For a copy with better formatting, go here, its alot easier on the eyes.

Perak Transit Berhad – The Peculiar RM3.2bil – RM4.8bil Bus Terminal Boom In Malaysia (PTRANS – 0186)

========================================================================One of the companies I’ve always been interested in is Perak Transit Berhad.

So much has been said about their Amanahjaya Bus Terminal in Perak, and its apparently monopoly like position when it comes to bus travel in Perak.

In addition, with the soon to be completed Kampar Bus Terminal, it seemed plausible for earnings to double, and thus the price of the stock as well (at least according to some analyst).

In fact, I actually bought a small position during the March bottom, before selling it off after finishing up my research.

The thing is, i don’t think it is as simple as that, as they are quite a few things that don’t seem to line up/make sense for me numbers wise.

Well, lets begin.

Overview of the Business

Perak Transit is involved in 3 main business lines,- Operation of Petrol Stations

- Operation of Public Transportation

- Operation of Integrated Public Transportation Terminal

Operation of Petrol Stations

Fairly standard business, makes about RM 1 million per year. No real surprises here.Operation Of Public Transportation

Well, the thing about operating bus routes, is that it is fundamentally a loss making business, that requires government subsidies to survive. The subsidies given are as follows.- RM10 million given by the Public Private Partnership Unit of the Prime Ministers Department in 2012 for the construction of their current Amanjaya Bus Terminal.

- Interim Stage Bus Support Fund. A fund to address the shortfalls of revenues for certain unprofitable routes. This translates to around RM 2 million a year. The contracts run for 2 years before renewal.

- Stage Bus Service Transformation ("SBST") Program, which basically turns it into a cost plus contract. As a network operator, they will be paid cost per km for each vehicle in the 16 stage bus routes in Ipoh, with the fares collected and repaid to Suruhanjaya Pengangkutan Awam Darat ("SPAD") (The Land Transport Government Agency) . The contract runs for 8 years before renewal is needed. This particular program has grown to become a major part of the bus operations.

And

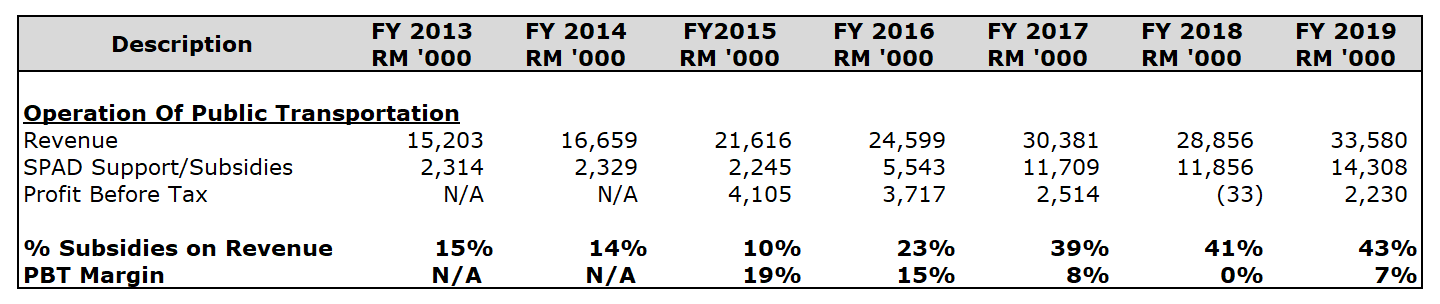

as we can see here, subsidies/cost plus contract have grown to become

approximately 43% of the business from the initial 23%.

And

despite costs plus contracts being a major part of this division,

margins is still relatively lackluster (which is a good thing from a

citizen perspective I guess?)

Having

said that, from my experience in working with the government on things

that require them to subsidize and make payment, i personally don’t

particularly like the experience.

This

is because the government service is usually run by little Napoleons,

with whom you have to really jaga the relationship etc, as at the end of

the day, they will do what they (while giving reasonable sounding

explanations).

I

still remember Ekovest bosses making sure to show their face on a

random update meeting with the Malaysian Highway Authority on 2 hour

notices.

At

the end of the day, when the chips are down, nobody dares to sue the

government (in Malaysia) at least, to fully enforce their contracts.

