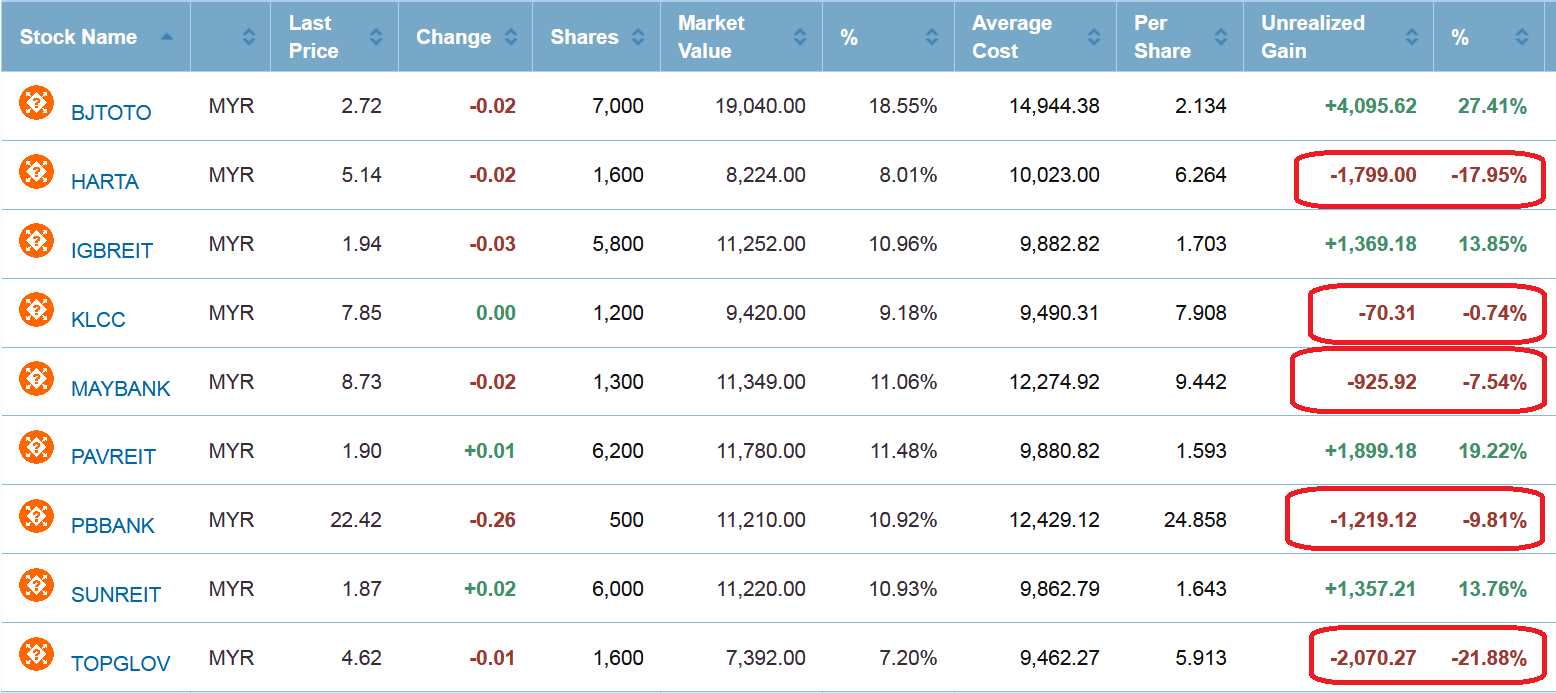

Before entering TKW 2019 stocks challenge, i come up with few sets of fictional portfolio , 1 of the portfolio i named it '' 2019 all weather passive bet '' https://klse.i3investor.com/servlets/pfs/115617.jsp

My idea is buy and hold for 1 year for the stocks i think is the most resilience, most stable, constant div pay out + modest growth , well after half year now , let see the perfomances , turn out 5 out of 9 stocks in the portfolio is in red , especially topglove and harta double digit loss, maybank pbbank more than 5% , KLCC no up no down , only IGB PAV SUN reits show green , and of course the lovely bjtoto

every stocks have the risk of going down , if you're someone 20 to 30 years old, having a all weather stocks portfolio is not going generate much wealth for you.

if you are a retiree with 10-20 years time to live, having this kind of portfolio is somewhat stable , but it always come with risks

So, what's the conclusion? there is no ''all weather'' stocks portfolio, to survive , 1 must always be willing to adapt to the new circumstances , no good then must change , don't be stubborn :)

https://klse.i3investor.com/blogs/abctesting/217065.jsp