Globetronics Recent Share Price Markdown - A Concern or an Opportunity?

Founded in 1991, Globetronics has grown rapidly over the last 20 years

from a humble 20,000 square feet rented facility to ten buildings

covering more than 600,000 square feet, with over 2,500 employees.

The Group's principal activities are manufacturing and assembly of

integrated circuits, optoelectronic products and printed circuit boards.

Other activities include manufacturing and fabrication of ESD

protective materials and ceramic metallisation, manufacturing of small

outline components and technical plating services for the semiconductor

industry, provision of hardware and software system solutions and

consultations, provision of burn-in services, trading of chemical

products and import and export of components and direct materials of

semiconductor.

Manufacturing and trading segments operate principally in Malaysia,

Philippines and Peoples' Republic of China. The services segment is

operated solely in Malaysia. The major shareholders of Globetronics

include Wiserite Sdn. Bhd. and Lembaga Tabung Haji. Globetronics was

listed on the Kuala Lumpur Stock Exchange on 3 November 1997.

Based on Financial Year (FY) 2015 full year results, Globetronics

achieved close to RM 350 million turnover, which is considered to be a

mid size enterprise. Other aspects of the company’s latest financial

results are illustrated in the table below.

-

Globetronics Technology BhdFY 2015 (RM’000)Revenue (RM’000)343,656Net Earnings (RM’000)75,262Net Profit Margin (%)19.7Total Debt to Equity Ratio0.016Current Ratio5.42Cash Ratio3.95Dividend Yield (%)3.068PE Ratio14.87

Since FY2011, Globetronics revenue has been in a growing trend from

RM265 million to RM 343 million in FY2015. This represents an average

year to year growth of 6.71%. Although there is a slight drop of revenue

from FY2014 to FY2015, net profit growth trend was not affected.

Globetronics achieves a growth of 2.8 times increase in 5 years or an

average year to year growth of 29.58%. Having a net profit growth rate

which is much higher than the revenue growth rate is a great sign of

effective cost management and increases in profit margin from year to

year. For net profit margin perspective, Globetronics scores a high

19.7% which is pretty amazing for a product manufacturing company.

In terms of company’s debt, Globetronics has very low total debt to

equity ratio of just 0.016. Such low liability of business operation

model leads to good current ratio of 5.42 and cash ratio of 3.95, which

are strong characteristic of being a company can withstand tough

economic situations.

As for dividend yields, Globetronics issues a 3.068% dividend yield

which is pretty good considering that the company’s dividend payout

ratio is only 0.455 (45.5% of their net profit is payout to their

shareholders as dividend).

The concern that investors need to be aware of is that the company is

operating in a highly competitive and fast moving technology sector

which posts ongoing challenges for Globetronics to sustain their current

growth. This can be seen in the dip of recent quarterly results as well

as their relatively low revenue growth rate as compared to their net

profit growth rate.

In summary, Globetronics greatest strength in their financial results

is the low debt ratio and high profit margin. The company also pays

reasonable dividends and current PE ratio of 14.8 is considered to be on

the low side for manufacturing sector.

Hence, this is an opportunity to pick up Globetronics after the recent

share price markdown as the pull back is likely due to recent quarterly

results being below expectations and concerns of slowdown in

semiconductor industry, but not due to the company’s fundamental

problems.

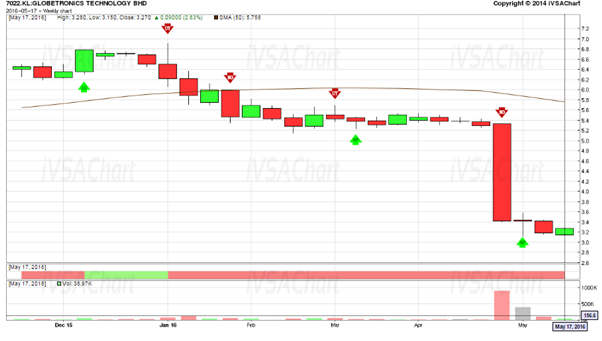

iVolume Spread Analysis (iVSA) & comments based on iVSAChart software – Globetronics

For Globetronics, after the registration of major sell off sign of

weakness (red arrow), the market broke down from RM5.30 to RM3.40,

nearly a fall of 35%. Currently, there is a spring, sign of strength

(green arrow) as the panic selling has subsided. At best, this market

will move sideways for the time being. Hence, we need to wait till there

are some sign of strengths (green arrow) to show up in the chart first

before buying.

GTRONIC (7022) - Holistic View of Globetronics with Fundamental Analysis & iVolume Spread Analysis (iVSAChart)

http://klse.i3investor.com/blogs/ivsastockreview/96806.jsp