Having said, this is not a particularly politically sensitive kind of subsidy, so i'm not too worried.

I

don’t particularly like this part of the business, but then again,

nobody really does. It also does not contribute much in terms of profit

anyway.

Operation of Integrated Public Transportation Terminal

And now, we come to the real meat of the business, which includes their “Monopolistic” Amanahjaya Bus Terminal and soon to be completed Kampar Bus Terminal.

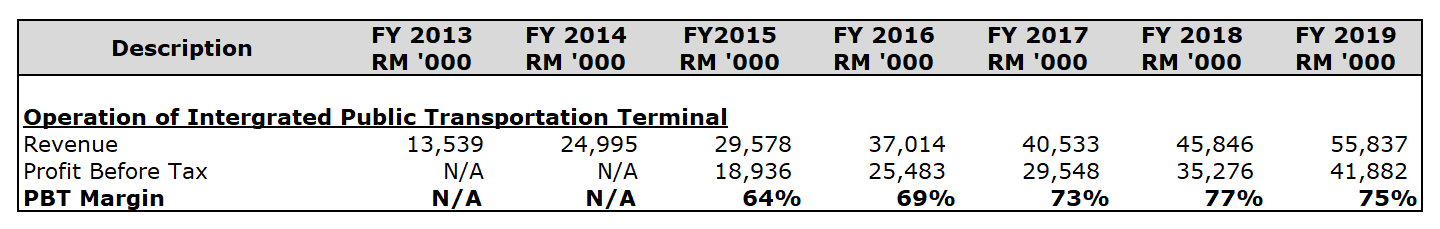

At first glance, the numbers look absolutely incredible!

I mean, it almost looks as if Surgical Glove companies should just pack up shop and go into the business of opening bus terminals.

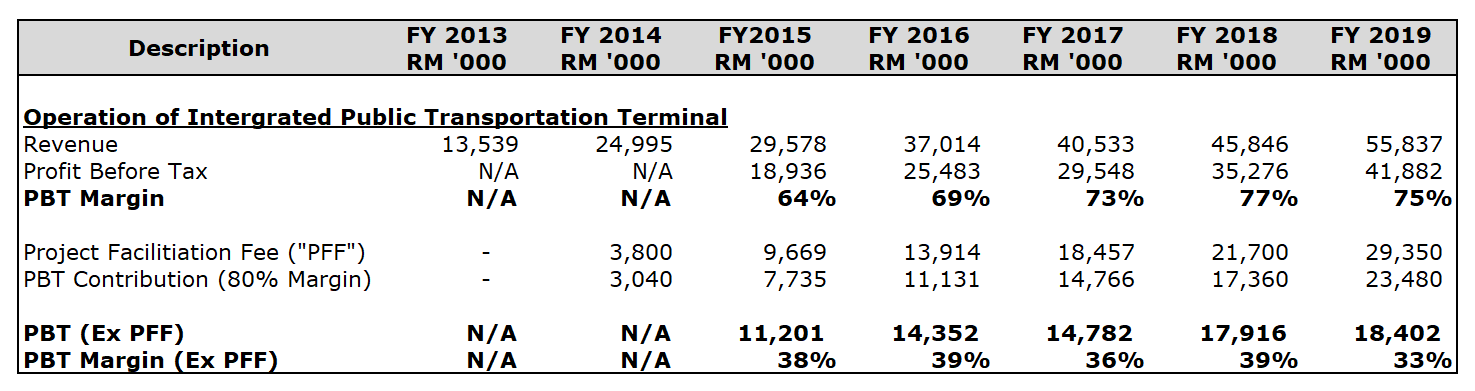

However, one thing Perak Transit includes in their numbers here, is something called a “Project Facilitation Fee”.

In their prospectus, it is stated that these are generally one off items, that should not constitute a major part of their income.

So lets try and extract it out and look at the normalized numbers.

Well, it looks a bit more logical, however, do note this is a segment reporting number, and it does not include any consolidation set offs.

