MKLAND - THIS STOCK IS TRADING WAY BELOW ITS NTA!!! BIG UPSIDE

POTENTIAL POSSIBLE !!!

Hello to all readers out there. In recent weeks, I saw that investors have been bargain hunting for stocks which are undervalued. One of the criteria to look at is the stock Net Tangible Asset (NTA).

Having said the above, the stock which I'd like to talk about today is MK LAND HOLDINGS BERHAD (MKLAND - Stock Code 8893, Main Market, Property)

BASIC INFORMATION ABOUT MKLAND

MKLAND was listed in BSKL in 1999, with core business in:

i) Property Development - Residential & Commercial

i) Property Development - Hotels, Resorts, Theme Parks

Market Capitalization : RM 181.09 million

Shares Float : 1.207 billion

Website : http://www.mkland.com.my/

1. TRADING AT 83% DISCOUNT TO ITS NTA OF 99 CENTS !!!

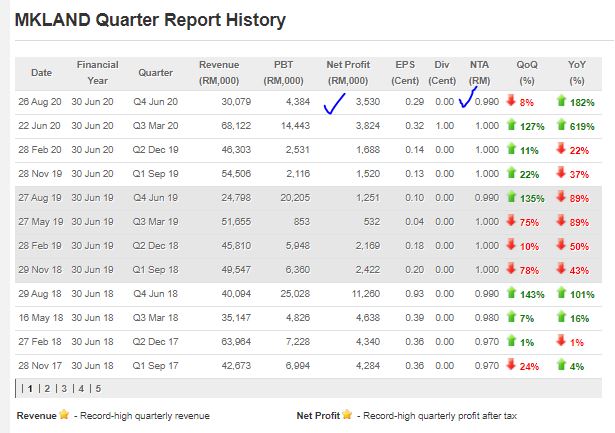

Below is summary of MKLAND latest quarter results. We can see that the company is still profitable despite recently Malaysia being under lockdown due to COVID19, therefore this shows us the strength and resilience of the company in facing hard times.

Also, we notice that the NTA stands at 99c. As of the latest closing price of 16.5c, this means that the stock is trading at 83% discount to its total NTA. Some long term investors might view this stock as undervalued and a bargain at current market.

2. NET ASSET VERSUS LIABILITIES ABOUT RM 1.2 BILLION !!!

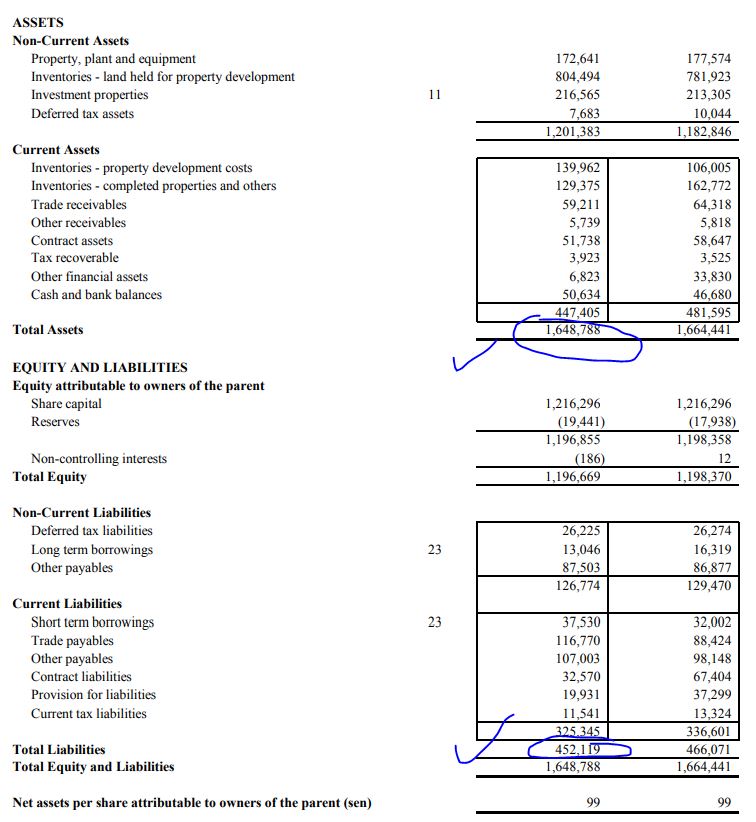

Refer below snapshot of the Assets Versus Liabilities summary taken from the latest QR.

As we can see, the total Assets stood at RM 1.648 billion, and total Liabilities stood at RM 452.1 million.

Therefore, this means that the total Assets exceed the Liabilities by about RM 1.2 billion, which shows the company having a solid asset backing.

Also, cash position improved to RM 50.6 million cash compared to RM 46.68 million in the same quarter last year.

3. TECHNICAL ANALYSIS - BREAKOUT OF ALL KEY EMAs, WITH BULLISH

VOLUME INTEREST

Refer below the basic price and volume chart with key EMAs for MKLAND daily chart :

A few observations on the daily chart:

i. Refer Circle 1, the closing price for MKLAND today 16.5c has broken up above all key EMAs, including long term EMA200 and EMA365, indicating a change of the bigger trend.

ii. Refer Circle 2, this move up in price is backed up by significant volume, which is indicating a surge in buying interest in this counter

iii. Refer blue regions, as resistance areas. For first resistance, MKLAND needs to break out above 19c, before testing the further resistances at 26-28 cents, then possibly making way further upwards towards its NTA value.

CONCLUSION

Considering all the above, I opine that current price for MKLAND is attractive due to below:

i) Trading at 83% discount to its NTA

ii) Net asset versus liabilities of RM 1.2 billion showing a healthy asset backing

iii) Chart showing a breakout above all key EMAs, with significant volume interest

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is never intended to be a BUY CALL whatsoever. I am sharing my observations ONLY based on fundamental; past history; current trading pattern; charts etc. Please make your own informed decision before buying this share or whatever share for that matter.

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/2020-09-21-story-h1514236782-THIS_STOCK_IS_TRADING_WAY_BELOW_ITS_NTA_BIG_UPSIDE_POTENTIAL_POSSIBLE.jsp