WANT TO BE A SPARTAN?

Click here https://www.telegram.me/kimstock for more details.

DATE: 14 NOVEMBER 2017

------------------------------------------------------------------------------

THE STOCK & TARGET

------------------------------------------------------------------------------

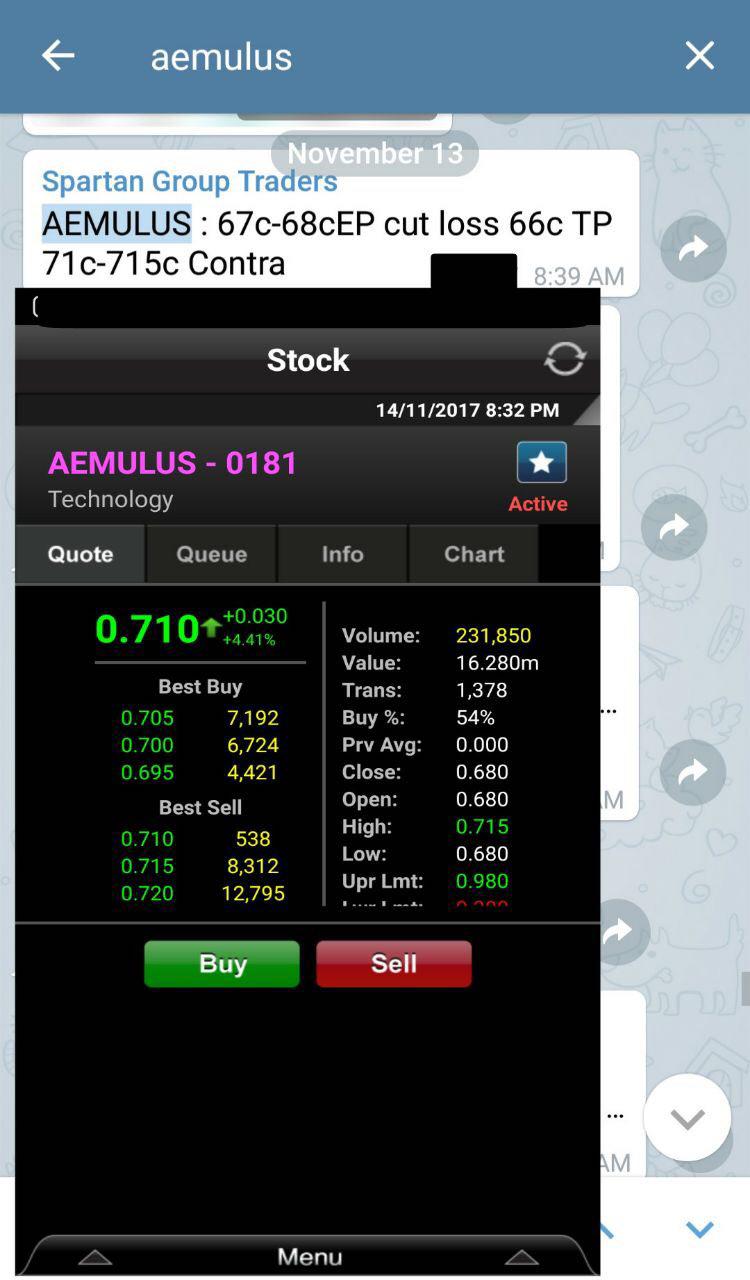

AEMULUS [ 0.71 cts ] - 1st TP - 0.71 cts (hit) / 2nd TP - Will release on SGT members only

"Closely watch this baby brewing because of big news in the corner I am forsees. Believe it or not..my SGT dancing allnite long!!! Join them without forcing! " - Kim Spartan

Kim has called and mentioned this one to SGT group with Entry Price (EP) 0.67 - 0.68cts before it exploded today as below screenshot. More coming to Kim's TP in immediate term.

------------------------------------------------------------------------------

THE STOCK & TARGET

------------------------------------------------------------------------------

AEMULUS [ 0.71 cts ] - 1st TP - 0.71 cts (hit) / 2nd TP - Will release on SGT members only

"Closely watch this baby brewing because of big news in the corner I am forsees. Believe it or not..my SGT dancing allnite long!!! Join them without forcing! " - Kim Spartan

Kim has called and mentioned this one to SGT group with Entry Price (EP) 0.67 - 0.68cts before it exploded today as below screenshot. More coming to Kim's TP in immediate term.

