Many people thinks the market is crashing... since 2016. But nobody can give a proper reason why. It's important to know why we think it's crashing (or not) because this directly means whether we should even be investing in the first place. If it's crashing we don't invest; if it's going up we should.

That's why we take the effort to find out for ourselves what is likely to happen in 2018, globally and in the Malaysian market.

While many will be talking about the upcoming election and its messy political backdrop, or the potential US-Korea War breaking out, or the bitcoin/cryptocurrency - we decide to take out the guesswork and first focus on getting our hands the best data sets to best represent the Malaysian stock market in 2018.

Here's what we find in Market Overview 2018 - Part 1: The Global Story For Malaysia

- JT Low

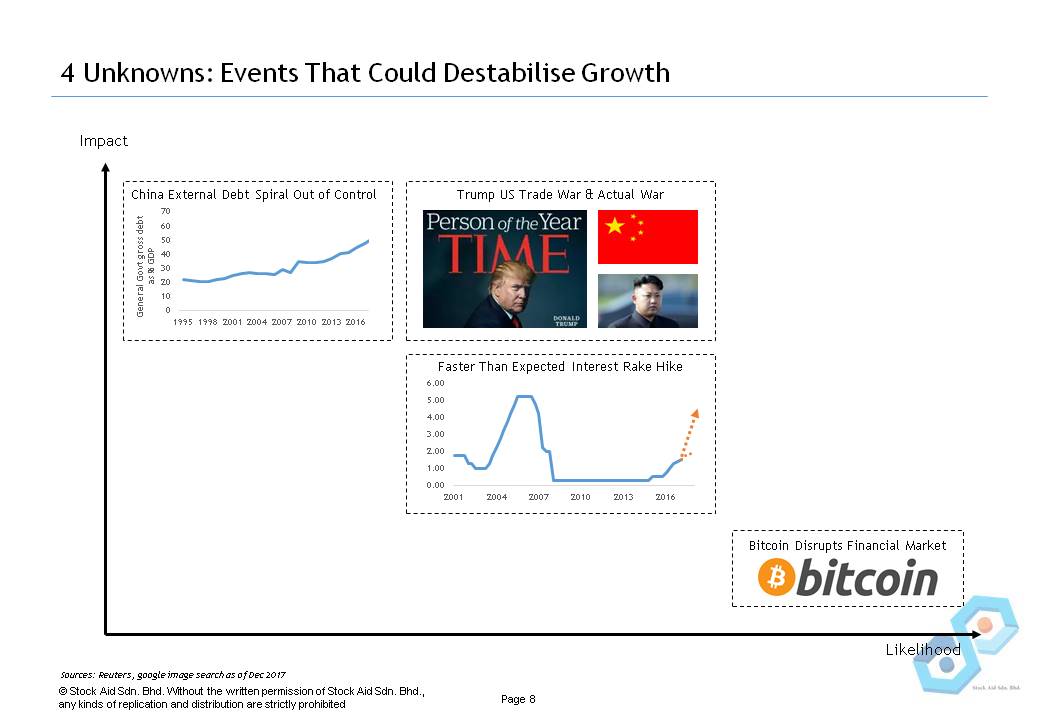

So there you go... 4 events that could potentially destabilize the financial markets, ranked by Level of Impact and it's Likelihood.

1. China debt spiralling out of control

We witnessed that China's economy can potentially cause havoc in the global finanicial market in 24th August 2015. Even scarier, it didn't seemed to happen because of humans. So given that a debt crisis in China could trigger a really damaging of reactions across major economies. But given that it's a sovereign state with a significant control over state matters (more so than most countries) they could easily avoid that by, let's say, printing money.

Impact: High

Likelihood: Low

2. Wars: Trump VS North Korea & China

Yes, WARS: A Nuclear War with N. Korea and a Trade War with China. Both could trigger a crash for the global financial markets.

Impact: High

Likelihood: Moderate

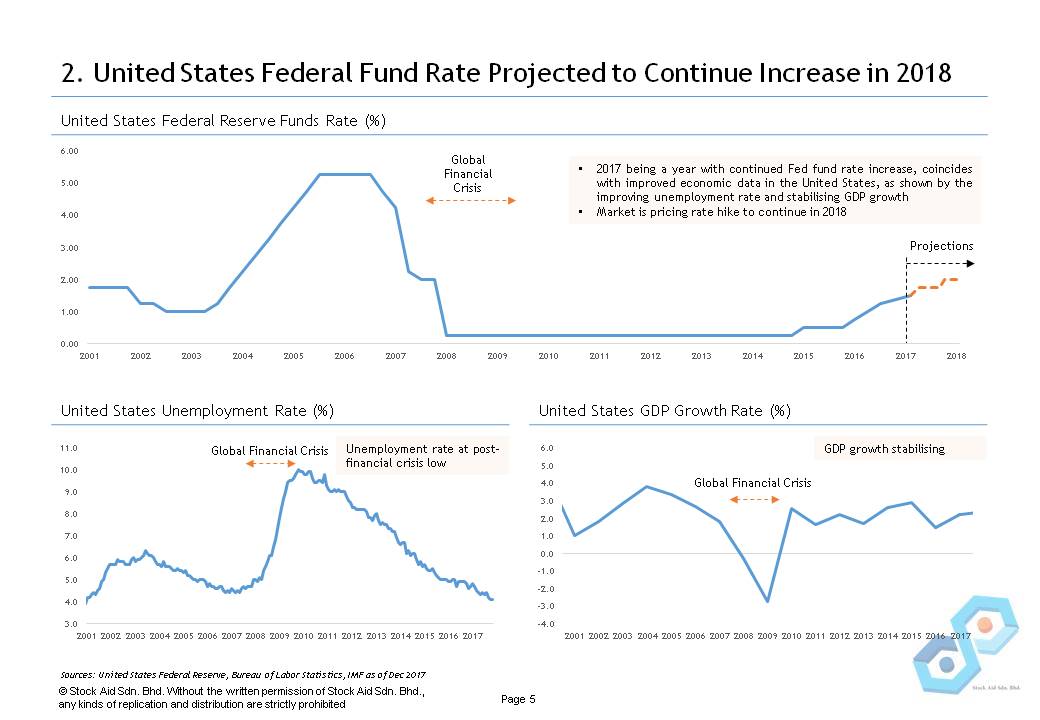

3. Interest Rate Hike by US Federal Reserve

In the previous slides, we argued that it's very likely that hikes are happening in 2018. The problem is when it happens too quickly. Fast and furious is no good for markets since many companies and house owners and regular joes with mountains of debts will be unable to cope. Given that the upcoming Federal Reserve Chairman seems to be following the footsteps of his predecessor, we aren't too worried, but who knows in a Trumpian environment?

Impact: Moderate

Likelihood: Moderate

4. Bitcoin Disrupting the Financial World

I assume I no longer need introduce Bitcoin: it is the number 1 'asset' for high risk high return speculation (even I do it for fun). But will it affect the finanical world? How likely it is? Given that it really is a breakthrough in technology, we believe that bitcoin redefining finance is a matter of time for the better or worse. But, for Malaysian's who're reading this I'm almost a 100% (I may be wrong: 1 | 2) sure you aren't buying anything with bitcoins yet, not yet anyways. Same as most people, in most countries. So given that:

Impact: Low

Likelihood: High

How can you make money from these information? Stay tuned for part 2 in our Market Overview 2018. Read more>> http://stockaidpro.com/

http://klse.i3investor.com/blogs/stockaidpro/143460.jsp