FPGROUP (5277) FOUNDPAC GROUP BHD – Crazy Expansion (TheProfessors777)

FoundPac is a design house and manufacturer of high-performance test sockets, stiffeners and

laser stencil. Its main clients include multinational semiconductor manufacturers, outsourced semiconductor assembly and test companies and printed circuit board design houses.

·

Clientele:-

Pentamaster Tech

JCET

Integra Technologies LLC

Amkor Technology Inc

NXP Semi

Synergy CAD

FoundPac |

Vs |

JFTech |

|

35 |

PE |

89 |

|

Customize |

Prod.Design |

Standardize |

|

EU,USA |

Market |

China |

|

No |

Patent |

33 |

FoundPac are focus in customized product design, this is also why FPG didn’t obtain any patent as customer requesting for unique stiffeners and test sockets in most of the orders. In other words, product margin is better as it produces to meet for exclusive usage.

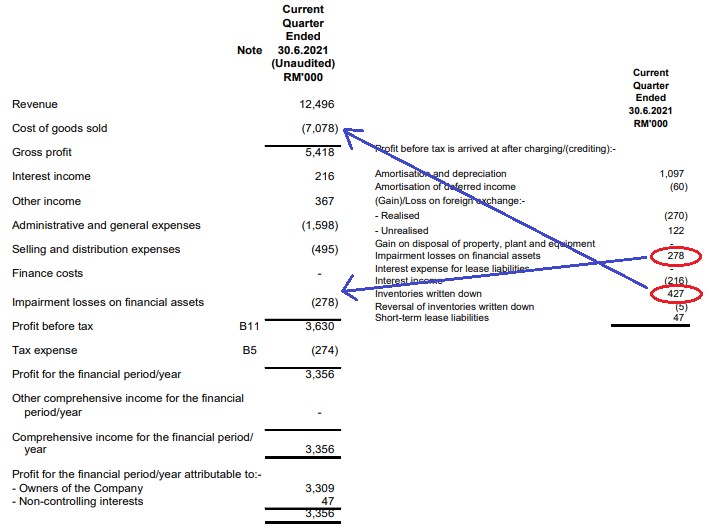

Financial (Qtr 4 2021)

Exclude one off adjustment mainly due to audited adjustment in quarter 4, the performance considers good. Adjusted PAT RM3.885 mil ( RM3,356k + (RM278k+RM427k)*75%).

Expansion 1 - Sin Yen Technology Sdn Bhd 70% stake RM 2.8 mil.

The company is involved in the field of Automated Manufacturing for Electronic Components and is actually an Automation Solution Provider designing and building sophisticated machinery.

Net Asset for this company approximate RM 4mil, FPG purchase 70% stake at NTA value. It's super cheap due with 20 years experienced company and international clientele. Recent quarter making a loses of RM 234k, I believe FPG able to turn SYT into profitable very soon.

The company has been dealing with customers from USA, Europe (Germany, Spain) and Asia (Malaysia, Singapore, Philippines, China, Taiwan, Hong Kong).

Expansion 2 - Dynamic Stencil Sdn Bhd remaining 25% stake RM 4.5 mil

It is approximate 1.19 time on NTA value which consider cheap deal as well. Total investment to acquire laser stencil firm amounted RM 21 mil. YA 2020 PBT RM 4 mil, YA 2021 PBT RM 2mil. PE < 10. (market cap RM 21 mil)

Expansion 3 - SDKM Technologies Sdn Bhd 70% stake RM 8 mil

SDKM's principal business is the manufacture and sale of accessory cables and connectors, AC sockets, optical digital cables, security intercom, elevator interphones and TV door phones.

It is approximate 1.263 time on NTA value RM 9.5 mil. YA 2021 PAT RM 3.96 mil. PE < 5. (market cap RM 11,4 mil)

Expansion 4 - International Automotive Task Force (IATF) 16949 certification

“CEO notes that FoundPac has been selected as an approved vendor for a key auto assembler in Malaysia”.

It means after getting the certificate, FoundPac can direct bid for automotive sterling related parts project.

“Based on 2020 AGM, CEO mention that the group has been utilizing the existing machines invested in FYE 2019 for automotive parts production. “

It means the company make use of existing spare capacity to generate more revenue and profit from its new diversify market segment.

Disclaimer: The material provided herein is for informational purposes only. It does not constitute an offer to buy orsell any securities. We accept no liability whatsoever for any direct or consequential loss arising from any use of information in this report.

I do not hold a position with the issuer such as employment, directorship, or consultancy.

I and/or others I advise may buy/hold/sell the mentioned securities at any time without further notice.

https://klse.i3investor.com/blogs/wwwfacebookcom/2021-09-12-story-h1570608105-FoundPac_Crazy_Expansion_TheProfessors777.jsp