On the last trading day of the year, Friday morning the price of Hengyuan shot up to Rm 19.20 from Rm 17.96, the closing price of the day before. Many people believed fund managers would push the price higher for window dressing.

The price has risen from Rm 3.00 to Rm 19.20, an increase of 640% within 12 months. This phenomenal rise has created history in our local stock market.

Let us look at last Friday’s figures:

The closing price of Thursday Rm 17.96

Opening price on Friday Rm 18.42

Day’s high Rm 19.20

Day’s low Rm 15,94’

Closed at Rm 16.30.

Total volume traded 127 million shares.

Estimated value 127 million shares X say Rm17 = Rm 216 million.

Obviously, there were more sellers than buyers on Friday. As a result, the price fell.

As I said many a time, no share can go up or come down continuously for whatever reason. Sooner or later, there will be a price correction. After about 2 hours of trading, the price suddenly dropped more than Rm 3 within 30 minutes.

There are various types of shareholders. Some are day traders who buy and sell frequently. Some are short term investors who will sell when the price achieves its target. Some are serious long-term investors who would buy based on good fundamentals and hold for a long time.

Statistics shows that long term investors make more money than the other types of investors and there are more losers than winners in day trading.

On Friday, obviously there was panic selling. I think even the long term investors were also selling.

Many of my friends who have followed me to buy Hengyuan asked me for my opinion. What should they do?

It is a matter of human psychology. Sellers are fearful that the price will continue to drop and buyers believe the price will soon recover and will continue its climb.

Its fundamentals have not basically changed.

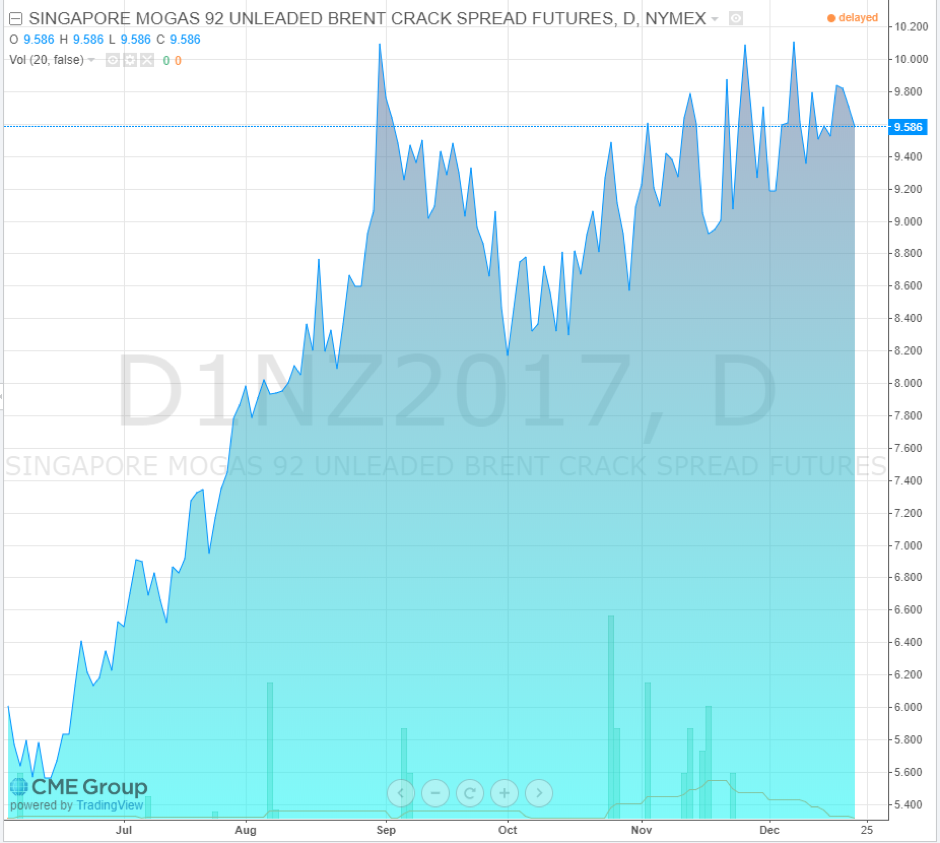

Based on the unusually high volume traded daily, I believe many institutional investors from China are buying aggressively. They are so bullish because they can see that both its revenue and profit are increasing. Its 1st half year EPS was Rm 1.20. Its 3rd quarter EPS was Rm 1.21 and they expect its 4th quarter EPS to be more than its 3rd quarter because its crack spread or profit margin has been better during the 4th quarter as shown in the Crack Spread chart below.

Hengyuan’s profit essentially depends on its margin of profit or crack spread.

Petron Refining in comparison with Hengyuan

Its half year EPS was 73.9 sen. Its 3rd quarter EPS was 39.3 sen. The total EPS for 3 quarters was 113.2 sen.

On Friday it dropped Rm 1.06 to close at Rm 13.54 per share.

Hengyuan is very much cheaper in terms of P/E ratio.

My opinion:

Looking at the huge volume of 127 million shares traded last Friday, I believe there were many institutional investors who have been buying aggressively, took advantage of the cheaper prices to buy more than usual.

I strongly believe its share price will continue to rise especially when its annual result is announced before the end of February 2018.

http://klse.i3investor.com/blogs/koonyewyinblog/142841.jsp