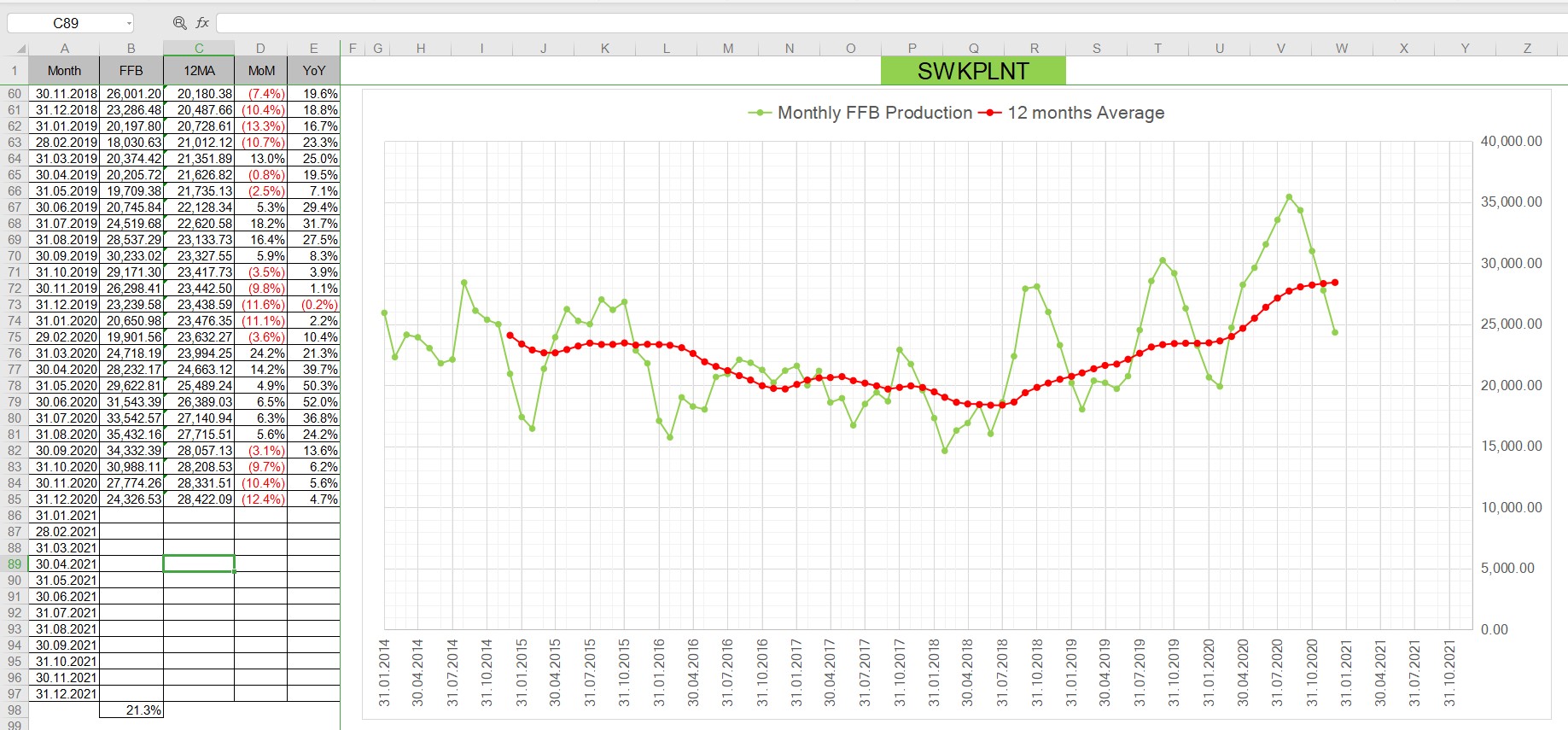

See the FFB growth:

Year 2017, Total FFB Production: 237,827mT

Year 2018, Total FFB Production: 245,852mT, Growth=3.4%

Year 2019, Total FFB Production: 281,263mT, Growth=14.4%

Year 2020, Total FFB Production: 341,065mT, Growth=21.3%

What about for Year 2021?

Analyst from Public Investment Bank in their report dated 23rd November 2020 wrote:

.......management has targeted FFB production growth of 18% to 415k mt for FY21 on the back of yield improvement from the enhancement area transferred to harvestable area......

Why such a non-stop high growth in FFB production?

Please read SWKPLNT's 2018 and 2019 annual reports.

