First, let’s talk about how to calculate whether is a company in a net cash position or not. Even if a company have millions of cash, it is not necessary a net cash company, because we had yet to take their borrowing into account. Hence, only companies that still have cash after deducting all their borrowings can be considered as net cash companies.

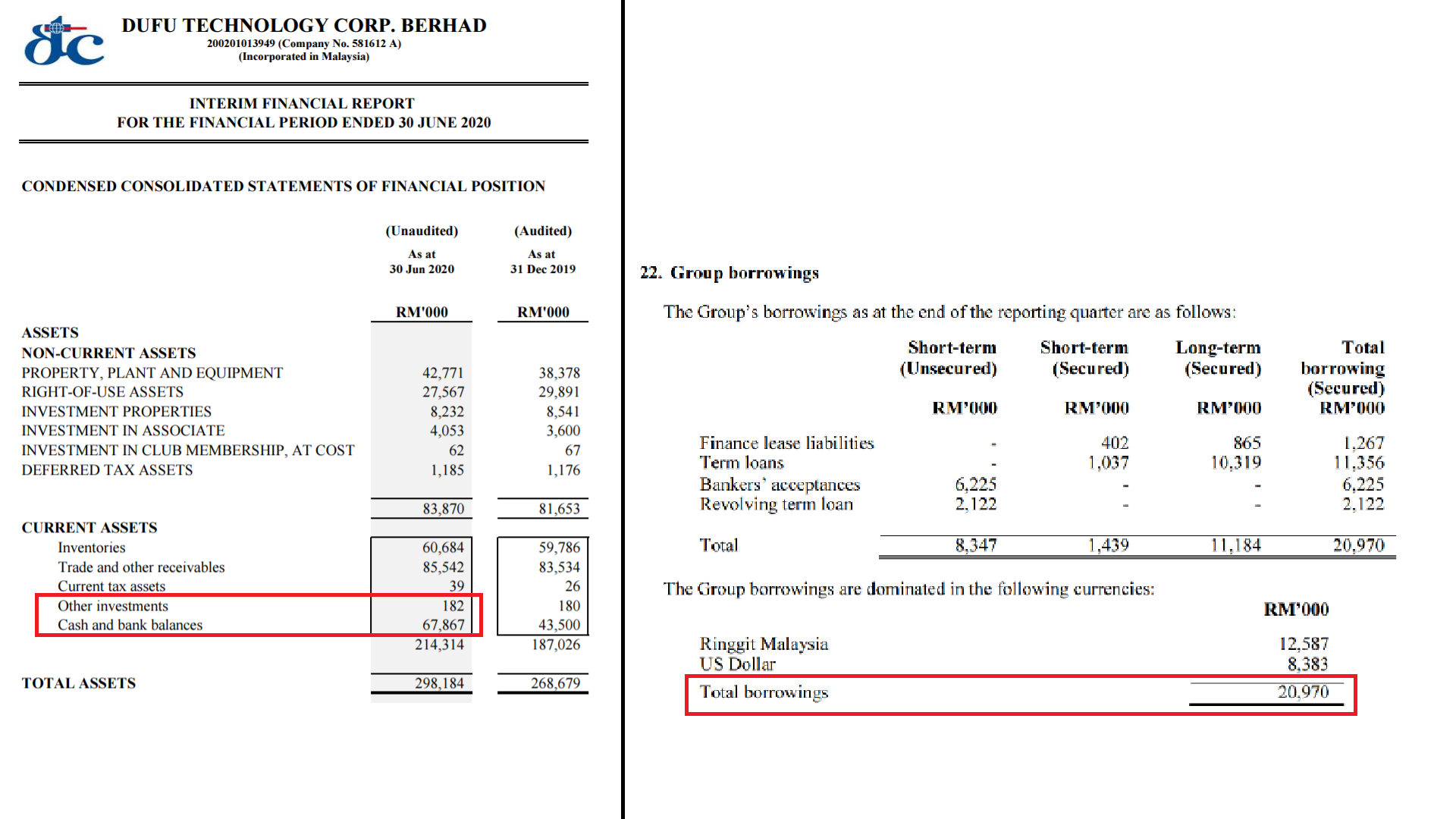

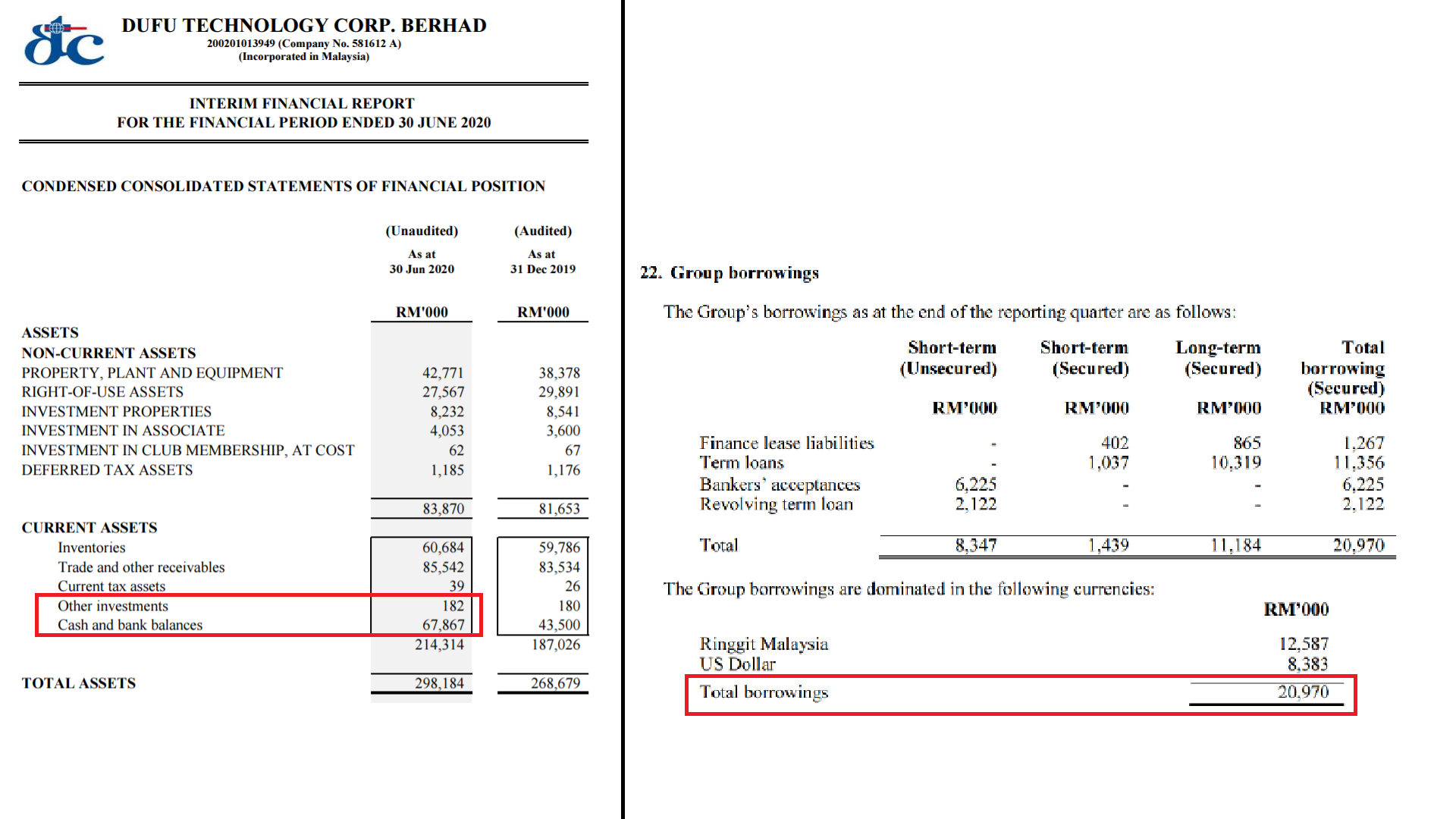

But, how can we find out how much cash and borrowings does a company possesses? To be honest, it is very easy to calculate. We will take DUFU’s 20Q2 financial result as an example. When we open the quarter report, jump to the balance sheet and find a section called current asset, then under this section, there will be “cash and bank balance”.

However, not every companies will only have one section of cash. For example, DUFU have another row as “Other Investment”, and it shall also be considered as the cash position, because investment shall be long-term, hence shall be put under non-current asset, but since it is put under current asset, we know that this investment is only temporary, and can easily be liquefied into cash.

If you think about it, what are the other items that can also be liquefied into cash in short amount of time? The answer is quite honest that “bank deposit” or “short term fund” will also consider as a company’s cash. Hence, if these key words appeared in the balance sheet under current asset, do sum them up and categorized them as cash itself.

