#jntstudynotes

ASIAPLY

WILL 20Q3 EARNINGS SKYROCKET?

THE ONLY ONE

Asia Poly is the only listed Malaysian manufacturer of cast acrylic sheets.

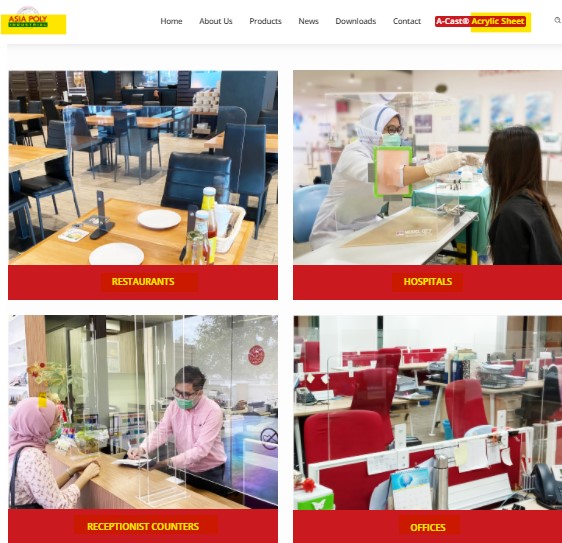

ALREADY-EXISTING APPLICATIONS: MANY

Acrylic sheets are widely used across various industries, ranging from food to transport, building, and medical industries.

NEWLY-EXISTING APPLICATIONS: SOCIAL DISTANCING, ORDER VOLUMES INCREASE

The Covid-19 pandemic has presented a new application for acrylic

sheets. The requirement for social distancing measures has seen greater

adoption of acrylic for table partitions, face shields and shield boxes.

ASIAPLY has received a very encouraging orders from new customers

from USA and Europe. This has allowed them to gain access to the one of

the world largest acrylic consumer market. With the emergence of the new

application of the acrylic sheet in social distancing and prolong trade

war, ASIAPLY expects orders from these two continents continue to grow

moving forward.

EMERGING APPLICATIONS: AUTOMOTIVE.

Beyond Covid-19, ASIAPLY is eyeing another segment with growth

potential in the automotive export markets. The adoption of acrylic in

automotive is growing as manufacturers aim to make cars as lightweight

as possible.

GREATER EFFICIENCIES & ECONOMY OF SCALE

As result from the higher sales orders, ASIAPLY expects factory

utilization rate to rise in the coming quarters, resulting in greater

efficiency and deduction in production cost.

AGGRESSIVE CAPACITY EXPANSION

Given that both ASIAPLY's production lines are currently running at

full capacity, the group plans to add a third production line by June

2021. The third production line, which is expected to run at full

capacity in September 2021, will effectively increase Asia Poly’s

manufacturing capacity to 1,600 tonnes per month.

PRIVATE PLACEMENT AT 41.5 SEN

This could be the entry cost of certain prominent investors.

BUSINESS RISKS

ASIAPLY's business risks include drop is

order volumes, reduction in ASP, rise of raw material costs (MMA) and

operational ineffiencies.

SO, WILL 20Q3 EARNINGS SKYROCKET? WE THINK SO

Based on ASIAPLY's news and management commentary, skyrocket earnings

can be anticipated. Surge in order volume and improvement of efficiency

as well as profit margins. However, if you look at ASIAPLY's quarterly

results, you will notice that the skyrocket of earnings in 20Q2, has not

taken place.

Our guess is, the skyrocket of earnings, would take place in this coming quarter.

ASIAPLY made an earnings of RM1.6 million in 19Q4. That was a 'pre-COVID' core earnings.

With surging order volumes, higher ASP and improving efficiencies, it is not impossible for ASIAPLY to achieve 2-3x earnings.

If you recall, ASP of Supermax (Glove players with the highest ASP

increase due to their own brand gloves) boosted its earnings and share

price by multiples in from March to August this year. This is because

all ASP increment directly contributes to bottom line.

This is why...

We believe ASIAPLY stands a chance to achieve 2.5x of 19Q4 earnings, that is around RM4 million earnings, or more.

Going forward, how would ASIAPLY's share price move?

Let's let Mr. Market decide.

DISCLAIMER

Our study notes are for sharing purpose only. We could be inaccurate. Valuation perspective is beyond scope. There is no buy/sell recommendation.

#jntstudynotes

https://klse.i3investor.com/blogs/jomnterry/2020-10-22-story-h1534768639-ASIAPLY_WILL_20Q3_EARNINGS_SKYROCKET.jsp