OSK is one of the companies i think is quite interesting now, and am buying a little bit. However, i caught myself asking the question, which is more worth it? The Warrant or the stock?

Below is my calculation and thought process

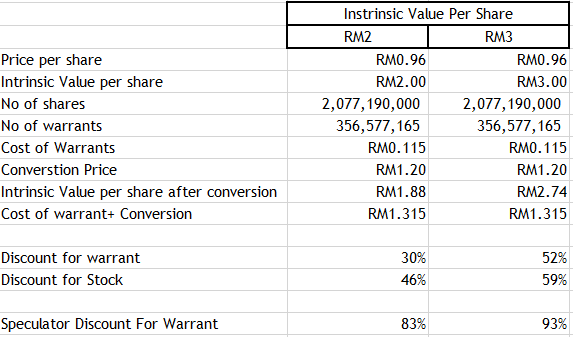

We first assume intrinsic value of the share to be RM2 and RM3.

As we can see here, for most investors other than Ong Leong Huat, the stock represent more value at 46% discount to intrinsic value (assuming RM2) and 59% (assuming RM3). While the warrant's discount is only 30% and 52% respectively.

Now, if one were to assume the intrinsic value is RM4, i think the discount for the warrant will exceed those of the stock, but i dont think the stock is worth anywhere near RM4.

Why do i say other than OLH?

Well, assuming OLH thinks the share is worth much more than what is traded (which he does), he would want to buy more shares, but given the low amount of public float, he is unlikely to be able to buy much, without pushing the price (and thus his cost) up considerably.

As he has roughly 149 million warrants, regardless of where the price is, it represents a great opportunity for him to buy 149 million shares, without pushing the price up!

Of course, this calculation is for people with a long term investment mindset, and would actually want to convert the warrants. And not so much be relying on the goreng factor or prediction of future price.

Speculator Calculation.

For a speculator, you may want to take into consideration the potential goreng factor, if the price goes up to say RM1.5 or RM2.

Or, you may also want to consider the speculator discount on the warrant.

For RM0.115 per warrant, you are able to buy the option to purchase the discount between the instrinsic value of the share after conversion and the conversion price!

For example,

RM2 Intrinsic value:

The difference between the intrinsic value of the share after conversion and the conversion price is RM0.68. And you only need to pay RM0.115 for the option to purchase this. Giving rise to a discount of 83%!

RM3 Intrinsic value:

The difference between the intrinsic value of the share after conversion and the conversion price is RM1.54. And you only need to pay RM0.115 for the option to purchase this. Giving rise to a discount of 93%!

Clearly quite lucrative, espeacially since you have till 22 July 2020, or 2 more years, for this discount to contract to near intrinsic value, even temporarily, and for you to take your profit.

But that could very well not happen, China debt is incredibly heavy, and recently a government linked company, fell, bringing down USD11 billion worth of debt.

Interest rates around the world are rising, and US, Canadian, Australian and Hong Kong businesses and homeowners are overleveraged and may very well not be able to pay if interest rise futher, causing them to forfeit and trigger a crisis.

If you dont get the chance for you to convert, or worse if we fall into crisis. You will end up with zero.

Conclusion

Well, i know what i'm buying. Let me know what you think, or if you think i am wrong or coming from a different perspective.