LETS JOIN KIM'S STOCKWATCH GROUP?

Date: 03 March 2021

KIM'S VIEW

It is no secret that things are getting tougher in the Malaysian retail space, with the latest data from Retail Group Malaysia pointing to a mere 1.8% sales growth in 3Q2019 against 6.7% in the same period last year.

1. AEON's is trading below my estimate of fair value (RM2.70)

2. AEON's will be able to benefit from the recovery of the economy and consumer spending. On top of that, valuation appears much more attractive now. Although consumers increasingly shop online especially since the pandemic, I think that offline shopping will continue to have its place with an experiential offering that online shopping cannot displace

4. AEON's forecast earnings growth (29.7% per year) is above the savings rate (3.7%).

5. AEON's is transforming its shopping malls to adapt to changing consumer demand. In a Nov 29 note, it pointed out that AEON’s valuations are undemanding in view of its growth potential and status as the largest shariah-compliant mall operator in Malaysia.

6. AEON's operates 35 outlets, 28 malls, 74 Wellness pharmacies, 42 Daiso stores and six MaxValu Prime supermarkets.

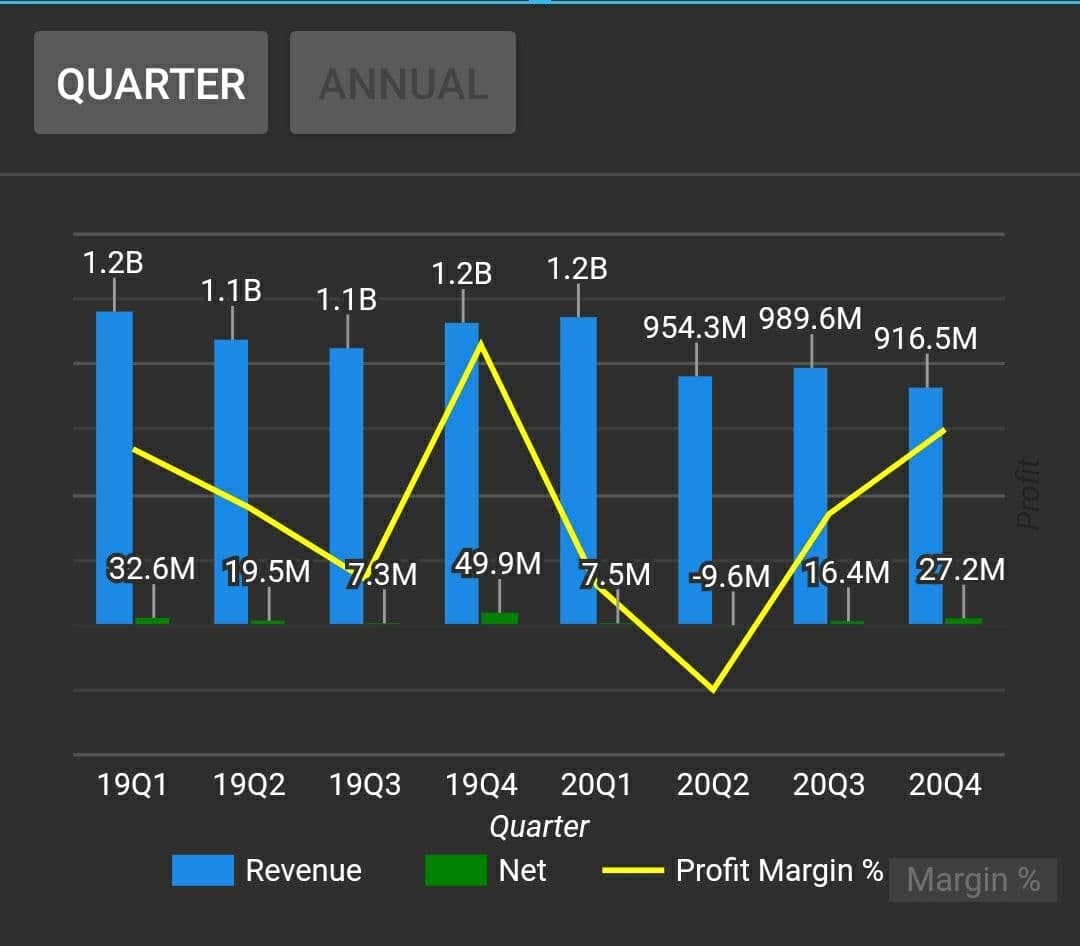

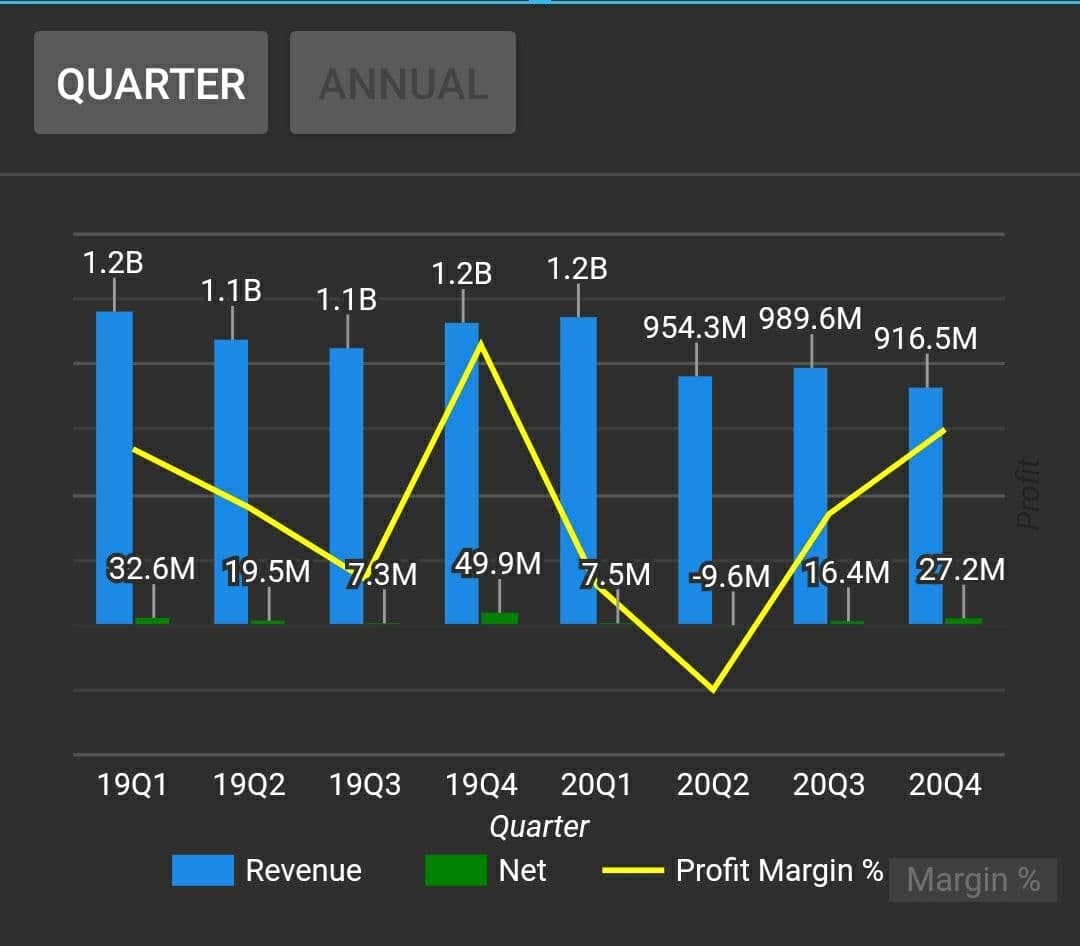

7. AEON's has experienced slower footfall due to the COVID-19 outbreak, but the situation is gradually normalising. Government is expected to introduce a stimulus package to drive consumer spending.

8. AEON's is in good position to benefit. Earnings growth moving forward would be driven by modernised store formats and product offerings to capture changing consumer demand, while earnings drag from the MFRS 16 adjustment would finally wear off in FY20.

