Some investors are optimistic that Cycle

& Carriage Bintang (CCB) is likely to declare special dividends in

near future (or more specifically, in 2016?) as CCB may on its way to

register highest profit in 10 years for the financial year 2015.

However, some doubt it as many are asking the same question: Where is the cash?

My question is rather: Will CCB do that?

Why I have such strong confidence on CCB to have sufficient cash to give special dividends of up to RM1.00 per share???

Before I answer that, let's take a look at the cash balances of CCB in the quarterly reports before & after the special dividends were announced in prior years, you will be surprised that they were even holding less cash then!!!

Now, let's take a look at the quarterly reports before & after announcement of year 2006 special dividend:

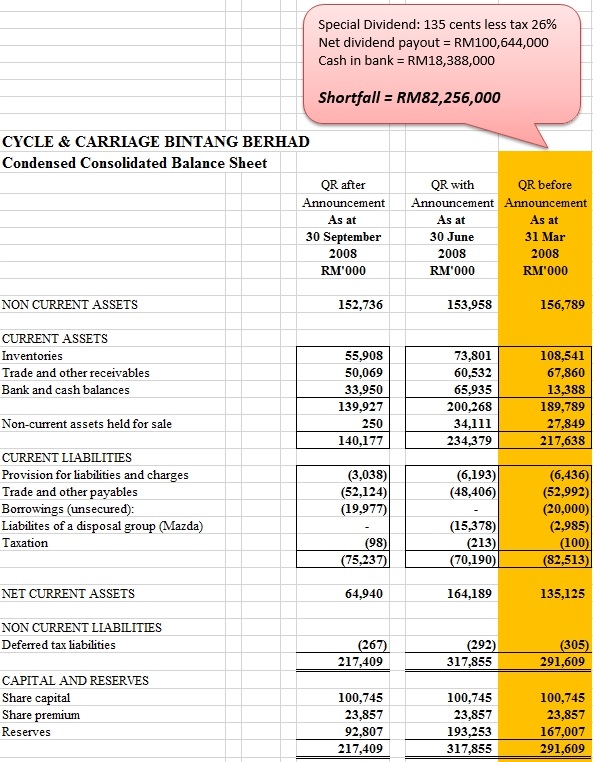

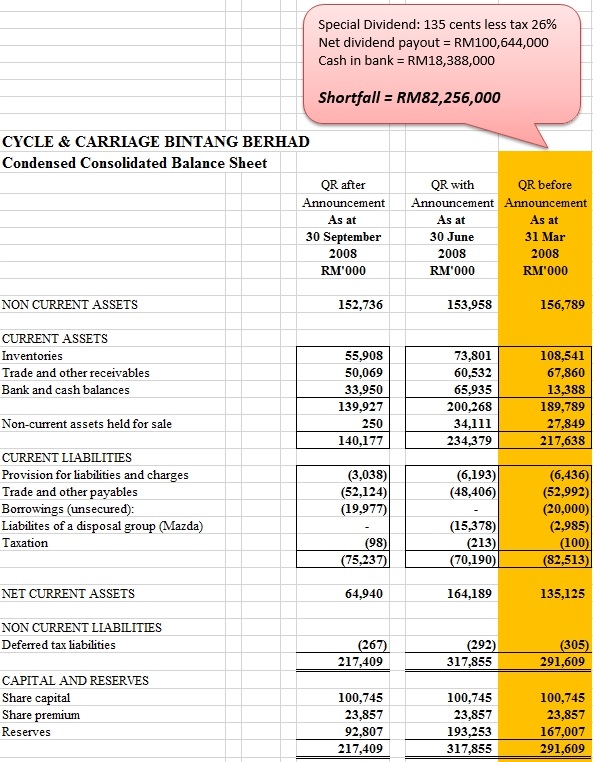

Continue to read quarterly reports before & after announcement of year 2008 special dividend:

