SMETRIC - EPF IS INSIDE THIS TECH STOCK !!!

Hello to all readers out there. Recently, a lot of stocks were oversold due to political uncertainty in our country. This has surfaced many opportunities for investors especially in tech sector.

Having said the above, the stock which I'd like to talk about today is SECUREMETRIC BERHAD (SMETRIC - Stock Code 0203, ACE Market, Technology - Software)

BASIC INFORMATION ABOUT SMETRIC

SMETRIC was founded in 2007 and listed on BSKL in 2018, with core business in:

i) Technology - Software Solutions, IT Security, Hardware Security

Market Capitalization : RM 61.64 million (as at writing)

Shares Float : 536.03 million

Website : https://www.securemetric.com/

1. EPF IS A SHAREHOLDER INSIDE THIS STOCK !!!

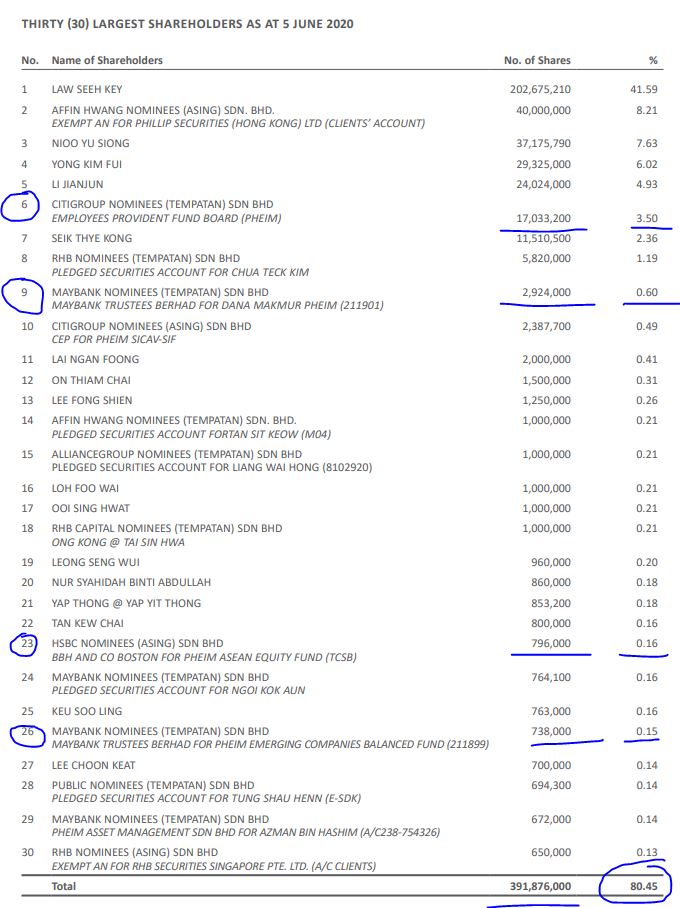

Refer below latest shareholding list as of latest Annual Report.

As we can note, there are a few notable funds inside, the biggest one being EPF with a shareholding of 17 million shares (3.5%).

Another 3 more funds circled are Dana Makmur Pheim, Pheim Asean Equity Fund, Pheim Emerging Companies Balanced Fund.

Therefore, EPF as a shareholder implies a confidence in the long term prospect of the company.

Also, we note that the top 30 shareholders hold 80% of the float shares. This means that there are about 20% floating shares in the market, should the top 20 shareholders be long term investors.

This allows for a better movement upwards, with less resistance in the path.

2. REPORTED PROFITABLE QR DURING COVID19 LOCKDOWN, AND

UPBEAT PROSPECTS IN DIGITAL SECURITY SERVICES

Below is the latest QR summary for SMETRIC. The company managed to record a profitable quarter in Q2 despite the lockdowns during COVID19. This means that the company services are highly in demand even though during economic downturn.

Also, below newspaper coverage by The Star, which highlighted that SMETRIC returned to profitable in second quarter.

The company remains upbeat on its prospect for digital security solutions, electronic identification products & related services.

The second quarter revenue increase is mainly contributed by growth in Public Key Infrastructure & Centagate products.

https://www.thestar.com.my/business/business-news/2020/08/25/securemetric-returns-to-the-black-in-second-quarter-upbeat-on-outlook

3. TECHNICAL ANALYSIS - BUY AND ACCUMULATE AT SUPPORT

Refer below the basic price and volume chart with key EMAs for SMETRIC daily chart :

A few observations on the daily chart:

i. Refer Circle 1, recently the stock price went down to S1 support area, and buyers rejected lower prices, indicating a strong support area in this region

ii. Refer Circle 2, the stock price is currently trading in the S1 area, indicating a low risk bargain entry for investors

iii. Refer Circles 3 & 4, recently the stock surged to 20c with significant volume entering, as the company reported better results and upbeat prospects for its products

iv. Refer Circle 5, sellers are getting dried up in recent weeks, therefore presenting opportunity for investors to enter this stock as bargain price

v. Should buyers be interested in this stock, we might see an upmove back to test the R1 resistance around 13-14cc, then R2 resistance at 18-19c, before moving further up

4. LOWER PRICE ENTRY TO SMETRIC VIA SMETRIC-WA

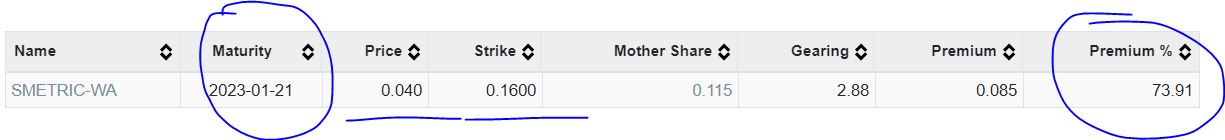

Below is profile for SMETRIC WA for those looking at lower price entry into this stock.

A few observations:

i. Expiry is in January 2023, which means ample time for those looking to hold the warrant for capital appreciation

ii. Strike price of 16c, implies a premium of 73.91%, which is reasonably low considering that the warrant still has about 26 months to expiry

iii. Latest price of 4 cts, implies low gearing of 2.88

CONCLUSION

Considering all the above, I opine that current price for SMETRIC is attractive due to below:

i) EPF as a top 10 shareholder implying confidence in its future business

ii) Recorded profitable Q2 results and upbeat on its prospects in digital market

iii) Chart showing a good level to accumulate this stock at the S1 support price between 10-11c

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is never intended to be a BUY CALL whatsoever. I am sharing my observations ONLY based on fundamental; past history; current trading pattern; charts etc. Please make your own informed decision before buying this share or whatever share for that matter.

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/2020-11-03-story-h1535600737-EPF_IS_INSIDE_THIS_TECH_STOCK.jsp