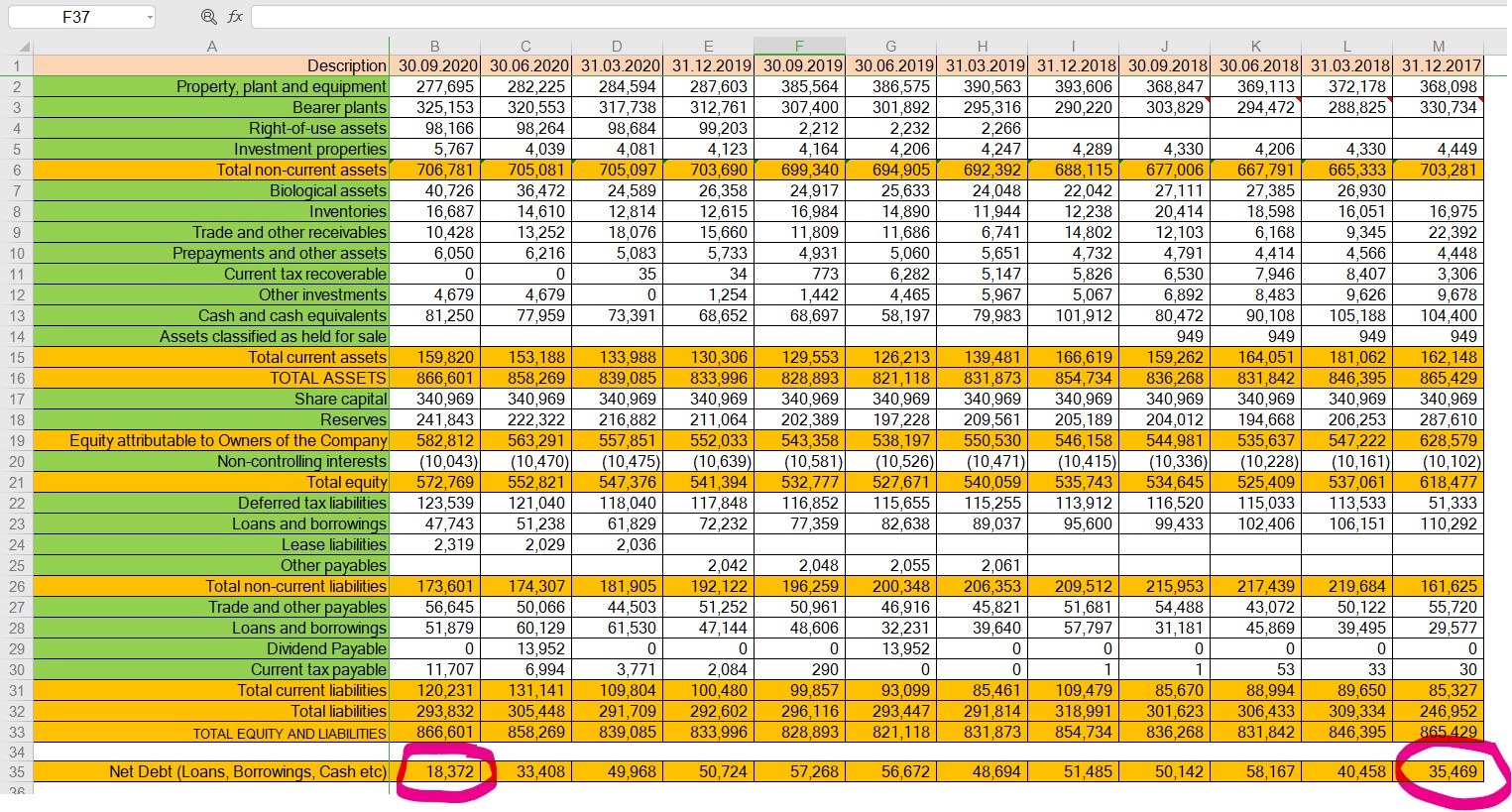

Read the quarterly balance sheets side by side.

The net debt reduced significantly.

The balance sheet now look very healthy, that was why they could afford to pay out 2 x RM0.05 in Year 2020.

I guess they would pay out more dividend for Year 2021.

