HBGLOB (5187) HB GLOBAL LTD - AN OVERLOOKED FOOD STOCK, TRADING AT 62% DISCOUNT TO NTA !!!!

AN OVERLOOKED FOOD STOCK, TRADING 62% DISCOUNT TO NTA !!!

Hello to all readers out there. Recently due to the CMCO which was reinstated by the government, I saw that many food stocks had rallied such as SAUDEE, SMCAP and few others. But I wish to shift your attention to this food stock in the MAIN Board which I feel had been overlooked by the market.

The stock which I'd like to talk about today is HB GLOBAL LIMITED (HBGLOB - Stock Code 5187, Main Market, Consumer Products & Services - F&B).

BASIC INFORMATION ABOUT HBGLOB

HBGLOB is a leading international one-stop gourmet convenient food specialist in China.

Their food processing capabilities includes Cleaning, Slicing/Cutting, Blanching, Boiling, Frying, Vacuum Frying, Steaming, Smoking, Stewing and Barbequing.

They produce various types of food material and packed with quick freeze mainly to meet customers orders and distributors.

They produce more than 1,000 types of products, all of which are approved and export to more than 20 countries such as Japan, USA, Singapore, Australia and Korea

Market Capitalization : RM 74.88 million

Shares Float : 468 million

Website : http://www.hbglobal.asia/

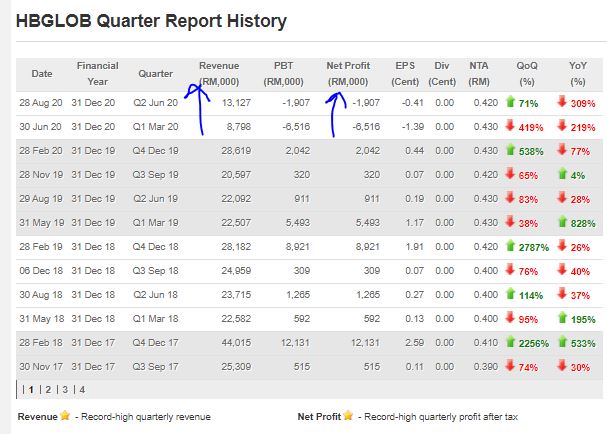

1. IMPROVING QUARTER RESULTS AS CHINA MARKET RECOVERS

HBGLOB main business is in China. As we noticed, that recently, China has been able to control its COVID19 cases to double digits. Therefore, economic activity is starting to pickup in China.

As we see from HBGLOB QR summary below, the revenue has been improving in the last quarter, and net loss has been reduced as well. I anticipate that the coming QR should be showing a better result, such as further reduced losses or even coming into the green. This would be a positive boost for investor confidence in company business.

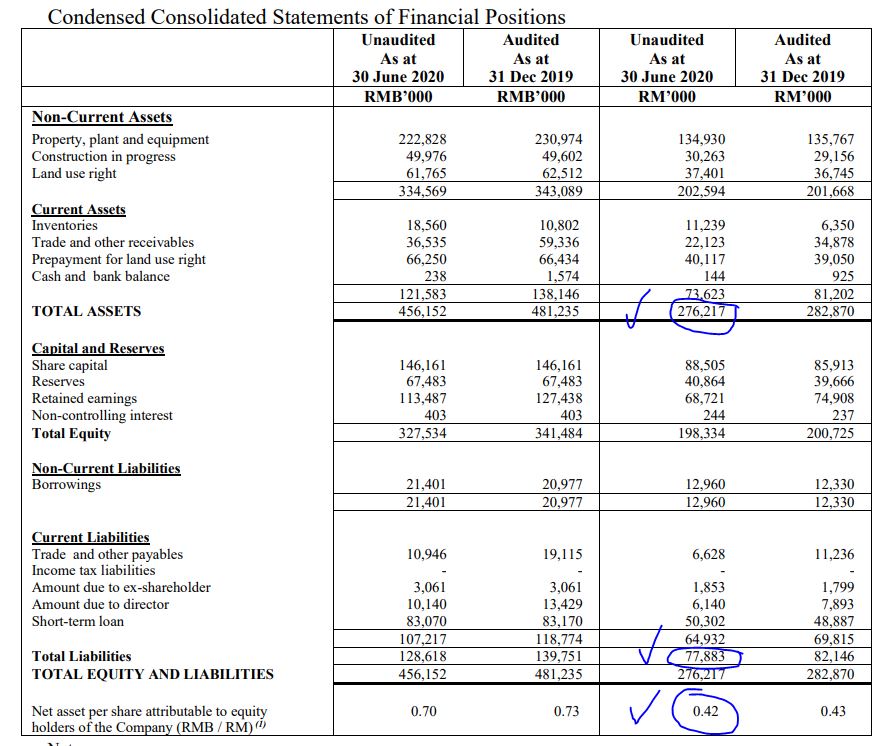

2. TRADING AT 62% DISCOUNT TO NTA, ASSETS SURPLUS OF RM 198.3 MIL

Refer below Asset Vs Liabilities as per latest QR. A few key points to note:

i) Total Assets stood at RM 276.2 mil

ii) Total Liabilities stood at RM 77.9 mil

iii) NTA stood at 42c per share, which means that as at latest closing price of 16c, the stock is trading at 62% discount to its NTA

iv) Total Assets exceed Liabilities by RM 198.3 million, making it a net surplus asset stock

3. TECHNICAL ANALYSIS - FORMING BULLISH ROUNDING BOTTOM & DOUBLE

BOTTOM PATTERNS, PENDING BREAKOUT ABOVE R1

Refer below the basic price and volume chart with key EMAs for HBGLOB monthly chart:

A few observations on the monthly chart chart:

i. Refer Circle 1, HBGLOB is forming a long term rounding bottom, since its IPO listing in 2011

ii. Refer Circle 2, we see a double bottom chart pattern forming, with a breakout pending above R1 resistance

iii. Refer Circle 3, HBGLOB had hit a high of 37c on the back of super high volume in March 2018, before making a pullback again towards its support

iv. Refer Circle 4, recently, we saw that trading interest in HBGLOB had started to improve, with volumes surging and price trending towards the first R1 resistance

v. Should buyers be interested in this stock, we might see a breakout towards R1 resistance 19-21 cents, then next R2 resistance at 27-29 cents, before making a breakout to a new year high.

CONCLUSION

Considering all the above, I opine that current price for HBGLOB is attractive due to below:

i) Improving QR prospects as China market recovers strongly from COVID19

ii) Trading at discount of 62% to its NTA

iii) A good entry seen on the chart, pending a breakout above R1 resistance

LET’S SEE HOW THE SHARE PRICE MOVEMENT IN THE NEAR FUTURE FORBEARING ANY GOOD CORPORATE NEWS.

Disclaimer : The above opinion is never intended to be a BUY CALL whatsoever. I am sharing my observations ONLY based on fundamental; past history; current trading pattern; charts etc. Please make your own informed decision before buying this share or whatever share for that matter.

BURSAMASTER

https://klse.i3investor.com/blogs/Bursa_Master/2020-11-22-story-h1536553149-AN_OVERLOOKED_FOOD_STOCK_TRADING_AT_62_DISCOUNT_TO_NTA.jsp