASPS_AND.jsp