And yes, the margins really are 80% (I’ll explain later)

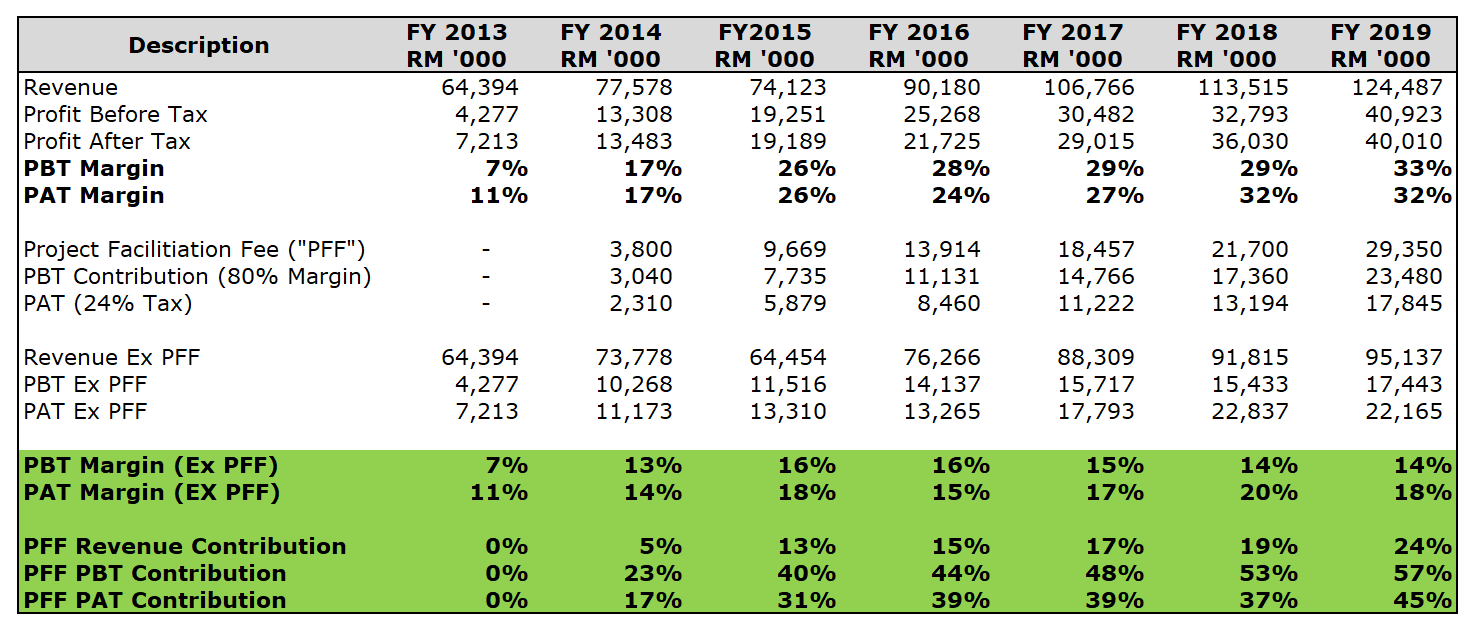

Lets account for the consolidation adjustments, and take a look at how the company’s annual results will look like excluding the PFF’s (since it is paid by third parties only anyway).

From what we can see here, it appears these “One Off”, “Non Recurring” and “Icing on the Cake” items, are not just continuously recurring, they have also consistently increased in size, that they now take the cake when it comes to company’s earnings by contributing to more than 50% of it in 2019.

Its almost as if, Perak Transit Berhad is not primarily a Bus Terminal company that gives advice to others on how to open their own Bus Terminals.

Instead, it is a company that specializes in giving advice to others on how to open a Bus Terminal, and also happens to have a Bus Terminal of their own!

What are these “Project Facilitation Fees” (“PFF”) ?!

So, we now have the million dollar question, what are these fees?They detailed out the nature of these fees in their Prospectus and Annual Reports, it can get quite lengthy, however, they all revolve around saying the same thing.

PFF’s are when the company provides advisory services to third parties who want to build their own Bus Terminals.

What they do is they rent out Terminal Amanjaya’s equipment, utilities and facilities, prepare preliminary concept paper for the proposed project, discussion and sharing of knowledge on design, planning and construction of terminal and attending all meetings organised by the third party with SPAD and other relevant governmental departments.