On the other hand, how shall we know how much borrowings do one company possesses? We can easily find it under the “notes” in quarter report, as it was mentioned under Note 22 from DUFU’s quarter report, their total borrowings are RM20.97 million.

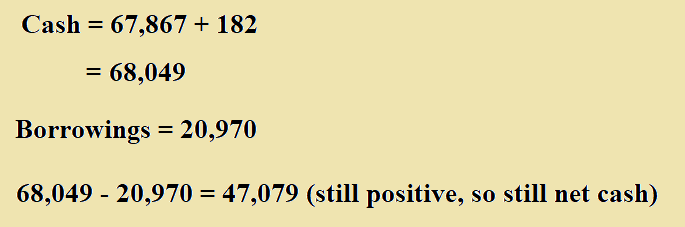

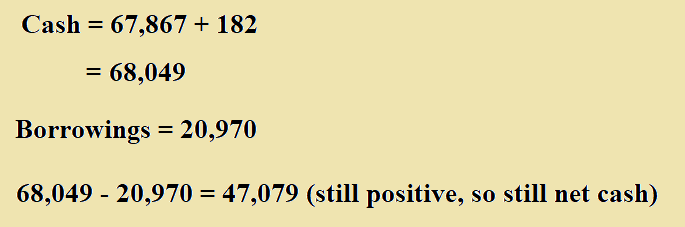

So, after acquiring all the necessary information, we can finally calculate whether is DUFU a net cash company or not. Having RM68.049 million of cash to be deducted by RM20.97 million of borrowings, we know that DUFU is a net cash company, with an extra RM47.079 million of cash position.

However, can we invest into a company that is in net cash position? There is no definite answer since it shall always depend on the company’s business model and growth. If a company is a growth stock but is not in a net cash position, it can be understood as their money are insufficient for them to expand their business, hence require some funding from bank. On the other hand, even if a company is in net cash position but stop growing, they will eventually run out of money by paying dividend as they will look to attract more investors by paying higher dividends.

In short, net cash shall not be the priority when selecting a company to invest, but its growth should be. However, if a growth stock is in a net cash position, that shall be a bonus for investor.

------------------------------------------------------------------------------------------------------------------------

首先,我们要知道如何算出一家公司是否处于一个净现金的情况。一家公司就算有几百万也不代表它是一家净现金公司,因为我们还没包括它的负债。因此,只有在减掉了负债后还依然留有现金的公司才能被归纳为净现金公司。

但是,我们要如何找出一家公司的现金以及负债呢?其实很简单,我们拿DUFU 20Q2的季报来当例子,并看它们的资产债务表,然后在流动资产 (current asset) 的部分会有现金 (cash and bank balance)。

但我们也要注意,一些公司并不会只有这一部分属于现金。以DUFU来说,它们还有一个 “其他投资” (Other investment) 的部分其实也属于现金。这是因为当一家公司决定要投资时,大多数都会是长期的,但是当这个投资活动被放到流动资产时,亦代表着这项投资只是暂时性的,并可以轻易地把这个转换成现金。

我们也必须动点脑筋来想还有什么物品是可以短时间内转换成现金的。其实,定期存款 (bank deposit) 以及短期基金 (short term fund) 都属于公司的现金。所以,当这些关键字出现时,我们必须把它们都加起来,并归纳成现金。

另一方面,我们要如何知道这家公司有多少的负债呢?其实我们可以很轻易地在 “notes” 底下找到。DUFU的note 22就是说明现在公司RM20.97million的负债。

那当我们已经获得了这些资料,我们就可以很轻易地证明DUFU是否属于净现金公司了。DUFU总共有RM68.049million的现金,减去RM20.97million的负债,我们可以知道DUFU还剩RM47.079million的净现金。

那么问题来了,我们是不是就可以直接投资净现金的公司呢?其实这并没有正确的答案。我们在筛选公司的时候应该以成长和生意模式来做最重要的标准。当一个成长中的公司并不属于净现金的时候,其实我们并不会太过奇怪,毕竟他们会向银行借钱来进行扩张。另一方面,就算一家没什么成长的公司拥有净现金时,它们反而会慢慢地流失这些现金。这是因为它们大多会选择排除大量的股息以吸引更多的投资者。

总结,一家公司是否处于净现金的情况不应该是你选择公司的第一指标,反而更应该注重公司的成长。但是,如果一家正在成长的公司拥有净现金,那可就再好不过了。

For more information, visit: https://www.facebook.com/InvestingKnowEverything/

Should net cash companies be prioritized? (净现金的公司应该成为我们的首选吗?)

