CHUAN (7016) CHUAN HUAT RESOURCES BHD - A TRULY OVERLOOKED STEEL STOCK !!!!

Hi to all fellow investors and traders !

Today I would like to share my thoughts the following counter:

CHUAN HUAT RESOURCES BERHAD or CHUAN (Code 7016, MAIN Market, Industrial Products & Services - Building Materials)

Some basic info on this company:

i. Number of shares float : 168.67 million

ii. Market Cap : RM 75.9 million

iii. Last closing price : 45 cents

iv. Website : http://chuanhuat.com.my/

CHUAN - A TRULY OVERLOOKED STEEL STOCK !!!

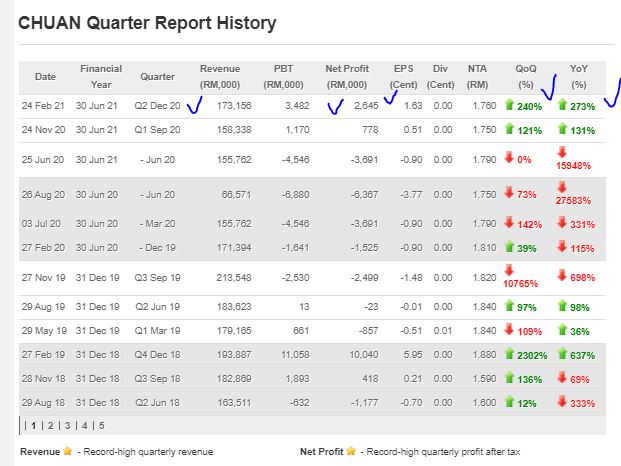

1. Superb Improvement in Feb 2021 Quarter Results - Mainly Due to Rise in Steel Price

CHUAN is a company with core business in Steel trading.

Refer its latest FEB 2021 QR below and the review of performance.

We can see that they had recorded an increase in revenue to RM 173 million, and a net profit of RM 2.6 million which is a 3 year high net profit (EPS of 1.63c).

This represents an increase of 240% QoQ and 273% YoY.

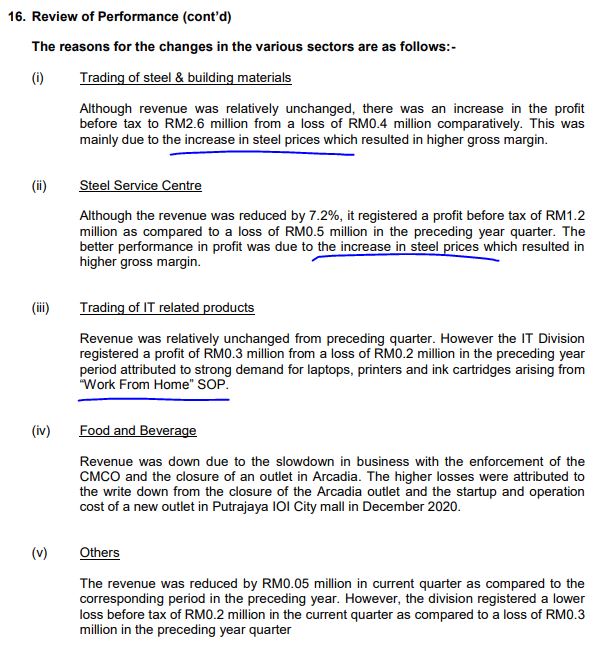

The big improvement in QR was mainly attributed to the rise in steel prices around the world, which has improved margins in all steel trading.

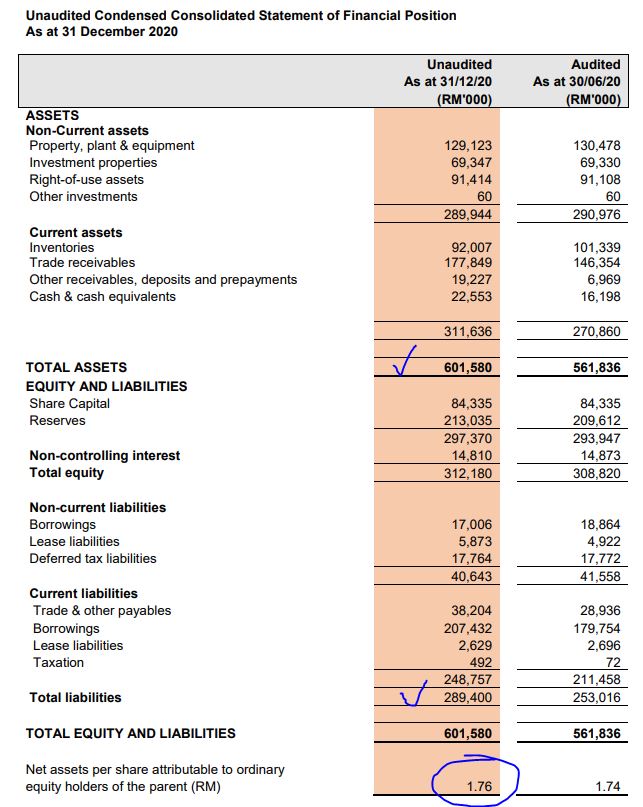

2. Trading at 74% Discount to its NTA of RM 1.76

Refer below the latest Asset versus Liability sheet from latest QR FEB 2021. A few points to note :

i. Total Assets stood at RM 601 mil versus Liabilities of RM 289 mil. This makes it a net Asset company with surplus RM 312 mil

ii. Total NTA stood at RM 1.76. With latest closing price of 45c, this means the stock is trading at discount of 74% to its NTA

iii. Cash position also improved to RM 22.5 mil compared to RM 16.2 mil in previous corresponding quarter

3. Technical Analysis - Uptrending in Channel, With Clear Support and Resistance Levels

Let's take a look at the daily chart of CHUAN :

A few observations:

i. We see that the price is on a bullish uptrend, as the price trades above the long term EMA200 and EMA365

ii. Price is trading within the uptrend channel, with the Support (S1) around the 42c area, whilst Resistance around the 51c area

iii. During a down day, it is observed that selling volume is smaller than buying volume. This means that more investors are holding on to the stock for higher prices

CONCLUSION

Based on my opinion, CHUAN should be given attention in coming weeks, based on below:

i. Big improvement in Quarter Results, due to rising steel price

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUY OR SELL CALL AND IS ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

https://klse.i3investor.com/blogs/InvesthorsHammer/2021-02-28-story-h1541943398-A_TRULY_OVERLOOKED_STEEL_STOCK.jsp

1