And all of this is due to their their experience with Terminal Amanjaya and the management’s long-term expertise in public bus services.

Basically, if you are interested in opening a bus terminal, we will help you with your proposals, talk to government and settle everything.

According to management, this there is very little incremental cost relating to the Project Facilitation Fees, its basically all profit (Prospectus indicates margins of 80%), and that these fees usually consist of 2-3% of the Bus Terminal Project’s Gross Development Value.

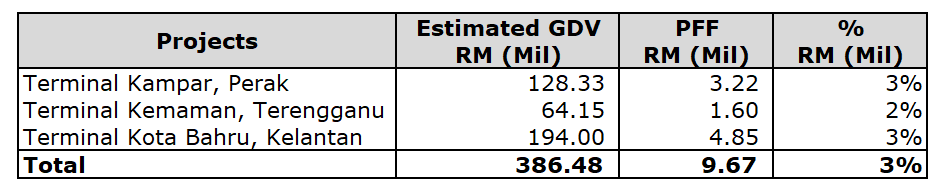

During their IPO in 2016, they were even kind enough to provide the breakdown of the fees for the year 2015.

Well it looks very reasonable, except.

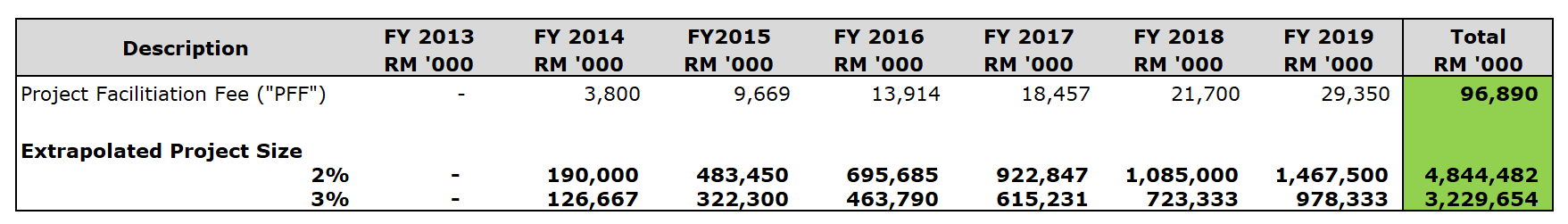

Except, these amounts have continually increased, and as of FYE 2019, they have received almost RM96.9 million in project facilitation fee’s.

Now to be fair, on the surface, this is a very good thing for the Company and its shareholders. However, we do need to really understand what this item and its nature.

I mean, if your children, started coming home from school with RM10,000 a day from whatever he is doing outside, i would imagine that as a parent, you would be more worried rather than happy. (But if you found out he's doing some weird software stuff that is doing extremely well, you would be very very happy)

So, back to the topic at hand.

Depending on whether it is 2% or 3% of the Gross Development Value, this indicates proposal for new Bus Terminals in Malaysian since 2014 totaling RM4.8 billion or RM3.2 billion. With the bulk of it happening in 2019.

To put things in perspective.

For RM4.8 billion, you can buy the entire Sunway Pyramid or even One Utama, the biggest shopping malls in Malaysia, with some of the best locations and still get change.

It does not make sense to me that they are RM4.8 billion worth of bus terminals proposal in Malaysia in the last 5 years.

This is bus terminals, not Highways or Airports.

And to make things really interesting, all these payments since 2014, came from a single party.

Maksima Timur Sdn Bhd. (They also happen to own around 1% of Perak Transit shares).

So who are they?

About Maksima Timur Sdn Bhd (Perak Transit 50% Profit Contribution Machine)

Now, according to their annual financial statements, Maksima Timur is an operator of transportation business, property development and investment holding, whilst its property development activities include acting as a project manager for construction of new integrated public transportation terminal complexes.Now, let me be clear. So far things are a little fishy. However, it does not appear to be fraud. As the most important Red Flags are not there. This is not the new episode of China Hustle (Malaysia Edition).

The PFF's are actually paid, and they are no long outstanding amounts in Perak Transit receivables (Though if i'm honest, as an ex-auditor, if these two companies are related and want to play with the numbers a bit, its not that difficult).

By the way, the company is audited by a small audit firm in Ipoh called, CWC & Company.

