Philip Farms:

I recently started trying out options again after attending some online classes on options strategy. My current favourite is buying LEAPS, which coincides with my investment mindset. Again, trade these with the highest caution, as they are highly prone to just blow up in your face.

Firstly, these look very confusing, especially to a 60 year old. Don't worry, it is far more interesting than watch paint dry. In fact, with the recent GameStop fiasco, it can give one a heart attack. Anyhow, the big idea in an option is to BUY TIME. You put a little downpayment today, for the chance of paying a lot less for an equity tomorrow. Now, tomorrow is a very dangerous road, as some people have bought options( or in bursa nearest equivalent is warrants). But the basic idea is the longer your time period, the better the chances of the company in turning around.

Not I personally believe that options are only very specific and cannot be abused to buy everything. The keywords here is time and downpayment. Options become very high risk if you are overpaying for time, as a derivative it can be downright bankruptcy. So thinking about it in broad strokes, it is only possible to buy options under certain conditions.

I realized my setup ranges is similar to my investment ranges.

1. Buy a company that is turning the corner, while still being less that appreciated by the general public.

2. Buy if the asking price of the option is very low compared to the risk taken.

3. Buy the industry only if it is turning the corner, where things are looking to, competitors are dead in the water, vaccination is in order, or a new government policy ( buy US) is in play.

Very very tight setup ranges. In essence, how I believe options should be played is only when the bad times are still here, and you understand the company enough to know how long it will take for it to move beyond the bad times.