------------------------------------------------------------------------------

THE PROFILE

------------------------------------------------------------------------------

Aemulus Holdings Berhad principally involved in the design, engineering and development of ATE, where its products are used by semiconductor manufacturers and OSAT companies to test semiconductor wafer and packaged devices, before they are shipped for final assembly into various electronic devices and gadgets.

------------------------------------------------------------------------------

THE KEYNOTE

------------------------------------------------------------------------------

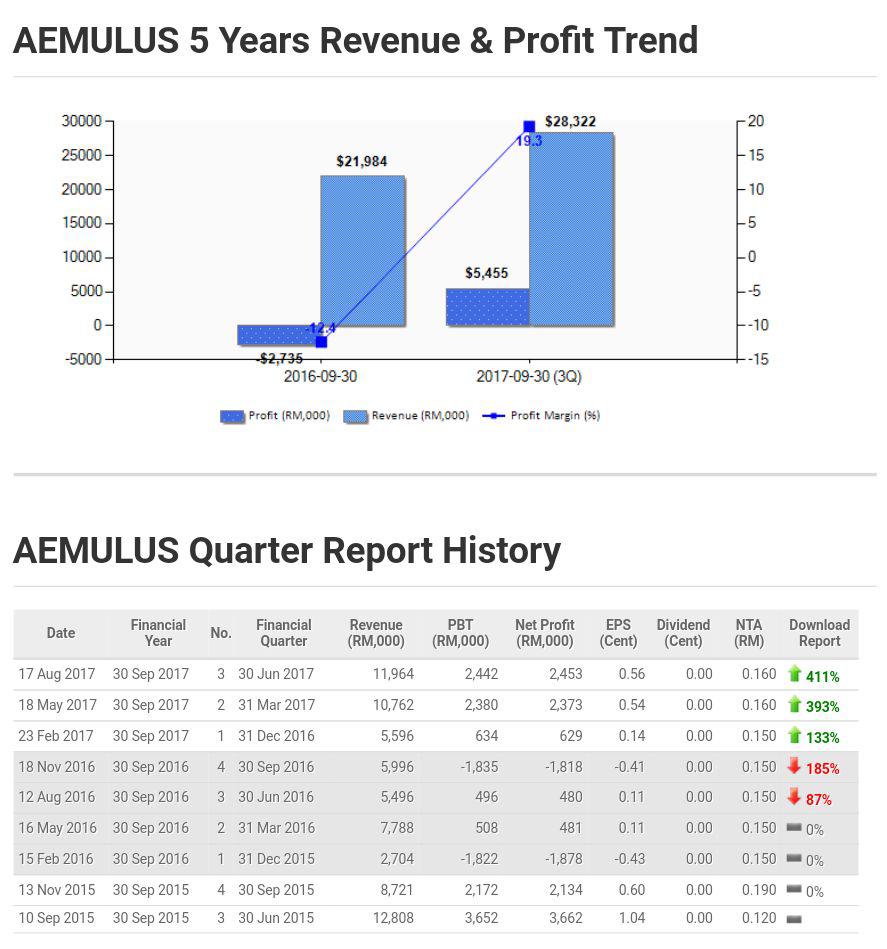

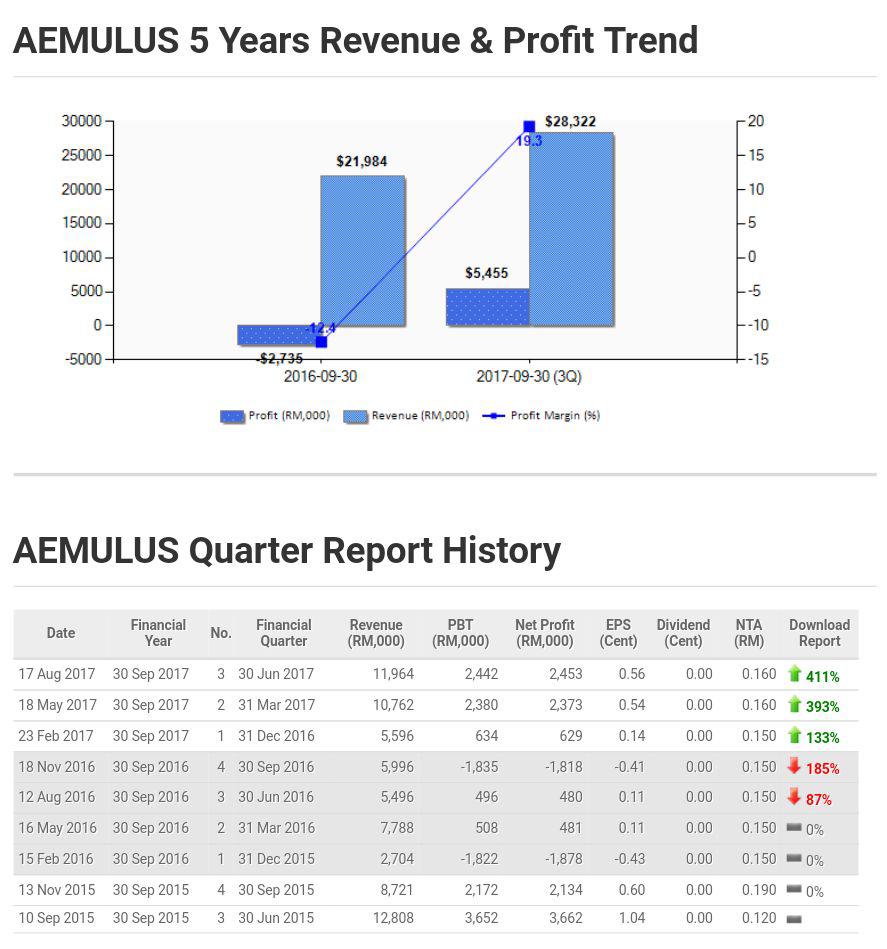

AEMULUS (JAN) - Aemulus Holdings Bhd plans to invest RM25mil in research and development (R&D) over the next three years following the purchase of a piece of land in the Bayan Lepas industrial estate, Penang. Aemulus, which designs and assemble automated test equipment and test and measurement instruments, said on Monday it was buying 1.62 acres of land in the industrial park for RM9.93mil.

AEMULUS (MAY) - Revenue in the second quarter of the financial year 2017 (2QFY17) rose 38.2% year-on-year (y-o-y) to reach RM10.8 million on the back of higher tester shipment volumes due to improving demand enterprise storage, smartphone and tablet (S&T) markets. The group’s earnings before interest, taxes, depreciation and amortisation margin expanded by 9.1 percentage points y-o-y to reach 24.3%. As a result of higher operating leverage, Aemulus Holdings Bhd posted a higher core net profit of RM2.4 million in 2QFY17 compared with RM1 million in 2QFY16.

In 1HFY/17, revenue rose by 55.9% y-o-y

due to higher tester shipment volumes on the back of a successful