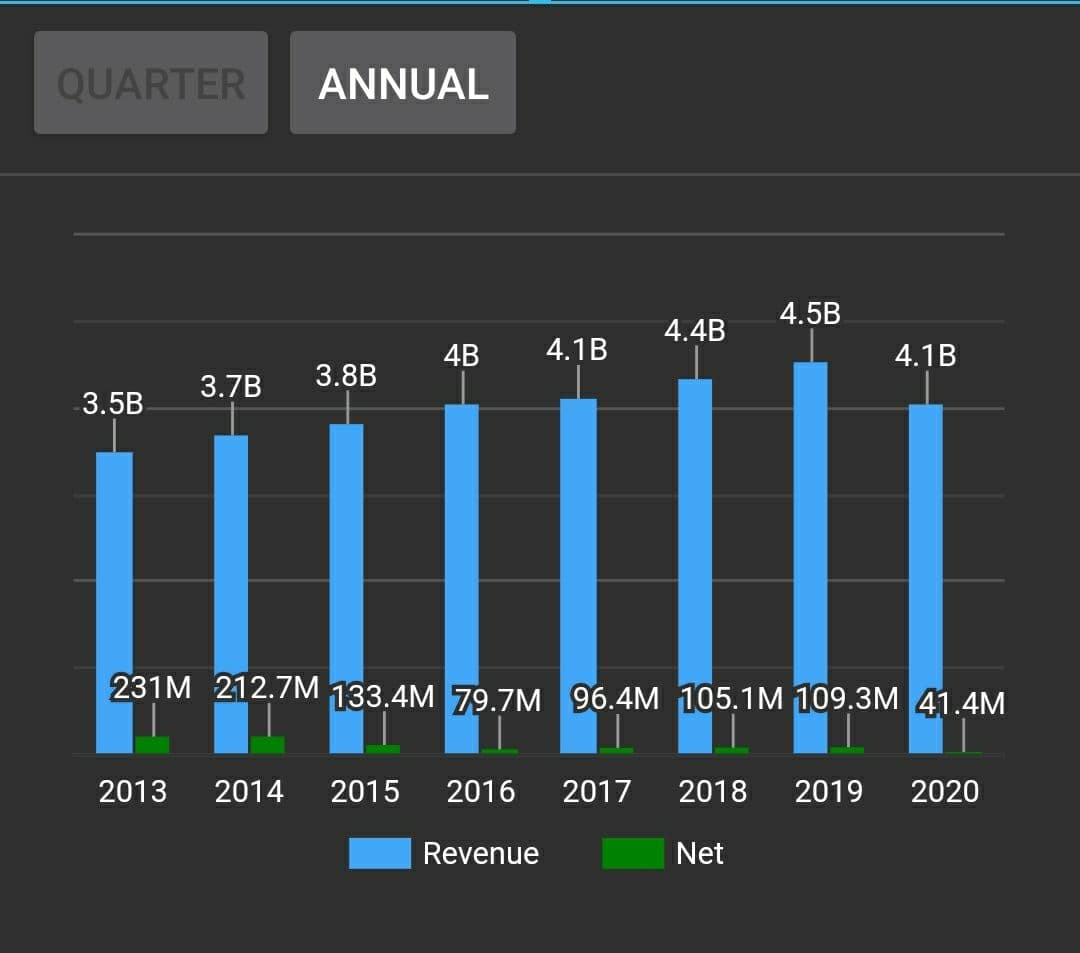

9. AEON's reported FY19 core net profit ofMYR109.3m (-13.8% YoY), which met consensus’ expectations but missed due to overly optimistic sales growth assumptions. Base on pre-MFRS 16 basis, FY19 core net profit would have grown by 1.9% YoY. Post-results, trimmed FY20-21F net profit by 8-9% to factor in more prudent sales growth assumptions.

LETS FLY & LETS ROCK!

Lastly, don't forget to click on our telegram link above and join us. Let us give you the latest update on the stock market and our group development. We hope you enjoy reading our blogs and give us your support.

Disclaimers: The research, information and financial

opinions expressed in this article are purely for information and

educational purpose only. We do not make any recommendation for the

intention of trading purposes nor is it an advice to trade. Although

best efforts are made to ensure that all information is accurate and up

to date, occasionally errors and misprints may occur which are

unintentional. It would help if you did not rely upon the material and

information. We will not be liable for any false, inaccurate, incomplete

information and losses or damages suffered from your action. It would

be best if you did your own research to make your personal investment

decisions wisely or consult your investment advisor.

https://klse.i3investor.com/blogs/spartan/2021-03-03-story-h1541978185-MY_OLD_GEMS_GOING_TO_SKYROCKET_AGAIN.jsp

LETS JOIN KIM'S STOCKWATCH GROUP?

Date: 03 March 2021

KIM'S VIEW

It is no secret that things are getting tougher in the Malaysian retail space, with the latest data from Retail Group Malaysia pointing to a mere 1.8% sales growth in 3Q2019 against 6.7% in the same period last year.

1. AEON's is trading below my estimate of fair value (RM2.70)

2. AEON's will be able to benefit from the recovery of the economy and consumer spending. On top of that, valuation appears much more attractive now. Although consumers increasingly shop online especially since the pandemic, I think that offline shopping will continue to have its place with an experiential offering that online shopping cannot displace

4. AEON's forecast earnings growth (29.7% per year) is above the savings rate (3.7%).

5. AEON's is transforming its shopping malls to adapt to changing consumer demand. In a Nov 29 note, it pointed out that AEON’s valuations are undemanding in view of its growth potential and status as the largest shariah-compliant mall operator in Malaysia.

6. AEON's operates 35 outlets, 28 malls, 74 Wellness pharmacies, 42 Daiso stores and six MaxValu Prime supermarkets.

7. AEON's has experienced slower footfall due to the COVID-19 outbreak, but the situation is gradually normalising. Government is expected to introduce a stimulus package to drive consumer spending.