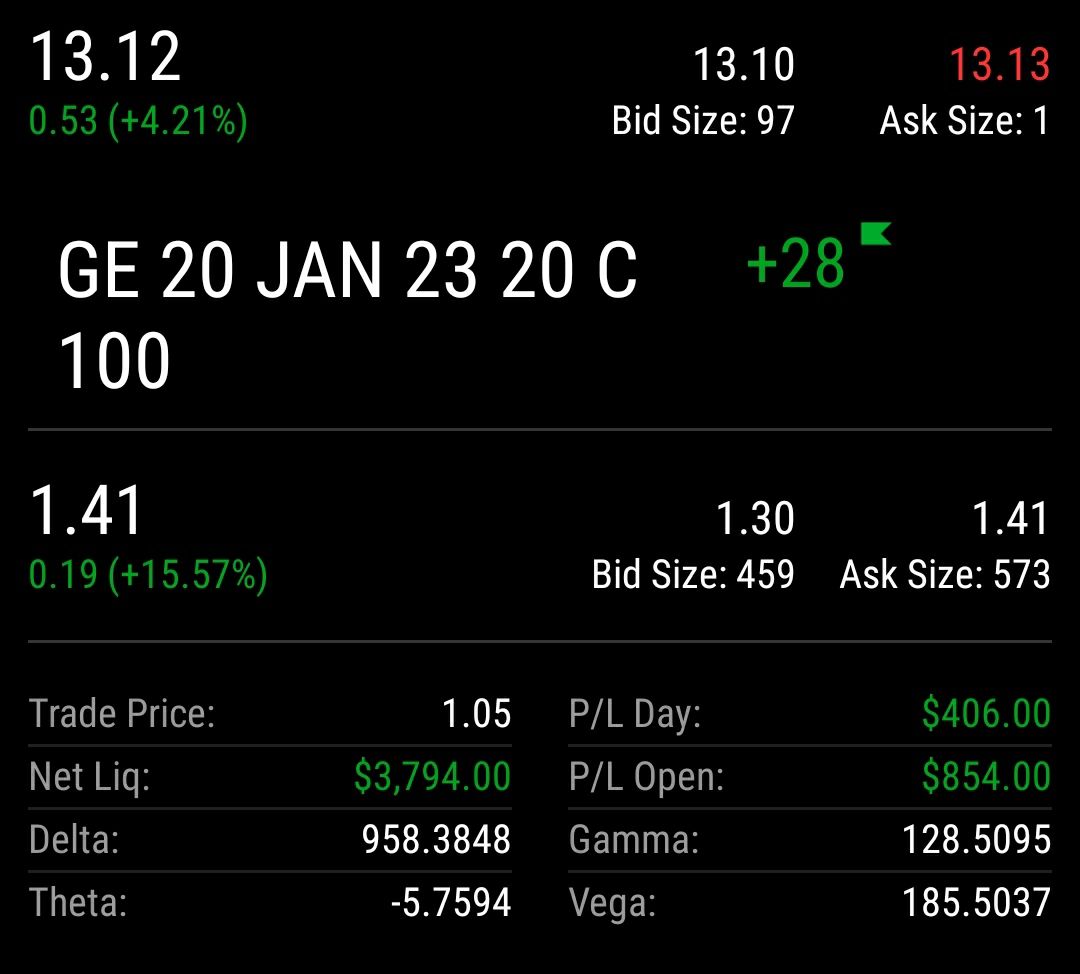

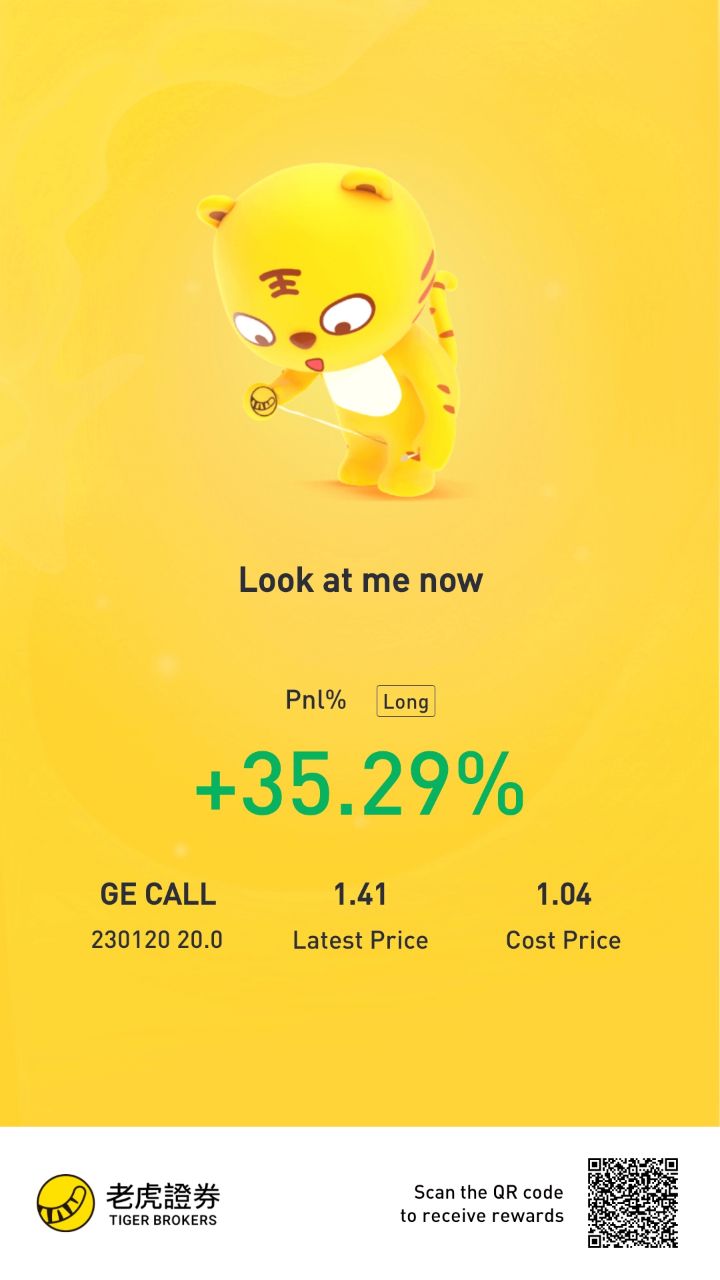

How to trade leap calls. If you believe that the long term share price of a company will take a long term to turn around, it might be good to plan ahead. Take for example these very illiquid January 2023 calls for general electric. They were previously selling for a strike USD 20, and the option price for a 2 year contract at 11.10 was 1.05 per share which I decided was a good low risk bet with high reward ( in comparison). So assuming I hold till maturity, I would be hoping that by 2023 January, the share price would be USD 21.05, to break even. Very high risk putting this into play definitely, which is why the most I would even bet on things like this is lunch money.

Be very sure though, this is purely gambling. Very very risky in either way.The most I would bet in time constrained options like these is 6k USD, just to understand how leap calls work. In my limited testing, the longer the time value, the lower the risk of being "wrong" especially compared to buying an option that expires in 2 or 3 months. However, the opportunity costs is also high, as you "buy" the privilege of holding something for longer period of time

This would be how I would apply trading and long term investing together. Obviously I also have 200k shares bought at 11.20 to ride on a 5 year cycle as a base which is only up a measly 17%, while a similarly held option price would have gone up by 40%.

But... Despite having higher alpha buying options and trading it to control more shares at lower prices, you need a strong basis in understand the business model itself.

The TAM of GE.

The competitors of GE.

How is GE performing versus peers.

The new projects and growth projections of GE in the industry.

What are the revenue and earnings projections by 2023-2025.

What is the management guidance? ( In this case CEO pay is directly link to share price performance, which I think is absurd. But it does mean that the share price goes up if the company performs).

These are simple scuttlebutt info, leading indicators that are ignored by many chartists who only look at Fibonacci, trend lines, Elliott waves, ichimoku, moving averages, basically reading price chart only to define their purchase

For me, even buying a simple 6k leap option has to be grounded in many details like, what is the USD/EURO/RMB/JPY/MYR currency chart ( turbine costs dropped tremendously for US companies due to forex, increasing the sales and profits of GE worldwide)

Oil prices increasing from 27 to 63 to 67 today, which means the sales of GE energy will increase by 15%, meaning more production and better times, as the euro operations of main competitor Siemens fight with alstom, we quickly realize on thing, as many companies shutter down or reduce capabilities, the big companies will come out of this in a far better shape than previously expected

GE aviation: selling non core assets like training simulators and piling into their core competency, this provides a clear mindset: cut the deadwood, build up cash for future

A major sticking point, management CEO pay scale is based on share price, meaning he gets paid 200 million if his share price goes to 20 for a certain average of months. So it is to his benefit to structure things so that happens.

How would it ideally be done? Cut dividends for GE, sell subsidiaries, do massive share buybacks, bring the company finances back in order. This has never been done in 127 years, this cutting dividend thing.

JP Morgan would roll in his grave, but also for the first time in 100 years, we have an outsider leading GE who is a major shareholder which has cut dividends of GE to 1 cent, pacing the way for a bright future.

So long term statistics, low expectations, full power of change, a new structure of core competencies, selling of GE capital and financial engineering efforts.... In the end.. we have a 6k trade of a LEAPS call

LONG TERM EQUITY ANTICIPATION SECURITIES. I like the term, but it basically means buying a long term option. My favourite kind, long term expiry date.

Philip "itchy fingers" C

https://klse.i3investor.com/blogs/Telegram/2021-02-25-story-h1541258361-HOW_TO_BUY_LEAPS_OPTION_CALLS_No_genting_no_problem.jsp