CABNET - THIS TECH STOCK A DAZZLING PEARL IN THE SEA !!!

Hello to all readers out there. Recently, i saw that NASDAQ had made a strong rebound after being sold off. This has surfaced many opportunities in our local TECH sector.

Having said the above, the stock which I'd like to talk about today is CABNET HOLDINGS BHD (CABNET - Stock Code 0191, ACE Market, Technology- Technology Equipment)

BASIC INFORMATION ABOUT CABNET

CABNET was founded in 1995 and listed on BSKL in 2017, with core business in:

i) Structured Cabling

ii) ELV Systems

iii) IT Services

Market Capitalization : RM 43.79 million

Shares Float : 178.75 million

Website : https://www.cabnet.asia/

1. SECURED 2 BIG PROJECTS THIS YEAR TOTALLING RM 28 MIL !!!

Below the latest 2 major projects secured this year, with the news article covering the projects:

i) RM 12 mil subcontract works for new KLCC skyscraper

https://www.theedgemarkets.com/article/cabnet-rises-526-securing-rm1188m-subcontract

ii) RM 17 mil electrical package job in Kedah

https://www.thestar.com.my/business/business-news/2020/10/27/cabnet-gets-rm17mil-job

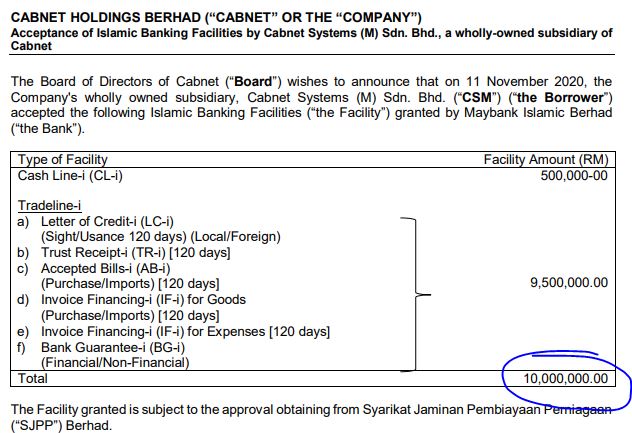

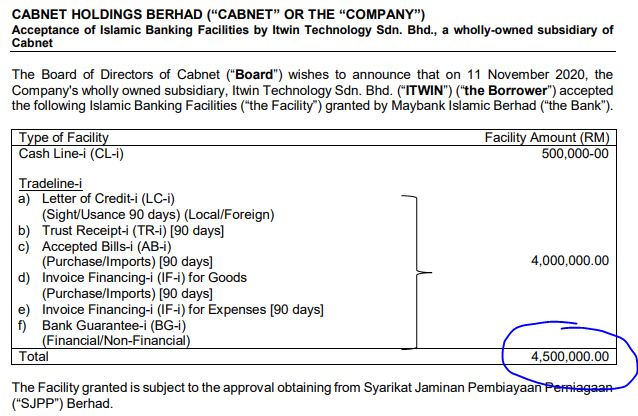

2. CABNET WAS RECENTLY AWARDED FINANCING OF RM 14.5 MIL

FROM MAYBANK ISLAMIC, INDICATING BANK CONFIDENCE

Recently on 11 November 2020, CABNET's subsidiaries were awarded a total of RM 14.5 million financing by Maybank Islamic, indicating confidence by the largest bank in Malaysia (by market cap).

I believe such financing is for the purpose of project executions. Below the details:

i) RM 10 million financing by Maybank Islamic Bhd for Cabnet Systems (M) Sdn Bhd

ii) RM 4.5 million financing by Maybank Islamic Bhd for Itwin Technology Sdn Bhd

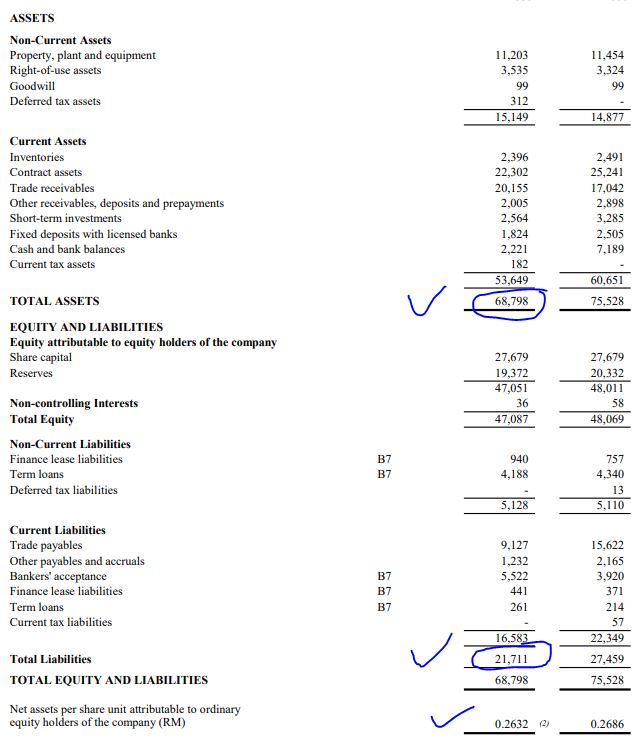

3. HEALTHY BOOK - ASSETS RM 68.8 MIL VERSUS LIABILITIES

RM 21.7 MIL !!!

Below Asset Versus Liabilities list as of latest QR. The following simplified notes:

i) Total Assets stood at RM 68.8 million

ii) Total Liabilities stood at RM 21.7 million

iii) This means a Surplus of Assets of RM 47.1 mil (68.8 - 21.7)

Also, CABNET will take the following steps to ensure its sustainability & performance :

a) To expand the Group's business portfolio in ICT to healthcare market segment, Data Center Solutions and overseas expansion

b) To increase revenue generation from maintenance services contracts and upgrade projects on existing building for sustainability

c) To continue efforts on the improvement of the efficiency and effectiveness of the Group's operations

d) Be more selective by tightening the pre-qualification process of new sales opportunity

e) take initiatives to reduce operating expenses via tightening of manpower and project cost management

4. TECHNICAL ANALYSIS - BIG ROUNDING BOTTOM PATTERN

FORMING - PENDING INVERTED HEAD & SHOULDERS BREAKOUT !!!

Refer below the basic price and volume chart with key EMAs for CABNET daily chart :

A few observations on the daily chart:

i. Refer Circle 1, CABNET chart is forming a big rounding bottom since its IPO listing in May 2017

ii. Refer Circle 2, an inverted head and shoulders pattern is forming with S1 support area, with breakout level at 25c to confirm bullish trend upwards

iii. Refer Circles 3 & 4, recently the stock surged to 36c with significant volumes entering similar to when it had its IPO listing. Also we see recently in November 2020, volumes are starting to increase showing improved buying interest

iv. Should buyers be interested in this stock, we might see an upmove back to test the R1 resistance around 30-32c, then R2 resistance at 44-46c, before moving breaking up above its IPO listing price

5. LOWER PRICE ENTRY TO CABNET VIA CABNET-WA

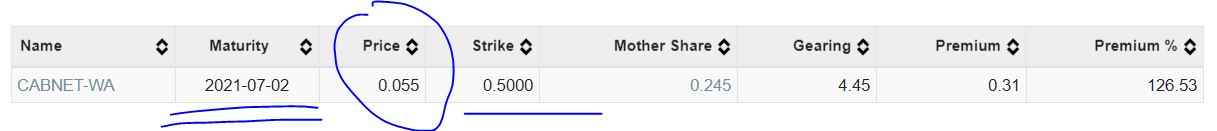

Below is profile for CABNET-WA for those looking at lower price entry into this stock.

A few observations:

i. Expiry is in July 2021, which means ample time for those looking to hold the warrant for capital appreciation (about 8 months)

ii. Strike price of 50c, which is reasonable as the strike price is near its IPO listing price

iii. Recent closing price of 5.5c implying gearing of 4.45

CONCLUSION

Considering all the above, I opine that current price for CABNET is attractive due to below:

i) Secured 2 major projects totalling RM 28 mil this year even in COVID19 pandemic situation

ii) Recently awarded financing line of RM 14.5 mil from Maybank Islamic indicating confidence in bank in its business

iii) Assets surplus Liabilities by RM 47.1 mil

iv) Technical Analysis showing a rounding bottom pattern forming, with a breakout of inverted head and shoulders at 25c level. This indicates bullish trend ahead for CABNET

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is never intended to be a BUY CALL whatsoever. I am sharing my observations ONLY based on fundamental; past history; current trading pattern; charts etc. Please make your own informed decision before buying this share or whatever share for that matter.

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/2020-11-21-story-h1536549273-THIS_TECH_STOCK_A_DAZZLING_PEARL_IN_THE_SEA.jsp