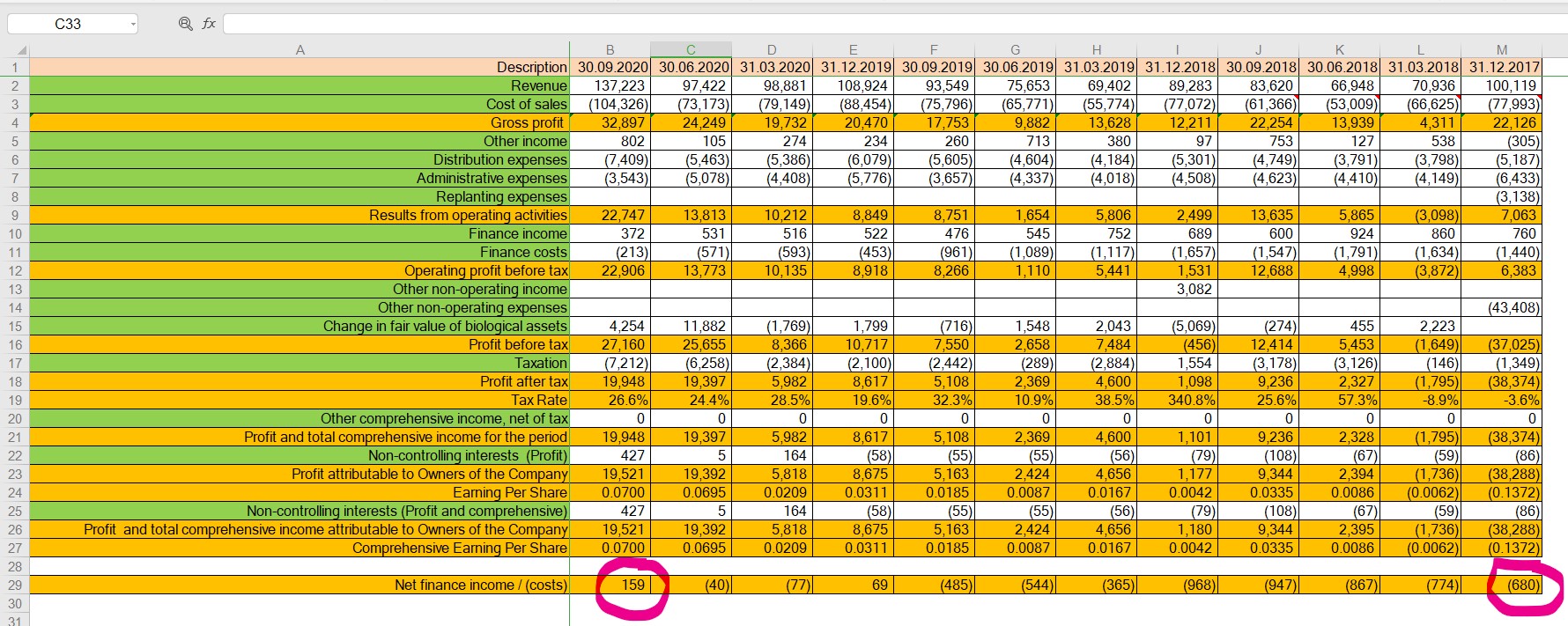

Read the quarterly profit or loss statements side by side:

Now already started to earn finance income instead of paying finance cost.

They sure will be able to pay out more dividend.

Now come back to the FFB target for Year 2021,

The growth in FFB production will be 415,000 - 341,000 = 74,000mT.

Assume the average FCPO price in 2021 is RM3000 (Yesterday was RM3914)

I checked from MPOB website, on the same day the FFB price for Sarawak was RM37.39 per 1%OER,

meaning if the FFB is of the grade 20% OER, the price was RM37.39*20 = RM747.80.

So, if the FCPO is RM3000, the FFB price will be around 747.8*3000/3914 = RM573.

SWKPLNT was very transparent since 2018, they disclose the estate and mill cost separately in the quarterly report.

Make a chart of estate cost against FFB production, apply a trend line y=mx+c. where

y=estate cost

x=FFB production

we get

m = RM159 per mT

c = RM9,970,000

Meaning the estate gross profit will increase by = 74,000 * (573 - 159) = RM30,636,000

or RM0.1099 per share.

Assume tax rate of 24%, EPS will increase by RM0.0834.

After reading the growth story of SWKPLNT, now we look at the dividend record:

1) Year 2016: 4.5 cents ex-dated on 08.03.2016

2) Year 2017: No dividend

3) Year 2018: 5.0 cents ex-dated on 28.05.2018

4) Year 2019: 5.0 cents ex-dated on 11.07.2019

5) Year 2020: 5.0 cents ex-dated on 14.07.2019 and another 5.0 cents ex-dated on 28.12.2020.

What about for Year 2021?

I think when SWKPLNT announce their Q4 2020 result later this month, they will declare another dividend of at least 5 cents.

And I predict they would pay out a total of 20 cents dividend in calendar year 2021.

Last,

Consult your stockbroker and Invest at your own risk.

https://klse.i3investor.com/blogs/gambler/2021-02-06-story-h1540987203-SWKPLNT_Growth_and_Dividend_Play.jsp