automated tester equipment design win for a tier-one smartphone company

and demand recovery across the enterprise storage and S&T segments.

Aemulus shipped three units of AE4600 tester in 2QFY/17, which already

exceeds the two units that it shipped for the whole of FY16. Overall,

Aemulus recorded a core net profit of RM3 million in 1HFY/17 against a

core net loss of RM0.8 million in 1HFY17.

AEMULUS (AUG) - The

ACE Market-listed group Aemulus Holdings Bhd is riding high on the

growing demand for semiconductors. This is evidenced in its latest

quarterly financial numbers. Its net profit for the third financial

quarter ended June 30, 2017 (3QFY17) jumped 411% to RM2.5 million

compared with RM480,000 a year ago. Quarterly revenue climbed 118%

to RM12 million from RM5.5 million previously thanks to the growing demand from the enterprise storage and Automated Test Equipment (ATE) segments which are continuously driving the top-line performance.

AEMULUS (NOV) - I am expecting goodies in bucket already - Kim Spartan

------------------------------------------------------------------------------

THE FINANCIAL

------------------------------------------------------------------------------

http://klse.i3investor.com/blogs/spartan/138219.jspto RM12 million from RM5.5 million previously thanks to the growing demand from the enterprise storage and Automated Test Equipment (ATE) segments which are continuously driving the top-line performance.

AEMULUS (NOV) - I am expecting goodies in bucket already - Kim Spartan

THE FINANCIAL

------------------------------------------------------------------------------

Regards,

Kim Stockwatch

Telegram : https://www.telegram.me/kimstock (Real live time trading)

Or Join Elite Spartan Group Traders (SGT)