For the most part, I think the numbers should still be accurate, but for a fee of less than RM10k, I doubt the auditors will goreng them too much into the numbers, especially since Audit Oversight Board Reviews are usually on listed companies, and i doubt this firm has any listed clients.

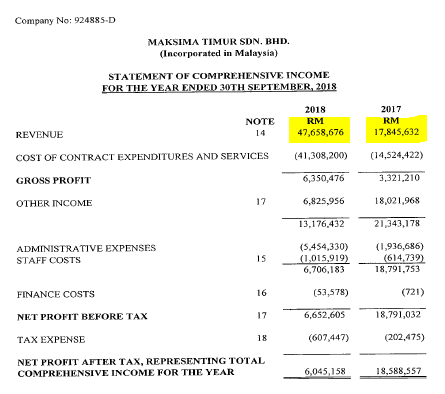

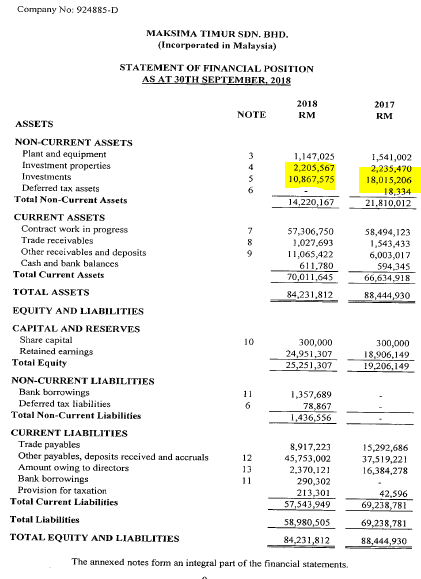

Now, looking at Maksima Timur’s annual financial statements and annual returns.

They are no overlapping directors and shareholders with Perak Transit Berhad, which seem to lend credence that it really is a third party company.

However, they are a few interesting things in the annual financial statements that don’t seem to make sense for me.

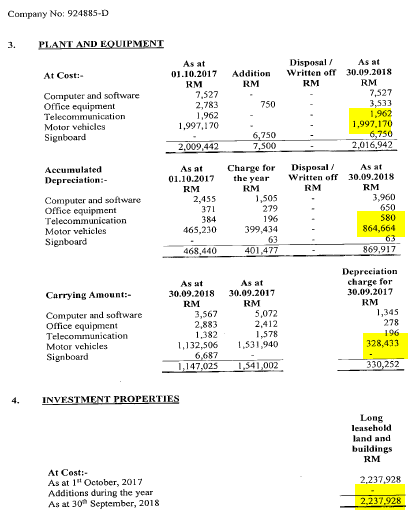

Building Contractor with ~ RM50m Revenue (Without Any Construction Equipment)

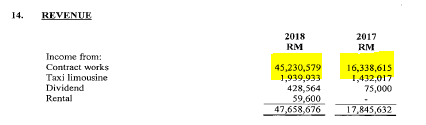

In 2018, this property contractor generated more than RM45 million worth of contract works revenue.

However, they did it with only RM1.1 million in Plant and Equipment and RM2.2 million in Investment Property (I imagine this is their office, and also property rented out to third parties).

And if you look at their Plant and Equipment, they generated that almost RM50 million worth of Contract Works Revenue with nothing but RM0.33 million worth of cars, and RM0.001 million in Computer and Office Equipement. Very impressive!

Look Ma, No Hands!

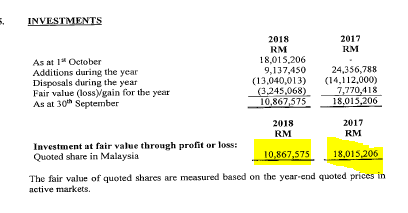

In fact, their “Investments” which consist wholly of quoted shares in Malaysia (and their shareholding in Perak Transit I imagine), at RM10 million (2017: RM18 million), is 3 times more than their Property Plant & Equipment and Investment Property combined (2017: 6 times).

Ok, to be fair, maybe they are just a weird pseudo project manager, that for some reason, only recognize a very small part of the project .

Honestly, it would be the first time I see something like this.