8. AEON's is in good position to benefit. Earnings growth moving forward would be driven by modernised store formats and product offerings to capture changing consumer demand, while earnings drag from the MFRS 16 adjustment would finally wear off in FY20.

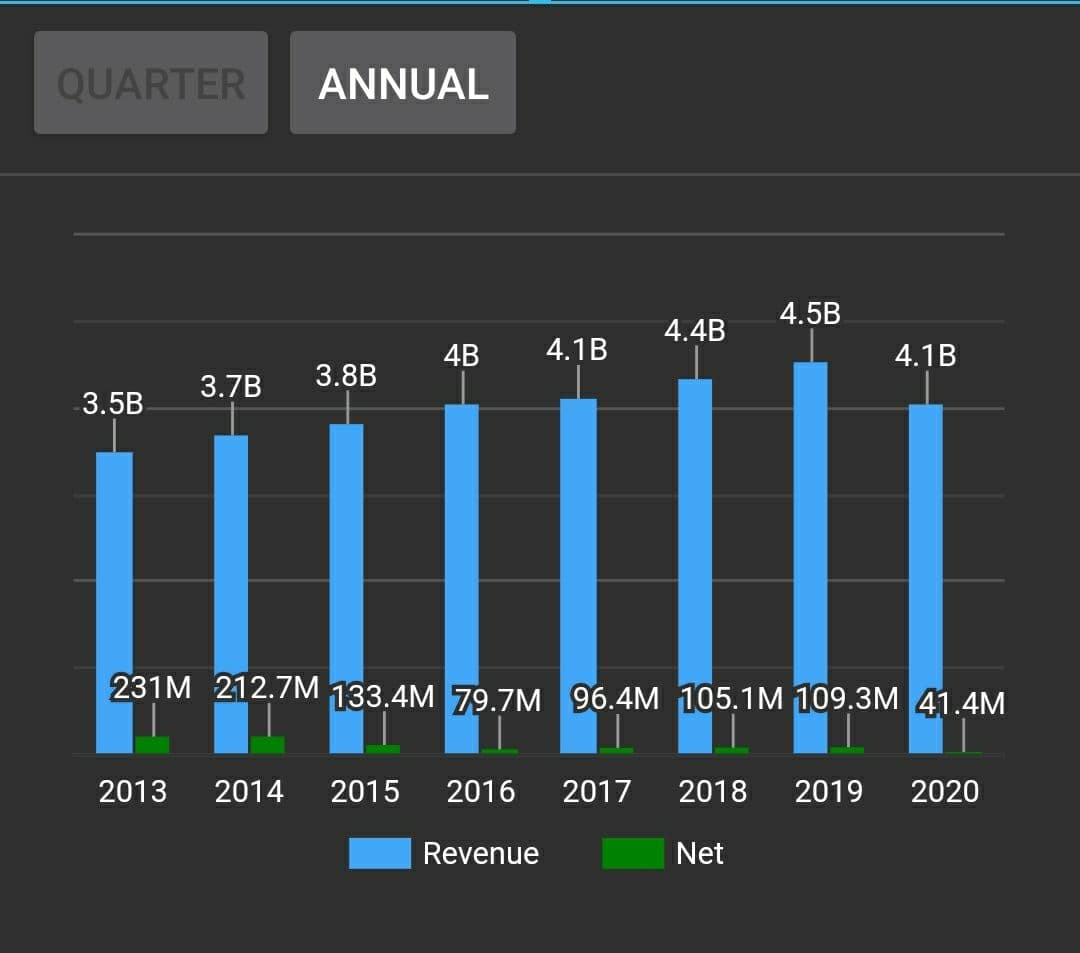

9. AEON's reported FY19 core net profit ofMYR109.3m (-13.8% YoY), which met consensus’ expectations but missed due to overly optimistic sales growth assumptions. Base on pre-MFRS 16 basis, FY19 core net profit would have grown by 1.9% YoY. Post-results, trimmed FY20-21F net profit by 8-9% to factor in more prudent sales growth assumptions.

LETS FLY & LETS ROCK!

Lastly, don't forget to click on our telegram link above and join us. Let us give you the latest update on the stock market and our group development. We hope you enjoy reading our blogs and give us your support.

Disclaimers: The research, information and financial opinions expressed in this article are purely for information and educational purpose only. We do not make any recommendation for the intention of trading purposes nor is it an advice to trade. Although best efforts are made to ensure that all information is accurate and up to date, occasionally errors and misprints may occur which are unintentional. It would help if you did not rely upon the material and information. We will not be liable for any false, inaccurate, incomplete information and losses or damages suffered from your action. It would be best if you did your own research to make your personal investment decisions wisely or consult your investment advisor.