First, let’s talk about how to calculate whether is a company in a net cash position or not. Even if a company have millions of cash, it is not necessary a net cash company, because we had yet to take their borrowing into account. Hence, only companies that still have cash after deducting all their borrowings can be considered as net cash companies.

But, how can we find out how much cash and borrowings does a company possesses? To be honest, it is very easy to calculate. We will take DUFU’s 20Q2 financial result as an example. When we open the quarter report, jump to the balance sheet and find a section called current asset, then under this section, there will be “cash and bank balance”.

However, not every companies will only have one section of cash. For example, DUFU have another row as “Other Investment”, and it shall also be considered as the cash position, because investment shall be long-term, hence shall be put under non-current asset, but since it is put under current asset, we know that this investment is only temporary, and can easily be liquefied into cash.

If you think about it, what are the other items that can also be liquefied into cash in short amount of time? The answer is quite honest that “bank deposit” or “short term fund” will also consider as a company’s cash. Hence, if these key words appeared in the balance sheet under current asset, do sum them up and categorized them as cash itself.

On the other hand, how shall we know how much borrowings do one company possesses? We can easily find it under the “notes” in quarter report, as it was mentioned under Note 22 from DUFU’s quarter report, their total borrowings are RM20.97 million.

So, after acquiring all the necessary information, we can finally calculate whether is DUFU a net cash company or not. Having RM68.049 million of cash to be deducted by RM20.97 million of borrowings, we know that DUFU is a net cash company, with an extra RM47.079 million of cash position.

However, can we invest into a company that is in net cash position? There is no definite answer since it shall always depend on the company’s business model and growth. If a company is a growth stock but is not in a net cash position, it can be understood as their money are insufficient for them to expand their business, hence require some funding from bank. On the other hand, even if a company is in net cash position but stop growing, they will eventually run out of money by paying dividend as they will look to attract more investors by paying higher dividends.

In short, net cash shall not be the priority when selecting a company to invest, but its growth should be. However, if a growth stock is in a net cash position, that shall be a bonus for investor.

------------------------------------------------------------------------------------------------------------------------

首先,我们要知道如何算出一家公司是否处于一个净现金的情况。一家公司就算有几百万也不代表它是一家净现金公司,因为我们还没包括它的负债。因此,只有在减掉了负债后还依然留有现金的公司才能被归纳为净现金公司。

但是,我们要如何找出一家公司的现金以及负债呢?其实很简单,我们拿DUFU 20Q2的季报来当例子,并看它们的资产债务表,然后在流动资产 (current asset) 的部分会有现金 (cash and bank balance)。

但我们也要注意,一些公司并不会只有这一部分属于现金。以DUFU来说,它们还有一个 “其他投资” (Other investment) 的部分其实也属于现金。这是因为当一家公司决定要投资时,大多数都会是长期的,但是当这个投资活动被放到流动资产时,亦代表着这项投资只是暂时性的,并可以轻易地把这个转换成现金。

我们也必须动点脑筋来想还有什么物品是可以短时间内转换成现金的。其实,定期存款 (bank deposit) 以及短期基金 (short term fund) 都属于公司的现金。所以,当这些关键字出现时,我们必须把它们都加起来,并归纳成现金。

另一方面,我们要如何知道这家公司有多少的负债呢?其实我们可以很轻易地在 “notes” 底下找到。DUFU的note 22就是说明现在公司RM20.97million的负债。

那当我们已经获得了这些资料,我们就可以很轻易地证明DUFU是否属于净现金公司了。DUFU总共有RM68.049million的现金,减去RM20.97million的负债,我们可以知道DUFU还剩RM47.079million的净现金。

那么问题来了,我们是不是就可以直接投资净现金的公司呢?其实这并没有正确的答案。我们在筛选公司的时候应该以成长和生意模式来做最重要的标准。当一个成长中的公司并不属于净现金的时候,其实我们并不会太过奇怪,毕竟他们会向银行借钱来进行扩张。另一方面,就算一家没什么成长的公司拥有净现金时,它们反而会慢慢地流失这些现金。这是因为它们大多会选择排除大量的股息以吸引更多的投资者。

总结,一家公司是否处于净现金的情况不应该是你选择公司的第一指标,反而更应该注重公司的成长。但是,如果一家正在成长的公司拥有净现金,那可就再好不过了。

For more information, visit: https://www.facebook.com/InvestingKnowEverything/

https://klse.i3investor.com/blogs/InvestingKnowEverything/2020-11-03-story-h1535571040.jsp