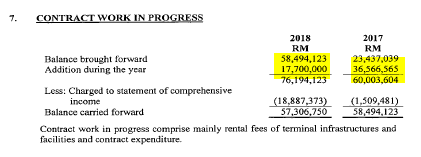

RM3.2 – RM4.8 billion worth of Terminal Proposals, Contract Work in Progress less than RM60mil

And here is something very interesting as well, for a company that have done proposals for RM3.2 billion to RM4.8 billion worth of bus terminal proposal.

The amount of contract works in progress is less than RM60 million.

Ok, to be fair, just because a proposals is completed, does not mean the project actually gets through.

In addition, many of the projects may already have been completed by this property project manager that does not have building equipment.

And to make things even more interesting, we can see that their additions in Contract Work In Progress in 2018 and 2017 is RM17.7 million and RM36.6 million respectively.

While the amount of Project Facilitation Fees paid by the Maksima Tinur (therefore added to Contract Work In Progress) to Perak Transit amounted to RM18.5 million in 2018 and RM21.7 million in 2017.

( I imagine there is some differences in the amount recognized during the year as Perak Transit year end is December, while Maksima Timur's year end is September.)

Looking at their numbers, its almost as if their projects consist solely of handling proposals on Bus Terminals from third parties, and paying fees to Perak Transit.

One wonders, why do these third parties need to go through Maksima Timur, instead of going to Perak Transit directly?

Ok, to be fair, it could really just be those few guys sitting there and managing subcontractors, but even then, the numbers is still a little funny.

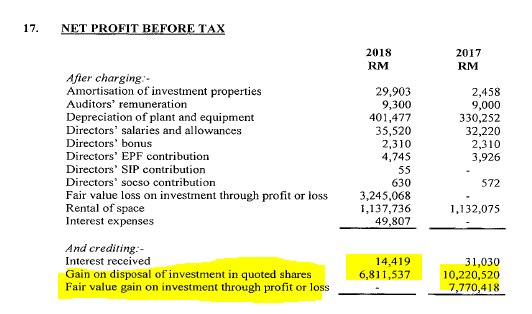

Zero Profit (Excluding Gain/Profit from Investment in Quoted Shares)

In 2018 and 2017, the company made RM6.0 million and RM18.6 million in profit.

Except, if you were to exclude the Fair Value Gain/ Gain on Disposal on quoted shares, which are not taxed (Malaysia does not have Capital Gains Tax), the profit will be zero.

Which would make sense of this was a company that is related in some way and in the business of moving around numbers (legally).

Or it could just be coincidental.

Conclusion and Valuation

Having done my research, in terms of valuation, I now understand why the price of this company barely moved, despite so many analyst talking about doubling of earnings (and thus price) when the Kampar Bus Terminal is completed.PFF’s contribute more than 50% of the company’s earnings, and the real nature of these things, how recurring are they etc, is all in doubt.

In addition, even if all those questions are answered, one major question remains.

This bus terminal expertise, does it lie with the company, or the top management of the company.

If it lies with the top management of the company, they can very simply just decide to open an Advisory Firm separate from the company and provide these consulting services, and thus keep 50% of Perak Transit's profits all to themselves.

As for the relationship between Perak Transit and Maksima Timur (the Number One Profit Generator for Perak Transit).

Who knows?

It is probably legal, and being an ex-auditor, to paraphrase Shakespeare,

“There are more things in Corporate Structures, Perak Transit Minority Shareholder; than are dreamt of in your philosophy”

There is probably some kind of corporate structure, that is kept in line via verbal agreement, handshakes, and honor.

In any event, there is a little too much speculation for my taste, and i'm not too keen to spend more money (beyond buying one copy of Maksima Timur's accounts) to find out more.

Well,Good luck!

And as always if you think i missed out on anything, have a different perspective, or think i am wrong, period. Let me know.

Disclaimers: Refer here.

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

Website: www.choivocapital.com

Email: choivocapital@gmail.com

https://klse.i3investor.com/blogs/PilosopoCapital/2020-05-23-story-h1507807751-_CHOIVO_CAPITAL_Perak_Transit_Berhad_The_Peculiar_RM3_2bil_RM4_8bil_Bus.jsp