Source: MIDF Research - 16 Oct 2020

Maintain BUY with a revised TP of RM1.10. We revise our TP for Mah Sing to RM1.10 from RM0.82 as we change our valuation method to Sum-of-Parts from RNAV to better reflect value of Mah Sing with significant contribution from property and gloves segment. We view the venture of Mah Sing into gloves manufacturing as a strong catalyst as it will boost Mah Sing’s earnings significantly going forward. Besides, we think that Mah Sing’s venture into gloves manufacturing could attract investors who would like to invest in gloves companies as valuation of Mah Sing is undemanding by trading at PE ratio of 5x at FY21 EPS compared to higher valuation of bigger gloves makers. Hence, we maintain our BUY call on Mah Sing.

The above hot news has attracted a lot more buyers. As a result, its share price shot up from 72.5 sen to 94.5 sen, an increase of 20 sen or 30.4% limit up yesterday.

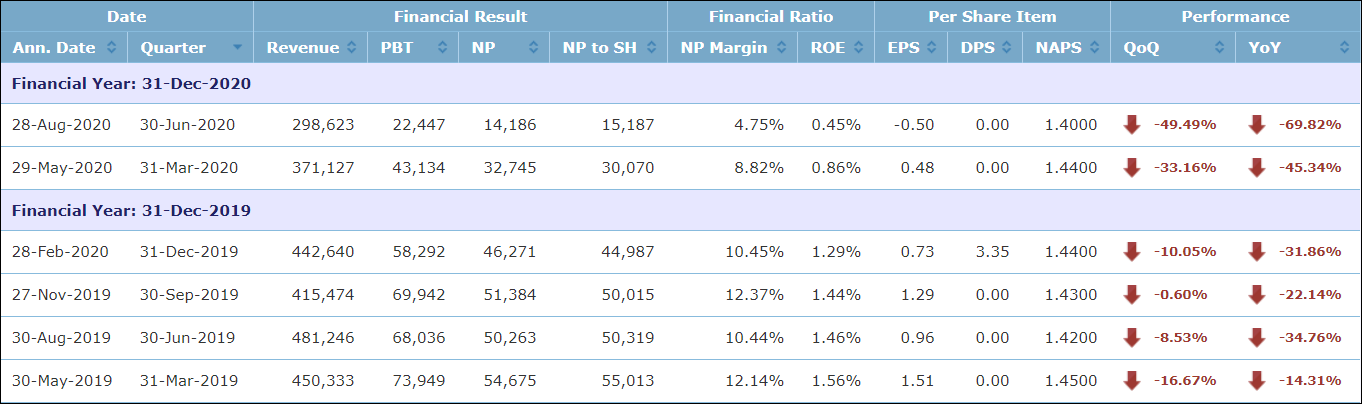

The table below shows that the company has been reporting reduced profit in the last 6 quarters. In fact, it reported loss in the latest quarter.

Investors should not buy it because it will take more than 2 years to start producing gloves and another one year to show profit, assuming its profit from the sale of gloves can cover the losses from its property business.

Covid 19 pandemic is affecting everyone’s movement and all businesses with the exception of medical gloves and medical products for the prevention of the virus.

Usually Investment Banks including MIDF have invested in so many listed companies. Most of their holdings are losing money.

Perhaps MIDF wants to promote Mah Sing because it has too many Mah Sing shares.

https://klse.i3investor.com/blogs/koonyewyinblog/2020-10-17-story-h1534702394-Mah_Sing_s_hot_news_Koon_Yew_Yin.jsp