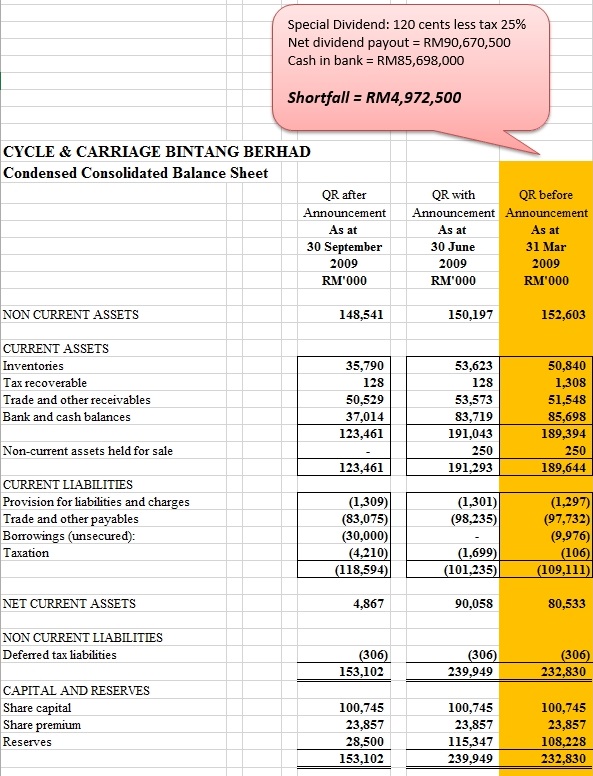

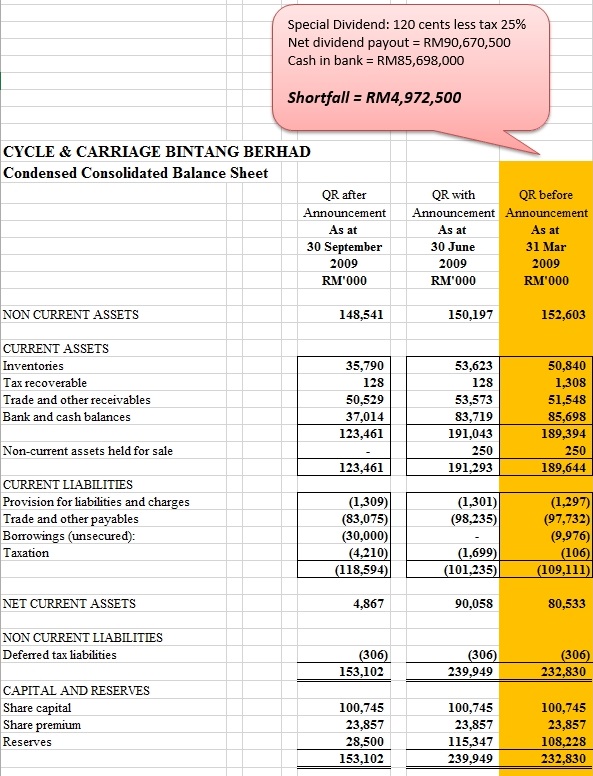

Lastly, the following are quarterly reports announced before & after the special dividends for 2009:

Receivables Turnover = Receivables / Sales x 12 months = 94.9m / 1,192.4m x 12 = 0.96 months (less than 1 month)

Notes to Accounts on Trade receivables are stated as follows:

"Trade receivables that are neither past due nor impaired are creditworthy debtors with good payment records with the Group. Most of the Group’s trade receivables are arising from financier in respect of finance provided to end customer, sales to reputable public listed companies and government or semi government institutions."

Total current assets = RM303.7m

Total current liabilities = RM217.1m

Net current assets = RM86.7m

Trade receivables are highly cash convertibles due to its natures as stated in the notes to account above.

While all current asset items are highly liquid assets and CCB is believed to be able to easily obtain financial supports (Bankers' Acceptances) from bankers, it will have no problem to declare special dividends of more than RM100m.

Furthermore, CCB is in the matured retailing business & do not require much capital expenditure/reinvestment except for normal refurbishment/upgrade of existing 3S centres.

I feel so awesome on the cash flows management carried out by the Management of CCB after reading the past years' cash flows statements of CCB.

CCB had done tremendous jobs in managing its cash flows to rewards its shareholders in the past, will CCB do it again? I leave it to you to decide.

Special Note: I will discuss the following in my next article

However, some doubt it as many are asking the same question: Where is the cash?

My question is rather: Will CCB do that?

Why I have such strong confidence on CCB to have sufficient cash to give special dividends of up to RM1.00 per share???

