1. Stock of The Year

In March 2016, I nominated Air Asia at RM1.66 as the Sailang Stock for 2016.

In July 2017, I nominated Hengyuan at RM6.90 as the Sailang Stock for 2017.

In April 2018, I nominated Muda Holdings at RM2.20 as the Sailang Stock for 2018.

Air Asia and Hengyuan has subsequently done well (if you didn't sell Hengyuan at closed to RM20, that is not my fault).

Muda has a bad time after my call, dropping to as low as RM1.60 in October 2018. But now it is trading at around RM2.10. Still not profitable, but down only about 5%. I consider that to be not bad as 2018 turned out to be a lousy year and most people's portfolio shrank more than that.

We have yet to enter 2019, but opportunity has presented itself. So I would like to make an earlier move by nominating soon to be listed Jaks-WA (on 16 December 2018) as 2019 Stock of The Year.

2. My 2019 Blue Eye Boy

Before we look at Jaks-WA, let's first look at Jaks. Jaks has 550 mil shares outstanding. Based on current price of RM0.50, its market cap is RM275 mil.

(klsei3investor's Jaks webpage mistakenly calculated Jaks' market cap as RM400 mil based on wrong numbr of shares of 819 mil shares)

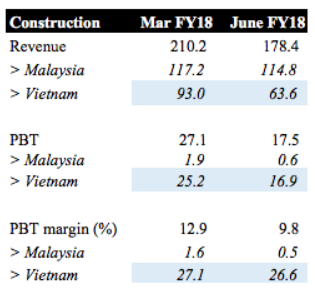

First of all, what has gone wrong in latest quarter ended September 2018 ? Why did it report losses of RM2 mil ? The main culprit is actually slower billing of Vietnam construction project. In previous quarters, the project generated revenue of RM93 mil and RM64 mil respectively. Its PBT (and hence net profit, since it is tax free) was RM25 mil and RM17 mil respectively (please refer to table below).

(Source : my 29 August 2018 Jaks article)

However, in latest September 2018 quarter, Vietnam revenue dropped to RM33 mil. Its net profit also dropped to RM7 mil. Plus small increase in property division losses, the group reported net loss of RM2 mil.

How will Jaks fare in FY2019 ?

As shown in table above, the Vietnam project's net margin was 27% in March and June quarters. However, it has dropped to 22% in latest quarter (reason not provided by company). Let's just be conservative and apply this latest profit margin going forward. The Vietnam project still has RM1.3 billion revenue to be booked in. This should lead to RM286 mil net profit.

Since next quarter will begin in October 2018 and the Vietnam power plant is targeted to be completed by mid 2020, there is 21 months ahead of us, equivalent to 1.75 years. Divide RM286 mil by 1.75 years, we arrive at net profit of RM163 mil per annum.

The property division incurred loss of RM17.5 mil in this latest quarter, out of which RM12 mil is LAD while RM6 mil is Evolve Mall operating loss. According to analysts, the Pacific Star project is targeted to be completed by mid 2019, which will eliminate the LAD. However, to be conservative, let's just assume LAD drags on until end 2019. As such, property division will report losses of RM70 mil (being RM17.5 mil annualised). Since Jaks owns 50%, the amount to be booked in will be RM35 mil.

In latest quarter, Jaks' interest epxenses had declined from previously RM7 mil to RM4.6 mil. Multiplied that by 4, pro forma FY2019 interest expense will be RM18 mil.

Let's not forget the RM50 mil Bank Guarantee to be released to Star Media. Assuming Jaks loses the court case, total to be booked in by Jaks will be RM25 mil.

Putting all the above figures together, I expect Jaks to report net profit of RM85 mil in FY2019 (being RM163 mil less RM35 mil less RM18 mil less RM25 mil).

Based on 550 mil shares, EPS should be 15 sen.

Applying a PER of 10 times, my target price for the stock will be RM1.50.

The fair value of the Warrants will be RM1.50 less RM0.64 (exercise price) = RM0.86.

Based on listing price of RM0.25, potential gain of 250% over next twelve months.

That is why I nominate it as my favorite stock for 2019.

(Dear readers, please don't really sailang. Sailang is merely a term used by me to communicate my fondness for a particular stock).

3. How About 2020 and Beyond ?

The power plant will be completed by mid 2020. How much will it contribute to Jaks ?

Instead of making all kind of assumptions, or use high tech terminology such as Enterprise Value, EBITDA, EBIT, Discounted Cashflow, Weighted Average Cost of Capital, ROIC, etc, I just make use of a neighbouring project as my reference material.

You guess it right, MFCB's Don Sahong hydroelectric power project in Laos.

I think they are comparable in terms of profitability because of the following :

(a) operate in same region (Laos vs. Vietnam) and hence should enjoy similar economics;

(b) similar capacity (Don Sahong 260 MW, Jaks' 30% of 1,200 MW = 360 MW);

(c) similar construction cost (Don Sahong RM2 bil divided by 260 MW = RM7.7 mil per MW. Jaks Vietnam project RM7.8 bil divided by 1,200 MW = RM6.5 mil per MW)

According to analysts, MFCB is expected to report RM200 mil net profit in FY2020 (after project completed), the bulk of which will be from Don Sahong.

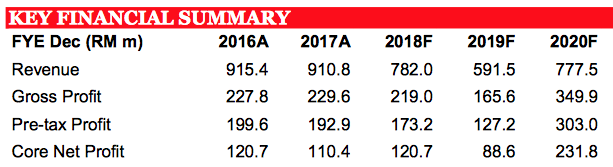

(Source : Public Investment Bank report dated 28 November 2018)

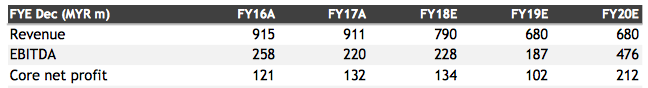

(Source : Maybank Investment Bank report dated 27 November 2018)

As Jaks's effective capacity is even bigger than Don Sahong (360 MW vs. 260 MW), it should generate more profit.

However, due to lack of actual information for Jaks' project, I would rather err on the conservative side - All I Am Predicting Is That After Factoring In Losses of All Other Divisions and Interest Expenses, Jaks Should Be Able To Maintain Its Net Profit in FY2020 At RM85 mil.

I believe the above is a fairly resonable prediction.

Meaning my target price of RM1.50 is equally good going into FY2020.

Concluding Remarks : Jaks-WA is a good buy at RM0.25.

https://klse.i3investor.com/servlets/cube/icon8888.jsp