Before I answer that, let's take a look at the cash balances of CCB in the quarterly reports before & after the special dividends were announced in prior years, you will be surprised that they were even holding less cash then!!!

Past Years' Special Dividends Records

CCB had declared special dividends on the following occassions:

1. Announced on 10 Aug 2006 - Special Dividend of RM2.03 per share less income tax of 28%

2. Announced on 30 Jul 2008 - Special Dividend of RM1.35 per share less income tax of 26%

2. Announced on 30 Jul 2008 - Special Dividend of RM1.35 per share less income tax of 26%

3. Announced on 30 Jul 2009 - Special Dividend of RM1.20 per share less income tax of 25%

I am not going to discuss the one that announced on 20 Nov 2003 (Special Dividend of RM4.17 per

share less 28% tax, amounting to a net dividend of RM3.00 per share) as

this was the result of selling back distribution rights to Daimler AG.

Now, let's take a look at the quarterly reports before & after announcement of year 2006 special dividend:

Continue to read quarterly reports before & after announcement of year 2008 special dividend:

Lastly, the following are quarterly reports announced before & after the special dividends for 2009:

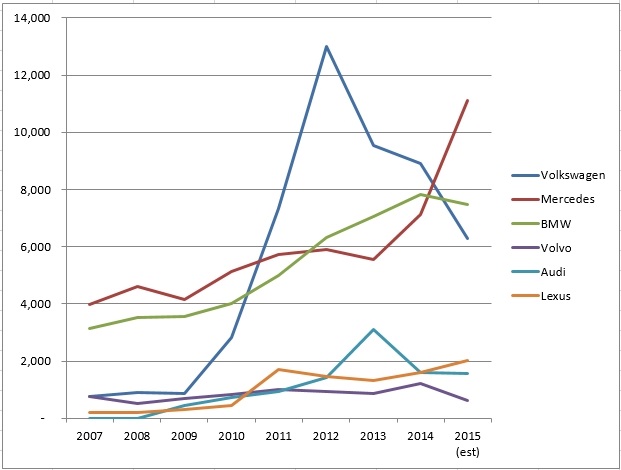

Analysis on latest Balance Sheet (30/9/2015)

Stock Turnover = Closing Stock / Sales x 12 months = 171.6m / 1,192.4m x 12 = 1.72 monthsReceivables Turnover = Receivables / Sales x 12 months = 94.9m / 1,192.4m x 12 = 0.96 months (less than 1 month)

Notes to Accounts on Trade receivables are stated as follows:

"Trade receivables that are neither past due nor impaired are creditworthy debtors with good payment records with the Group. Most of the Group’s trade receivables are arising from financier in respect of finance provided to end customer, sales to reputable public listed companies and government or semi government institutions."

Total current assets = RM303.7m

Total current liabilities = RM217.1m

Net current assets = RM86.7m

CONCLUSION:

Stocks in hand are presumably hot selling items since waiting period to get Mercedes Benz cars are more than 3 months. (please help to verify with the salesman at CCB show room).Trade receivables are highly cash convertibles due to its natures as stated in the notes to account above.

While all current asset items are highly liquid assets and CCB is believed to be able to easily obtain financial supports (Bankers' Acceptances) from bankers, it will have no problem to declare special dividends of more than RM100m.

Furthermore, CCB is in the matured retailing business & do not require much capital expenditure/reinvestment except for normal refurbishment/upgrade of existing 3S centres.

I feel so awesome on the cash flows management carried out by the Management of CCB after reading the past years' cash flows statements of CCB.

CCB had done tremendous jobs in managing its cash flows to rewards its shareholders in the past, will CCB do it again? I leave it to you to decide.

Special Note: I will discuss the following in my next article

DECLARATION & DISCLAIMERS:

I have interest & own shares in this company.

All the above are merely presented &

written for sharing, educational & reference purposes and does not

constitute as recommendation to purchase/buy or sell. You should make

your investing decision based on your own judgement & at your own

risk. I will not be responsible nor liable for your action.

CCB (2925) - (SuperMan 99) Cycle & Carriage Bintang (CCB) - Special Dividends & Amazing Cash Flows Management

http://klse.i3investor.com/blogs/hardworkeasylifesuperman99/89038.jsp

CCB, CCB (2925), 2925, EN2925, KLSE:CCB, Investing, SuperMan 99